If you’re trying to trade Solana memecoins like any other crypto, you’re setting yourself up to lose. Every time.

Memecoins aren’t investments. They aren’t real assets, just high-risk bets. These tokens have no use case, no roadmap, and no product. Indeed, memecoins operate on a completely different standard than most cryptocurrencies: virality, momentum, and pure chaos.

And that’s exactly why traditional trading strategies fall apart the moment you apply them here.

If you’re serious about catching the next pump and avoiding becoming someone else’s exit liquidity, you need to rethink your entire approach. Don’t worry, we’ll show you.

Here’s how to do it right.

Memecoins Don’t Care About Fundamentals, Neither Should You

If you’ve spent hours staring at charts and websites, hoping to find a clue to your Solana memecoin’s next move, you know how cruel the market can be. You wake up to your bags halved, the community ghosted, and no update or shiny “partnership” to save you.

Here’s the brutal truth: memecoins don’t follow rules. They don’t care about utility or tech or locked liquidity. Their only currency is attention, and that evaporates fast.

One day your X feed is flooded with memes, hype is pumping through Telegram, influencers are shouting it from the rooftops. The next day, all you hear is crickets. Sometimes, it turns out the memecoin creators paid for engagement and the community wasn’t real. Other times, the hype just moves on, and the price crashes.

So forget “fundamentals.” The real question is: Is the meme alive? Are people sharing, tagging, hyping, laughing? Are new faces flooding into the chat? If the answer is no, your bags are a ticking time bomb.

When it comes to memecoins, your only reliable bullish signal is social momentum, not candlesticks or volume charts. And when the buzz fades, so should you.

Why Technical and Fundamental Analysis Will Burn You Here

We know for most cryptocurrencies, these two methods are the backbone of research and analysis. Drawing support and resistance feels like the only thing you can do to make sense of these crazy charts.

But memecoins are different. You spot a breakout, set your target, and then boom, someone dumps 80% of liquidity, and your profit turns to dust.

It’s like the market is trolling you, because it kind of is. In the world of memecoins, charts lie. Locked liquidity or “nice devs” won’t save you if the hype train derails.

Memecoins move on hype cycles, virality, and social chatter. Not logic. The smart traders know this and chase the community wave instead of the chart wave.

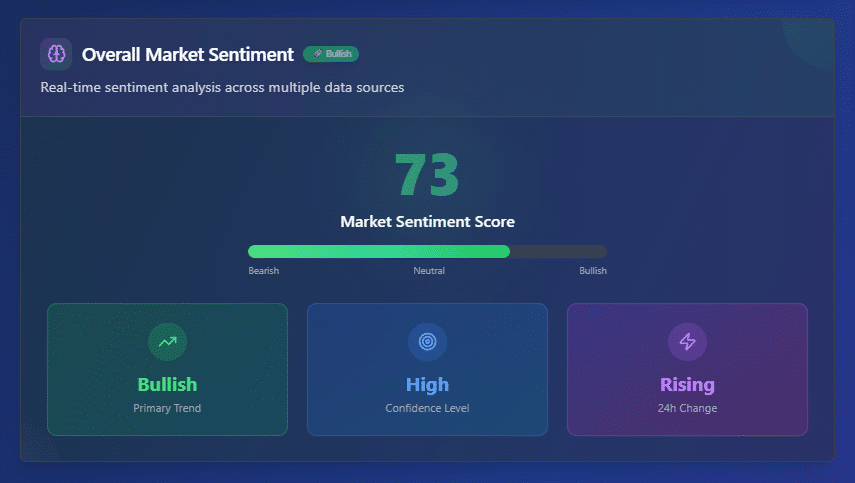

In this context, crypto research tools that help you track social sentiment are invaluable. They don’t pretend memecoins behave like blue-chip tokens. Instead, they show you what actually matters: who’s buying, how fast Telegram’s growing, which memes are blowing up, and when the narrative is about to explode.

This is how you stay one step ahead instead of being blindsided.

When Trading Memecoins, Watch the Crowd (Not the Chart)

Price action in memecoins is a lagging indicator. The real money is made by feeling the shift before the price pops.

The moment a memecoin stops being an inside joke and becomes a full-blown obsession or massive Internet movement, the clock starts ticking. You want to be in before the crowd floods in, not after.

Watch wallet inflows, Telegram growth, retweet speed, and who’s buying and selling. Ask yourself:

- Is this real hype or bots pumping fake engagement?

- Are people creating memes or just farming likes?

- Are whales quietly accumulating or already cashing out?

With the right crypto tools (especially those built for Solana memecoins) you can spot these subtle signs while others are still clueless.

How to Make Better Solana Memecoin Trades

Most traders lose because they treat memecoins like investments: holding long, hoping for a recovery, trusting the dev team. That’s a losing game because there are no fundamentals to back it up. With memecoins, virality is key.

Here’s the smarter play:

- Don’t hold memecoin bags for too long. Although there are exceptions, most Solana memecoins are made to pump fast and dump faster. Take your profits quickly and move on. If you’re up, scale out. Avoid hero plays.

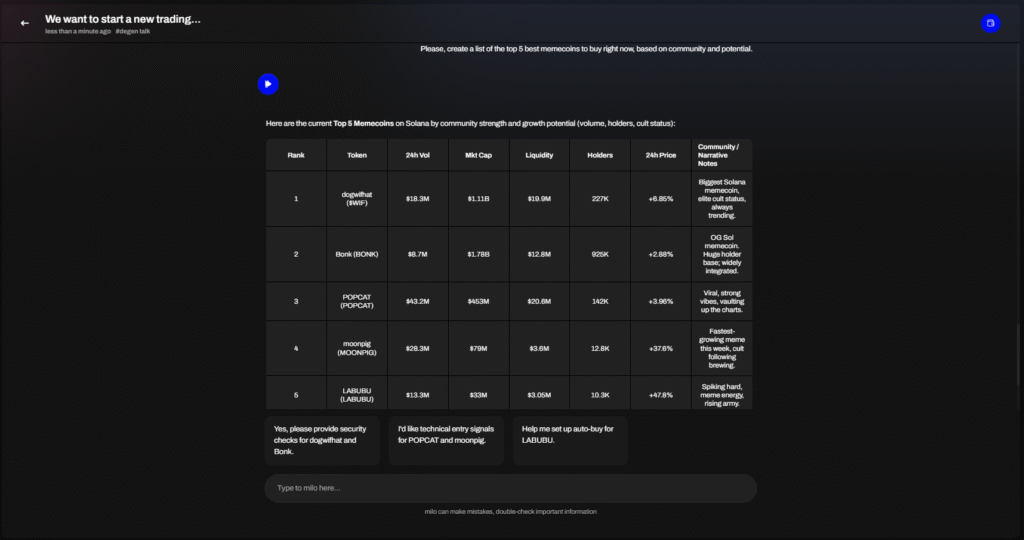

- Use automated trading tools. Bots win this game every time. Both Solana trading bots and crypto memecoin sniper are good options, as automation always beats manual trades. Fast fingers get crushed by fast scripts. We use Milo, a free-to-use crypto AI agent that connects directly to your wallet and executes trades for you. Try it, you won’t regret it.

- Protect your downside. Set strict stop losses, keep your position sizes small, and only risk what you’re willing to lose. This isn’t blue-chip crypto, it’s more like digital scratch-offs. Again, Solana AI agents can help you do this, or even do it for you. All you need to do is ask.

- Trade like a predator, not a fan. Don’t get emotionally attached to communities or projects. Your job is to spot when hype is about to blow, ride it, then get out before the turn.

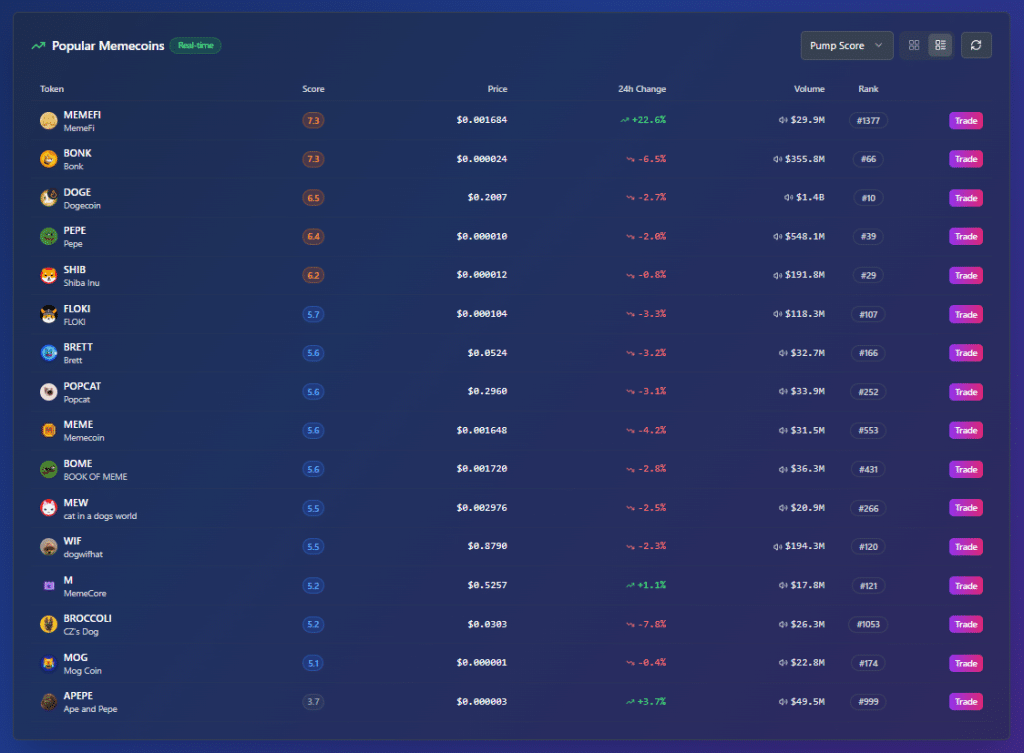

- Track the right metrics. Forget just watching the price. Use a crypto screener or memecoin tracker that focuses on social signals, wallet flows, and fresh buyers. Pump Parade makes this simple by pulling data from Twitter, Telegram, and on-chain activity all in one place.

Where to Find and Trade the Best Solana Memecoins

Solana is at the center of the memecoin boom, driven by its lightning-fast transactions, low fees, and an ecosystem built for viral momentum.

If you’re wondering where to buy Solana memecoins, the action is happening across a growing set of launchpads. Platforms like Let’sBonk and Pump.fun have become ground zero for early-stage memecoin launches, fueling the next wave of speculative frenzy.

But don’t let the launch simplicity fool you. What comes after launch is chaos. Bots snipe launches within seconds, whales fight for position, and the market moves in milliseconds.

If you don’t know what you’re doing, you’ll be down 80% before you even realize what went wrong. Over 60% of wallets on Pump.fun end up losing money. Only preparation, sharp instincts, and smart decision-making will keep you in the winning 40%.

That’s why having the right tools, like Solana trading bots, memecoin platforms, social sentiment trackers, can make all the difference. The edge comes from spotting momentum before it shows up on the charts.

Platforms that combine on-chain activity, social buzz, and AI-driven alerts help you catch the wave early instead of chasing it after the fact. And this is exactly what we built PumpParade for.

The Truth About Solana Memecoins

If you trade memecoins like regular altcoins, you’ll keep losing to those who don’t.

Solana memecoins don’t follow fundamentals, roadmaps, or even logic. They run on speed, hype, and herd psychology. Success doesn’t go to the most “informed” trader, it goes to the fastest, the sharpest, and the ones who understand the rules of the game.

And the first rule is this: memecoins are not investments. They’re social trades. Attention is the fuel, and once that attention fades, so does the chart. If you’re not tracking where the crowd is going, what they’re laughing at, hyping up, or aping into, you’re already behind.

Winning in this market means adapting. It means having tools that surface early momentum, not just clean technical analysis. It means knowing how to read Telegram spikes, wallet inflows, and meme velocity. It means understanding when to ride the wave and, more importantly, when to get off.

This is why most traders get wrecked. They either hold too long, enter too late, or ignore the signals that matter. But with the right mindset, the right discipline, and a real edge in narrative tracking, you can flip the odds.

So if you’re treating memecoins like tech stocks, stop. Start treating them like what they are: fast-moving, emotionally driven, narrative-fueled mini-cycles.

Memecoins are a game. If you’re going to play, play to win.