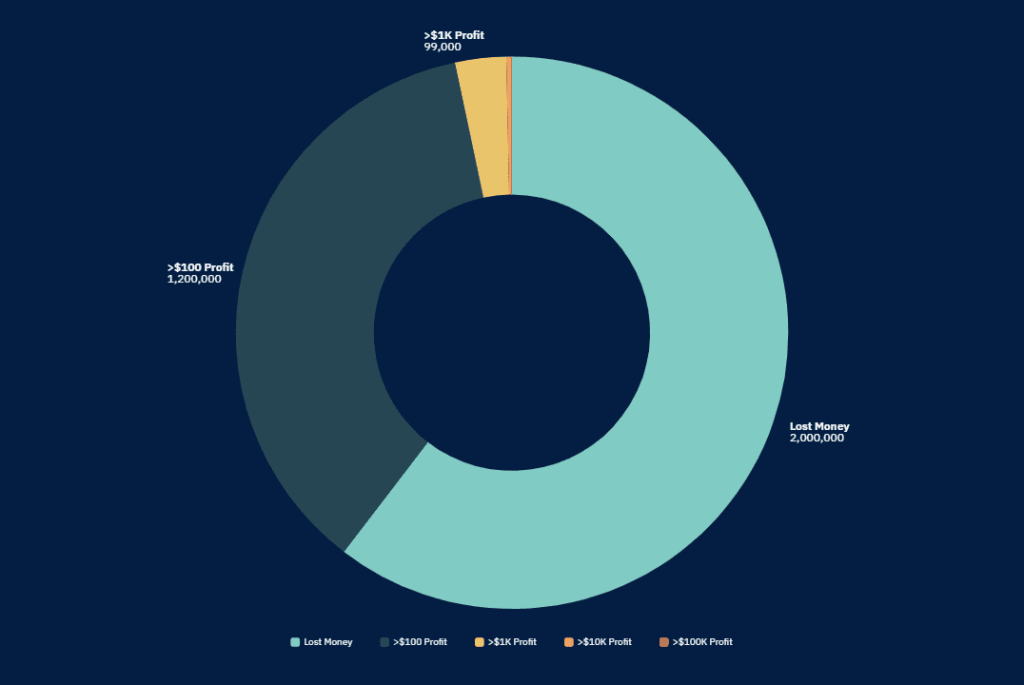

More than 60% of Pump.fun users are losing money. That’s millions of wallets in the red, with 1,700 of them down over $100,000 each and a small handful losing more than a million.

On the surface, Pump.fun feels like a golden ticket into Solana’s meme coin scene. It’s cheap to launch a token, easy to trade, and simple enough for anyone to try. But behind the fun branding and viral hype, the numbers tell a very different story.

From Dune Analytics data, back in June:

- 56.6% of wallets lost between $0 and $1,000

- Nearly 1,700 wallets lost over $100,000

- 46 wallets lost over $1 million

- Around 5,000 wallets made more than $100,000

- Just 311 wallets cleared over $1 million in gains

For most participants, “winning” means a few hundred dollars. And for a large majority, it means losing. Reports of bots, frontrunning, scam tokens, and wash trading have been circulating for months, and the PUMP token launch is already causing major volatility across the Solana ecosystem.

If you want to be in the minority who come out ahead, you need to trade differently from the crowd.

We recently published an article about what works and what doesn’t in the world of memecoins. It’s a great complementary read to this article. Check it out here: The Brutal Truth About Solana Memecoins: Here’s Why You’re Missing the Best Opportunities

How to Tilt the Odds in Your Favor on Pump.fun

We won’t sugarcoat it: Pump.fun is a wild, unpredictable beast. If you jump in without a plan, you’re probably going to lose.

Even if you do have a plan, you can still struggle to make a profit. But if you’re smart about it (and have a little bit of luck), there’s a chance to be in that profitable 40%. It comes down to mindset, patience, and a few practical moves that most people overlook.

Let us walk you through what we’ve seen work.

Don’t Chase the Hype After It’s Already Exploded

The hardest pill to swallow when trading cryptocurrency (especially memecoins) is accepting that you missed a once-in-a-lifetime opportunity.

In other words, most people jump in way too late. You’ll see a coin blowing up on Twitter or Discord, and your first instinct is to buy in right away, thinking you’re catching the wave. But by then, the early buyers and bots have already made their move, and you’re left chasing their profits.

The better play is to get in early, when nobody’s talking about the coin yet. Now, we know what you’re thinking: that’s easier said than done. But you can do this by paying attention to two factors: the community growth and the chain itself.

Watch for new tokens that just popped up and liquidity that just got added. Monitor social media mentions and token holders since day one. These early signals give you a clearer picture before the hype train leaves the station.

Of course, this is a lot of data to process for our brains. Fortunately and thanks to AI, we now have second brains to take care of this for us. Tools like Milo and Pump Parade can help you not only process data, but also interpret and analyze it to receive fresh, curated insights on memecoin opportunities.

You won’t catch every winner this way, true. But you’ll avoid a ton of losses caused by late entry.

Always Assume You’re Dealing With a Scam Until Proven Otherwise

This one is brutal but true: nearly every token on Pump.fun is suspect. Scam tokens, rug pulls, and shady projects are everywhere. So you have to be your own gatekeeper. Don’t just buy a coin because it sounds fun or because a couple of influencers hype it.

Here’s what we check every single time before we even think about putting money in:

- Is the liquidity locked? If it’s unlocked or locked for only a few days, run.

- How much of the token supply does the team hold? If they control a massive chunk, you’re basically betting on them not to pull the rug.

- Does the contract code have any scary functions, like the ability to mint unlimited tokens or block your trades?

- Is the community real, or are you seeing bot spam and fake hype everywhere?

If you don’t know how to do some of this yourself, there are tools and AI-powered scanners that can flag the obvious red flags for you. We recommend you simply connect to Milo, open a chat, and ask it to run a security check on the tokens you’re interested in. It takes only a few seconds and you’ll get a detailed, comprehensive report to ensure you make the right decision.

Don’t skip this step, it’s where most people lose the most money.

Watch Out for Bots and Whales, They’re Playing a Different Game

Unfortunately, bots and whales dominate Pump.fun’s early action. They have lightning-fast tech and big pockets, which means they get in and out before most of us even see what’s happening.

But if you know exactly what to look for, you can avoid getting steamrolled by them. For example, watch addresses that keep winning big: these are usually bots or pros. When you see a big player making a move, don’t just blindly follow.

Sometimes they’re setting traps to shake out smaller traders. These are called pump-and-dump schemes, and you wouldn’t believe how many people get caught in them. We’re talking about millions of dollars in liquidity being absorbed by these whales every single time.

You can also spot suspicious patterns of volume spikes that don’t match genuine buying interest. The more you watch, the better you get at sensing when the market is being manipulated and when it’s just normal trading. Again, make sure you use the right crypto research and market analysis tools to stay ahead.

Take Your Profits Sooner Rather Than Later

Greed is the enemy here. We get it, it’s tempting to hold out for that huge 10x moonshot. But most of the time, you’ll end up watching your gains evaporate while hoping for a miracle.

The smart move is to take partial profits early and secure your wins. For example, when your token doubles or triples, lock in some gains. You don’t have to sell everything, but securing some profits means you walk away ahead even if the price crashes later.

And don’t be afraid to set stop losses to protect what you’ve earned. In fact, we actively encourage you to do it. The market can turn on a dime, and keeping some distance from your winners helps keep you in the game longer.

Don’t Put All Your Eggs in One Basket

This should be a no-brainer already, but in case you need a reminder: memecoin trading is high-risk by nature. You want to protect yourself from any one trade wiping you out. That means dividing your capital into smaller chunks and spreading it over multiple tokens.

Limiting your position size to just a small percentage of your total funds helps you weather inevitable losses while still giving you room to catch a big winner.

It’s like the saying goes: don’t bet the farm on a single hand. Small bets over time are what lead to smaller, yet consistent and sustainable profits.

We recommend using AI agents to diversify your memecoin portfolio. They are surprisingly effective at it. With the right prompts, you can have them surface multiple coins that respond to different market conditions, giving you broader coverage. The key is in how you ask

Catch the First Wave, But Be Wary of the Afterparty

Most Pump.fun tokens make their big moves right out of the gate, within minutes or a few hours. That’s when volume, attention, and price surge all at once.

If you miss that first burst, be very cautious about jumping in later. The “second wave” is often where the traps lie. Developers and bots may unload their tokens, and volume tends to dry up fast.

Look for clear signs before chasing a token that’s already cooled off. Factors like renewed social activity, fresh liquidity, or sustained buying interest are good signs. Otherwise, you’re more likely to get stuck holding tokens that nobody else wants.

Keep Your Emotions in Check

We can’t stress this enough: memecoin trading is a rollercoaster, and emotion is the enemy of logic. Fear and greed make you chase losses, hold losers, or buy at the wrong time .

Try to build a simple trading routine and stick to it. Decide your entry and exit points in advance. When you hit your target, take profits and walk away. When you hit a stop loss, accept it and move on.

Don’t ever change your plan because of how you feel in that particular moment. “I’ve hit my target but I’ll let it run a little bit more, it’s been doing good so far.” Famous last words.

This is where AI can make the biggest difference. It acts purely on data, without fear, greed, or hype clouding its decisions. Designed to simply follow the rules you set, it helps you stick to your plan and avoid the emotional mistakes that can derail trades.

AI can scan multiple coins at once, analyze market sentiment, liquidity, and volatility, and surface opportunities that fit your strategy. It can even simulate different scenarios, giving you a clear picture of potential outcomes before you commit. In a market as unpredictable as memecoins, AI becomes your steady hand, keeping your decisions rational, disciplined, and focused on your goals.

Interested in more ways AI can help you with your crypto trading strategy? Make sure to check out our article about it: How to Use AI for Crypto Trading (The Right Way)

Remember, no one wins every trade. Success comes from making consistent, disciplined choices over time, not chasing a single big win. AI has become an invaluable tool for maintaining that consistency.

Now, let’s dive deeper into how exactly you can make this happen.

Using AI Agents to Level the Playing Field

Pump.fun moves at Solana speed, faster than most traders can think, let alone react. AI agents bridge that gap by processing massive amounts of data in seconds and acting on it instantly.

Here’s what they can do for you:

- Scan on-chain activity in real time: thousands of wallets, new token launches, liquidity pool changes… and flag unusual patterns before the crowd notices

- Run instant technical analysis: detecting breakouts, volume surges, and momentum shifts without you staring at charts all day

- Check contracts and wallets for scams: spotting risky code and suspicious wallet behavior before you enter.

- Monitor community sentiment: separating genuine buzz from botted hype across Twitter, Discord, and Telegram

- Automate trades: buying or selling based on pre-set conditions so you can react in milliseconds, not minutes

Think of it like having a 24/7 research team, analyst, and sniper trader rolled into one. They never get tired, never get emotional, and never chase a meme out of boredom.

Like we mentioned, we tried a Solana AI agent called Milo that blew our minds, and we have been recommending it ever since.

If you’re willing to dive into the world of memecoins, make sure to connect to Milo and check it out. It’s free, extremely easy to use, and connects directly to your wallet. And if you’re feeling skeptical (like we did at first) you can start small, with as little as $1.

Memecoins & Pump.Fun: The Wild West of Web3

Pump.fun isn’t designed to make everyone rich. It’s fast, volatile, and full of traps. However, if you approach it with discipline, do your homework, take profits quickly, spread your risk, and let AI handle the parts humans can’t do fast enough, you have a much better chance of being in the profitable 40%.

In a space where most traders end up as exit liquidity, your only job is to make sure you’re not the last buyer holding the bag.

There’s no magic formula for making every trade profitable. But there are guidelines that, if followed carefully and consistently, can help you win more often than you lose. Remember, these are:

- Assume every token could be a scam until proven safe.

- Watch out for whales and bots. Not every wallet you see on-chain is a trader like you.

- Avoid chasing trades after the big move has already happened. That ship has sailed.

- Get in early on coins before the hype hits. Monitor community growth and social sentiment before anything else.

- Stick to a clear routine with pre-set entry and exit points.

- Lock in profits early and use stop losses to protect gains.

- Diversify your positions so one bad trade doesn’t wipe you out.

- Leverage AI tools to scan data, track sentiment, flag risks, and keep decisions disciplined.

In the end, winning on Pump.fun takes a mix of skill, discipline, and luck. Most traders will keep feeding the machine, chasing pumps, and holding empty bags.

If you want to be different, you need to think ahead, act early, and let data, not emotion, guide your decisions. The chaos is not going away, but with the right mindset, smart risk management, and AI as your companion, you can avoid joining the majority that loses and start positioning yourself among the few who consistently come out ahead.

In this game, survival is victory, and every win you stack after that is pure profit.