I’ve lost money to rug pulls more times than I care to admit. That sinking feeling, watching liquidity vanish from a token you thought was solid, sticks with you like a tick to a dog.

It’s not so much about the loss as it is about trust in the space and the industry. After the first one, every new launch feels like a potential trap until you’ve learned how to read the subtle signals hiding behind the hype.

Rug pulls are designed to exploit impatience, greed, and inexperience. They look irresistible: small supply, high hype, a catchy narrative, and a sense of urgency.

But over time, I’ve learned to slow down, pay attention, and use both instincts and tools to separate safe opportunities from traps. Let me show you how it works.

Understanding Liquidity: Where the Money Really Lives

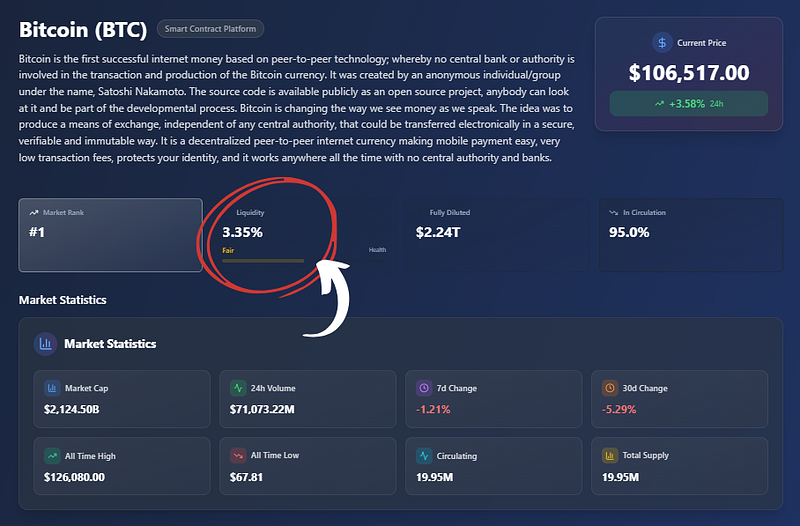

The first thing I check is liquidity which, if you’re a newbie, means how much of that token is available on the market. The higher liquidity, the easier it is to trade.

Early on, I thought liquidity simply meant enough funds for trading. I quickly learned it’s also the first defense against rug pulls. If liquidity isn’t locked, the deployer can pull the entire pool and leave holders with nothing.

I remember countless Solana memecoin launches where everything was pumping, and my gut told me to check the liquidity first. Sure enough, their liquidity pools were completely unlocked. In other words, the developers had the power to pull the entire liquidity with just a few clicks, devastating the price.

That glance alone takes two minutes, but saved me from losing thousands. Liquidity locks aren’t glamorous. They don’t promise gains. But they tell you the money in the pool can’t disappear overnight: a small comfort that can save your capital and your sanity.

💡 I recommend using Pump Parade to track liquidity, circulation, and other critical on-chain data that can help you research and find safe tokens. Discover Pump Parade’s AI tools here.

Reading Contracts: The DNA of a Token

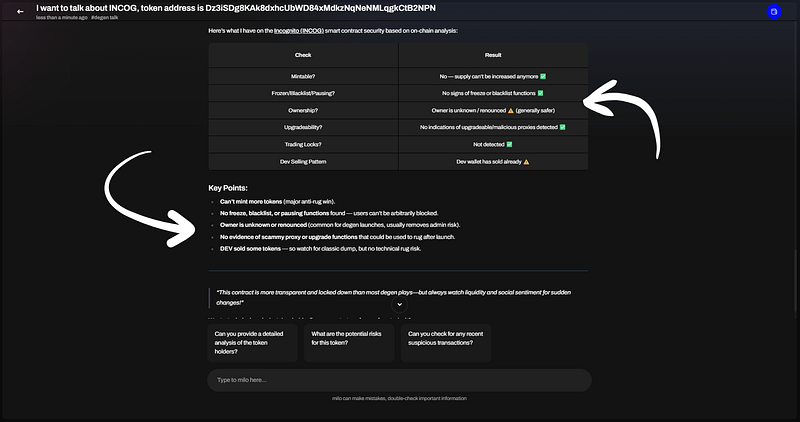

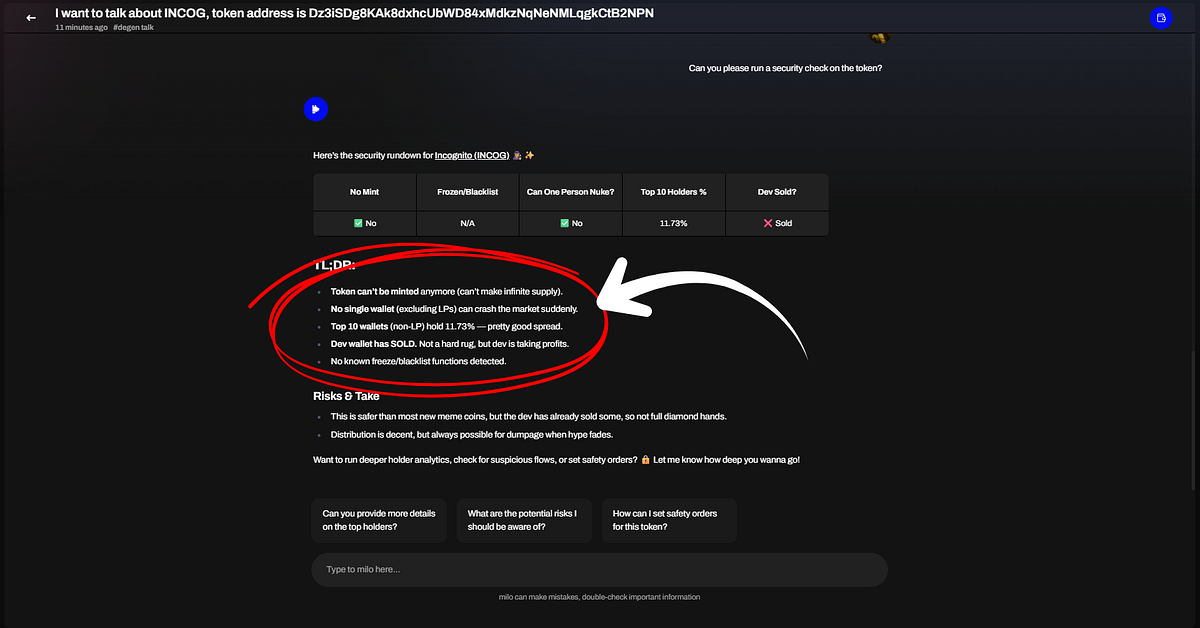

Contracts used to feel like a mystery to me. I didn’t realize that reading a token’s contract could reveal its intentions. Hidden mint functions, unlimited supply permissions, or special privileges for the deployer are common rug pull mechanisms.

Now, reviewing contracts is like detective work. I look for anomalies, risky permissions, and anything that doesn’t match the project narrative. Verified contracts, especially with audits or on-chain confirmation, give me peace of mind. They don’t guarantee success, but they show transparency and security.

Every time I spot a risky permission in a contract, my heart skips a beat, and I know better than to dive in blindly. That small discipline has saved me more times than I can count.

It’s critical to understand this: smart contract integrity tops everything else. If you find a token where every signal points to an incredible opportunity, but the smart contracts show vulnerabilities or shady mechanisms, it’s time to look somewhere else.

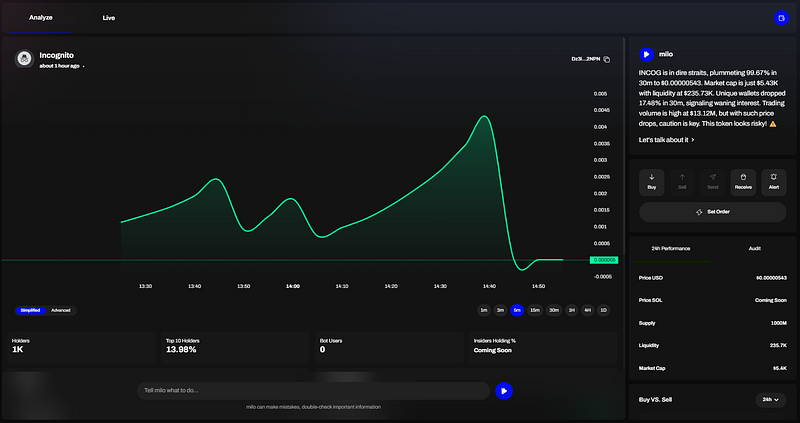

💡 For this purpose (and many other things), I use Milo: a crypto AI agent with full access to on-chain data. Milo can read, analyze, and assess smart contract safety and integrity. It’s free to use, you only have to connect your wallet. Get started here.

Knowing the Team: Accountability Matters

Early in my career, I thought anonymous teams were not a big deal. After all, privacy and anonymity are critical aspects of crypto. Losing money on projects where the team simply vanished, leaving their Discord and Telegram channels abandoned, taught me otherwise.

Accountability matters more than hype. A doxxed team with a track record, verifiable identities, and consistent engagement changes the entire risk profile of a project.

I’ve started following teams who post regularly, answer questions, and maintain transparency. Even if the market dips, I feel secure that the team isn’t planning to exit overnight. Rug pulls are less likely when someone is watching, reporting, and accountable.

The emotional difference is striking: a doxxed team turns fear into cautious confidence. You’re still aware of risk, but you don’t feel like you’re holding a ticking time bomb.

I still believe privacy and anonymity are a huge deal, but only for users.

Researching Tokens: Separating Noise from Signal

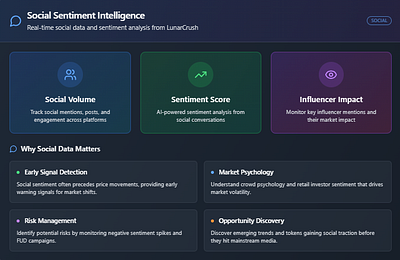

Hype is a rug pull’s best friend. Screenshots, fake Telegram groups, and bots can make even experienced traders feel FOMO. I learned quickly that research tools are indispensable to tell real engagement from fabrications.

Specifically, these tools can help you track holder distribution, monitoring community engagement, and comparing tokenomics to safe, proven launches.

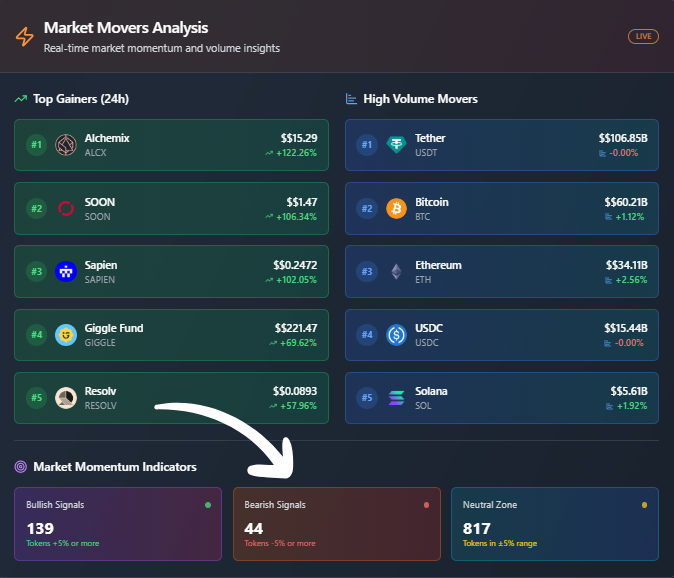

One common indicator I look for is large wallet concentration, suspicious spikes in engagement, and liquidity movements that could hint at manipulation. Again, Pump Parade is a wonderful tool for this, with visual dashboards packed with data to find all the information you need.

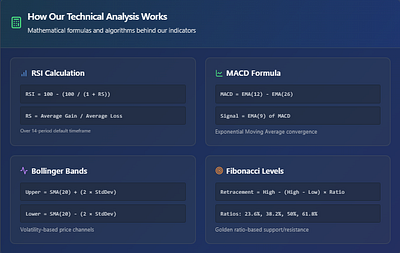

This is where AI tools have changed everything. They allow you to process more data faster and reduce emotional errors.

Visit Pump Parade now and start analyzing over 1,000 tokens for free.

Using AI for Security: Milo and Pump Parade

Milo has become my digital partner in every Solana memecoin. Before I consider buying a token, I run Milo to:

- Confirm liquidity locks and amounts

- Scan contracts for risky permissions like minting or withdrawal privileges

- Detect anomalies in supply or behavior that might signal a rug pull

- Generate a concise, human-readable summary of potential risks

It’s free and extremely easy to use. It surfaces risks I might miss and turns hours of manual checks into minutes.

Seriously, you wouldn’t believe how many vulnerabilities you are exposed to until you run a security check with this AI agent. The relief is instant, like a rush that comes from narrowly avoiding disaster.

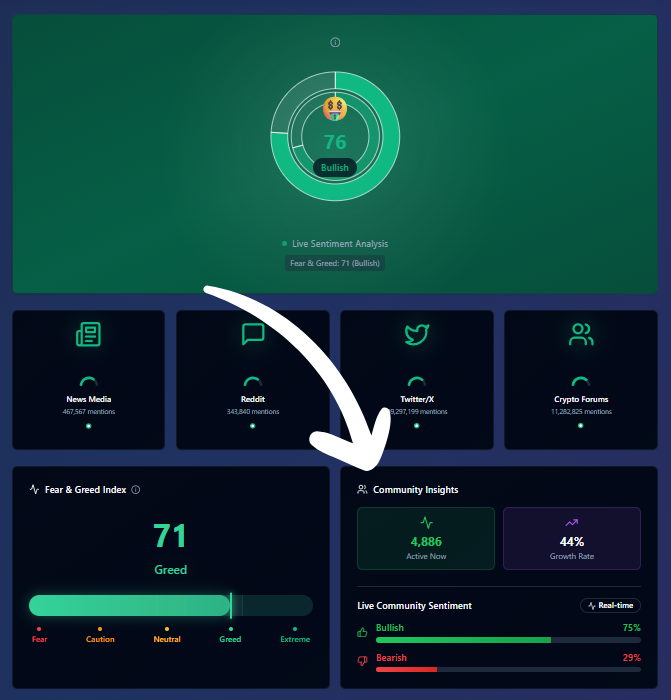

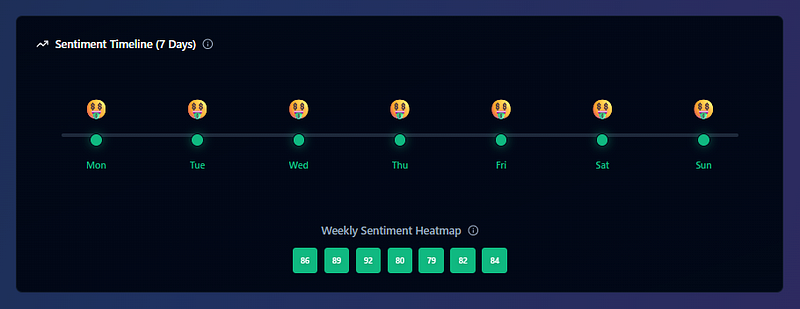

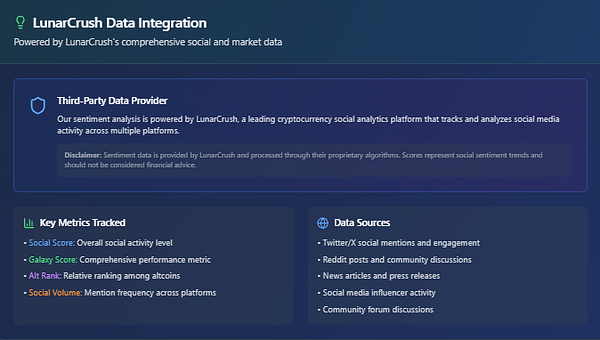

Pump Parade is the other tool you should use for these kinds of checks. It complements Milo by analyzing the social and technical side of tokens. It helps me:

- Track whether community growth is organic or bot-driven.

- Monitor liquidity, wallet concentration and holder growth.

- Spot sudden spikes in engagement that may indicate coordinated hype.

- Monitor sentiment across Twitter, Telegram, Discord, and Reddit.

- Compare early activity to historical patterns of successful tokens.

Visit Pump Parade and get the best insights on more than 1,000 cryptocurrencies.

Together, Milo and Pump Parade form a safety net. Milo flags on-chain risks, while Pump Parade warns of social and narrative manipulation. Using both makes it possible to feel grounded and confident even in the chaos of launch hype.

Learning to Spot Rug Pulls Before They Happen

Unfortunately, rug pulls will always exist. But with experience and the right tools, you can spot the warning signs before committing funds. I now approach every new token I invest in with a blend of instinct, careful observation, and AI-powered analysis.

I check liquidity, review contracts, research the team, track social sentiment, and run automated checks with Milo and Pump Parade.

It’s not about removing risk completely (nothing in crypto can do that) but about stacking the odds. Each precaution builds confidence and discipline. You move from reacting to hype to acting deliberately. You start trusting signals, spotting traps, and feeling in control instead of panicking.

The market will always test you. But over time, you develop radar. You learn to sense the danger before it hits your wallet. You learn to navigate launches with awareness, patience, and a plan. And that, more than anything else, keeps you in the game.