After enough cycles, you start to notice that the crypto market doesn’t announce itself. It doesn’t flash a warning before the mood shifts. Instead, it changes in ways you feel before you see.

The energy on X, the chatter in Telegram, the sudden absence of posts from people who were loud yesterday: that’s the first clue.

You don’t need to look at charts to know something has shifted; you just feel it.

In a bull market, everyone feels unstoppable. In a bear, everyone starts questioning everything they once believed. In a crab market (sideways), the exhaustion is palpable: it’s in every trade you take that goes nowhere and every candle that refuses to break.

I’ve lived through each of them many times, and the hardest lesson I’ve learned is that you don’t survive by predicting the market; you survive by recognizing the cycle you’re in and aligning with it.

That’s the best approach. Here, I’ll show you how to identify each cycle and how to act when you do.

The Bull: When Everything Feels Easy, Until It Doesn’t

I remember the first bull I really noticed. It wasn’t a single candle or an indicator; it was the energy.

Tokens I didn’t even know existed were doubling before lunch. Telegram groups that had been dead were suddenly full of people claiming insane gains. My DMs were blowing up with screenshots of 10x, 15x, 20x coins.

For a moment, it felt like you could throw a dart at a chart and hit gold. For those who were here at that time, this is what the 2021 bull market felt like, fueled by unhinged money printing and inflation.

I’ll be honest: I got greedy. I chased coins because everyone else was. I held on too long because I convinced myself “this one is different” and that “it’s impossible that this coin drops 90% from here.” But they did.

Watching gains evaporate overnight is humbling. It’s easy to think bull markets are simple, but they teach the opposite. They teach clarity.

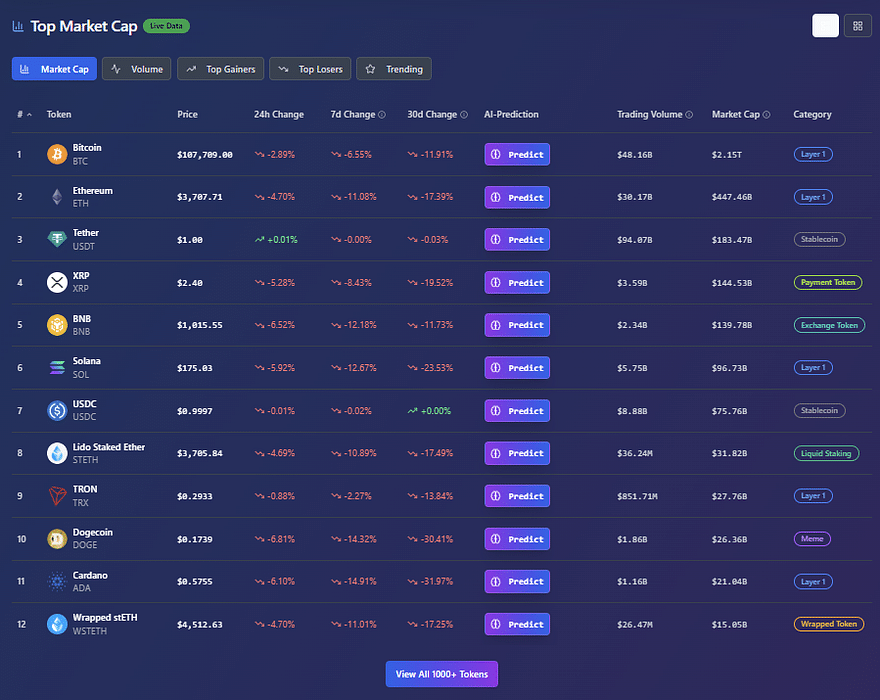

What I’ve learned is that the real winners in this game are the ones who can spot authentic traction early before the herd notices. Volume alone doesn’t tell the full story. You need to know who is driving that volume, why it’s moving, and whether it’s sustainable.

Here’s what I do now:

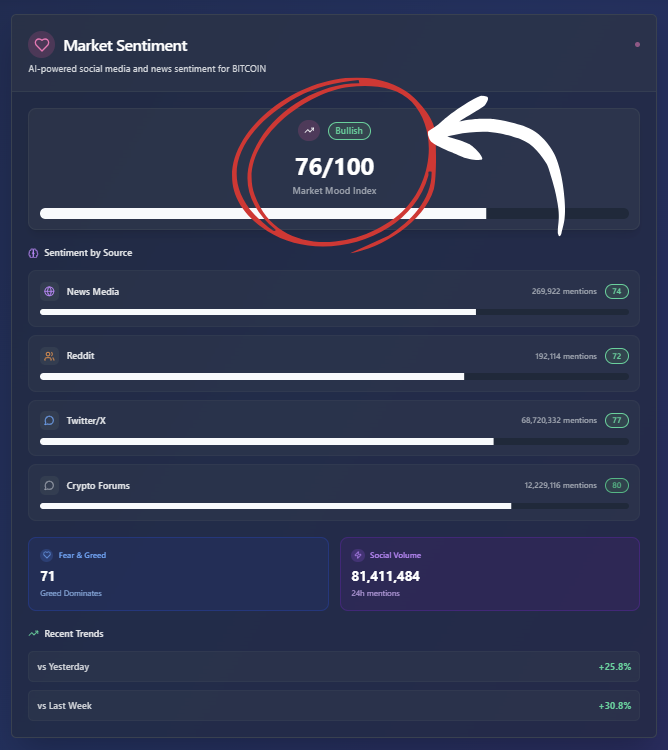

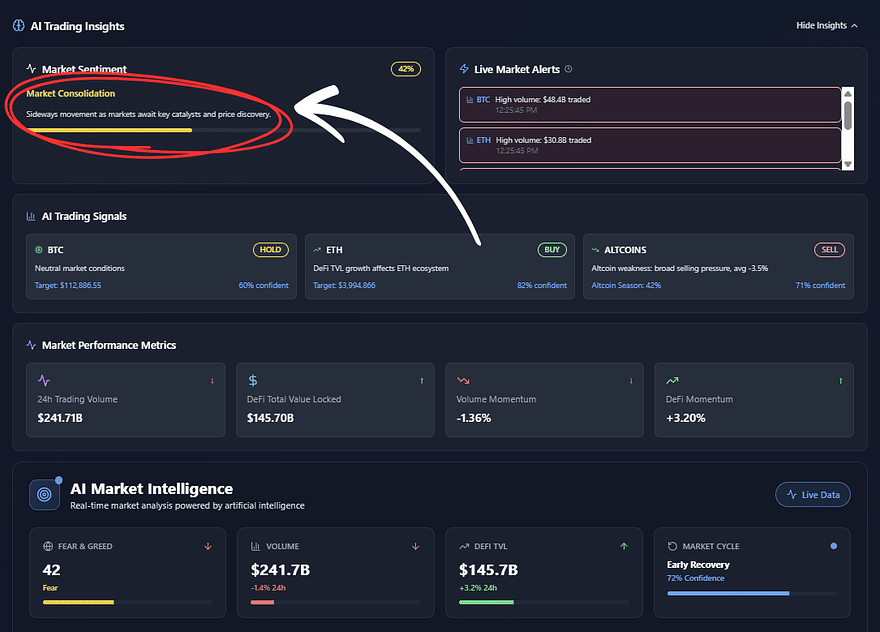

1. Look for engagement, not just noise: Don’t just watch for tokens trending on X or Telegram. Click through. See if real accounts are talking about it, not bot farms. Are people asking questions, making memes, debating? That’s real social lift. On Pump Parade, you can filter by organic engagement to see if the chatter is coming from verified or active traders instead of shill accounts.

2. Cross-check wallet activity: A coin can look hot on social media but dead on-chain. I check for unique wallet growth and repeat transactions. If new wallets are holding and existing ones are adding, that’s traction. If it’s the same five wallets bouncing volume back and forth, it’s manufactured hype. Pump Parade’s token screeners show wallet concentration and flow patterns instantly.

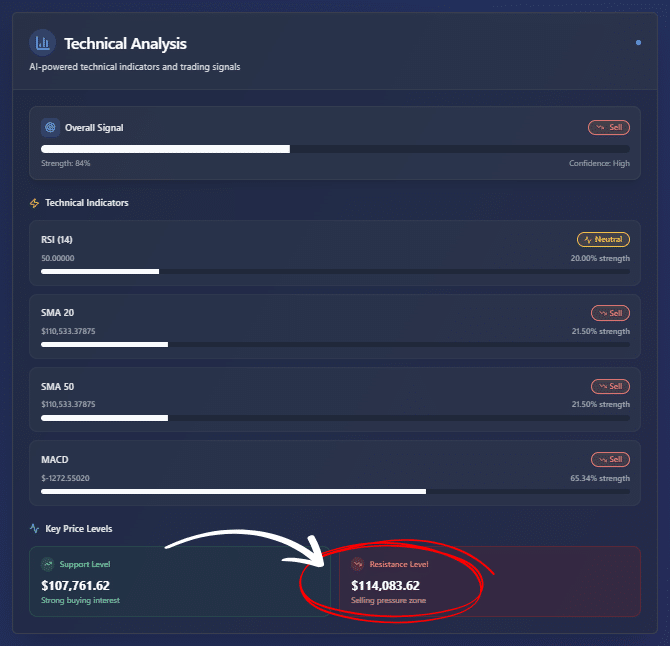

3. Match sentiment with market behavior: If sentiment is rising but volume and liquidity are flat, it’s just talk. If both are climbing together, that’s confirmation. The best setups happen when social momentum, wallet growth, and volume spikes align within a short window, usually 12 to 24 hours.

4. Time your entries with fresh catalysts: Look for when engagement starts expanding beyond the core community, when new influencers, meme pages, or trading groups start picking it up. That’s usually the moment before the big move. But be careful, because it doesn’t last long until everyone notices and you miss your chance.

5. Don’t be greedy. Take profits: The market rewards discipline, not perfection. When you’re up big, scale out. Set targets before you enter and respect them. Most of the time, the difference between a winning trade and a baghold is knowing when to walk away. Take profits while there’s still liquidity. You can always re-enter if the setup stays strong.

Using Pump Parade, you can automate most of this:

- Track real-time engagement spikes across X, Telegram, and Reddit.

- Combine with on-chain technical analysis to confirm trends.

- Set alerts for organic narrative lift before it consolidates.

💪🏼 Visit Pump Parade today and start trading smarter with the most advanced crypto AI tools.

The difference between luck and conviction is data. Once you start reading traction this way, you’ll stop chasing pumps and start catching them before they happen.

Even in a bull, you have to manage fear and greed. The fear of missing out pushes you to buy too early; the greed of winning keeps you holding too long. You need both awareness and humility.

When a trade feels too easy, that’s often when the market is setting up to take it back.

The Bear: When Conviction Is Tested

Bear markets feel like someone turned down the lights and left you alone with your losses. I remember staring at a coin that had been my top performer just weeks before, now down 70%, refreshing CoinGecko like the screen itself could reverse reality. My emotions were running circles: frustration, denial, a tiny flicker of hope.

I learned that patience in a bear isn’t a virtue; it’s a survival skill.

In these stretches, you start noticing subtle signals. Even while prices bleed, some projects quietly keep growing. Wallet counts rise, liquidity remains stable, developer activity doesn’t slow.

That’s the real signal: the market whispering, “I’ll come back to these, eventually.” Those are the opportunities.

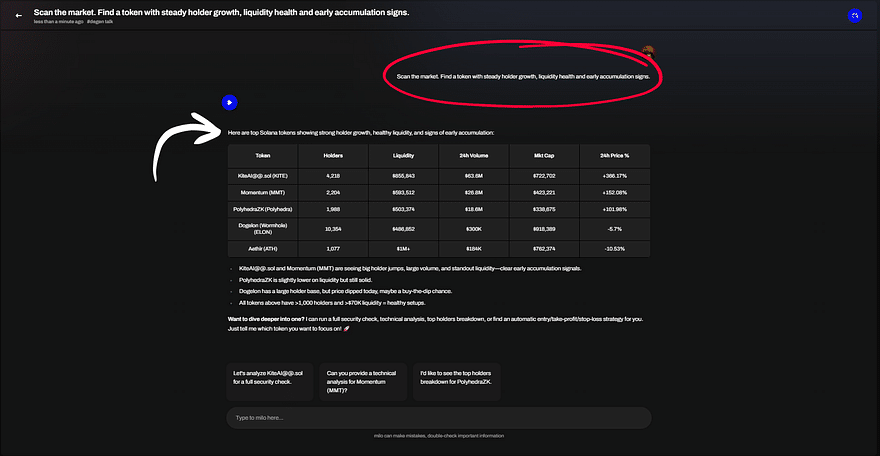

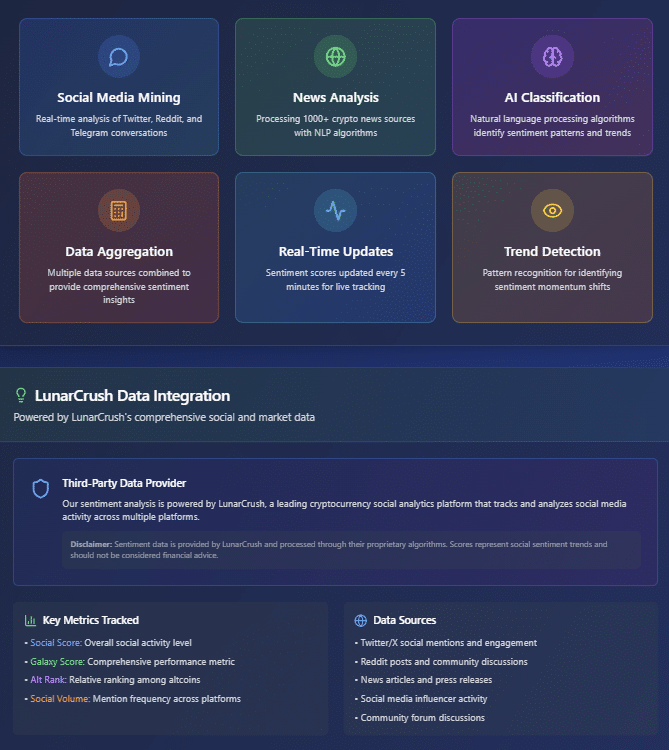

Milo, a crypto AI agent for trading and research, has been a game-changer here. With it, you can filter for tokens that are quietly accumulating holders or holding liquidity, even when nobody’s watching.

Those quiet coins become my anchor during the storm. In a bear market, survival isn’t about chasing pumps; it’s about finding consistency where others see only decay.

Here’s how I use Milo to stay ahead:

1. Track steady holder growth: Instead of looking for sudden spikes, I focus on tokens with consistent increases in unique wallets. Steady growth shows real adoption and community interest, not short-term hype. Milo lets you screen for these patterns in seconds.

2. Monitor liquidity health: Liquidity is often overlooked, but it tells you which coins can sustain moves without getting rug-pulled. I filter for tokens with stable or growing liquidity pools to avoid traps.

3. Spot early accumulation: Milo can flag tokens that are quietly building positions under the radar. These are the coins that often move first when broader attention arrives.

4. Align research with risk management: I never blindly buy everything Milo flags. I check wallet concentration, sentiment, and transaction patterns before committing. That ensures I’m riding organic traction instead of artificial hype.

Using Milo, can help you consistently find gems that survive the bear market and build a foundation for bigger moves when the next cycle begins. It’s about finding calm and consistency while others panic.

Emotionally, bears are brutal. Watching positions shrink tests every nerve. But the traders who can look past the pain, do their research, and accumulate selectively come out stronger. It’s not glamorous, but it’s where lasting edge is built.

The Crab: When Patience Feels Impossible

The crab market is the one that really tests your mental stamina. Prices drift sideways, sometimes from months. Every small breakout turns into a fakeout. Even trades that look solid take half a week to move a few percent.

If you’re impatient, this is torture. You start questioning yourself: maybe I’m bad at trading, maybe the market has left me behind, maybe I’m never going to catch the next wave.

I’ve been there. I’ve forced trades out of boredom and watched tiny gains disappear, one candle at a time. Eventually, I realized that crab phases are not for doing more: they are for seeing deeper. This is where I build watchlists, research quietly, and start noticing the small sparks of a narrative before the crowd.

That quiet spark, a project with slow but consistent engagement or a micro-community forming around a token, is often the first hint of the next bull.

Here’s how I navigate the sideways grind:

1. Focus on subtle social signals: Even in a chop, some tokens are quietly heating up. Pump Parade’s social sentiment tracking makes it easy to spot these. Look for small but consistent increases in engagement rather than viral spikes.

2. Track early communities: Micro-communities forming around a token often precede larger market moves. I monitor Telegram groups, Discord activity, and X chatter to see which projects are quietly gaining traction.

3. Watch for steady narrative growth: A slow build in attention often signals a story taking root. I pay attention to the whispers before the scream. In other words, the subtle hints that most traders miss.

4. Prepare watchlists in advance: Instead of chasing the market, I use crab phases to compile tokens that meet my engagement and liquidity criteria. When volatility returns, I’m ready to act with conviction.

5. Don’t force trades. Take your time: Crab markets reward patience, not activity. Avoid making moves out of boredom. Let the data guide you. Small sparks become big opportunities if you’re ready when the market wakes up.

If you focus on the quiet signals and build a systematic approach, you can turn sideways markets from frustration into an advantage. The edge comes from noticing what others dismiss as nothing.

Again, Pump Parade’s social sentiment tracking is invaluable here. Even in the sideways chop, you can see which tokens are quietly heating up. You start recognizing subtle signs: the whispers before the scream, that give you an edge when volatility finally returns.

Crab markets teach discipline, patience, and foresight. They reward the people who can resist action when nothing is happening.

Reading the Market Is About Awareness, Not Prediction

I’ve learned that the real advantage doesn’t come from predicting what’s next. It comes from seeing what’s happening now, clearly, without wishful thinking.

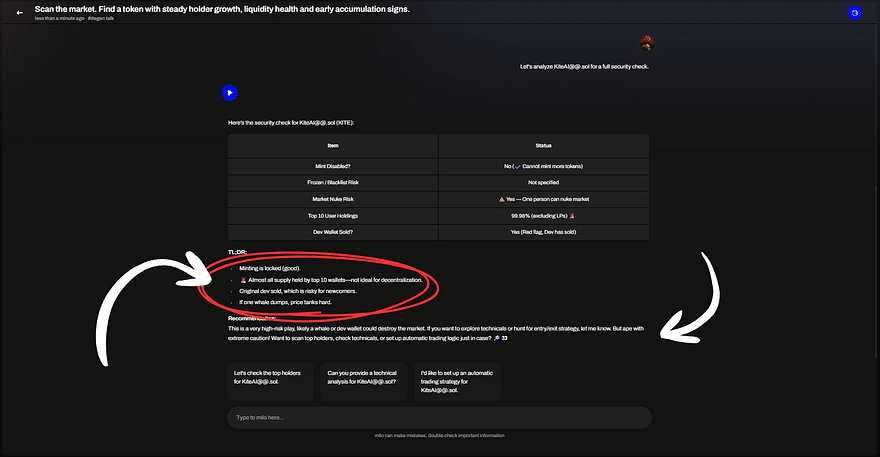

You can feel when euphoria is building, when despair is settling in, or when the market is quietly consolidating, waiting for its next move.

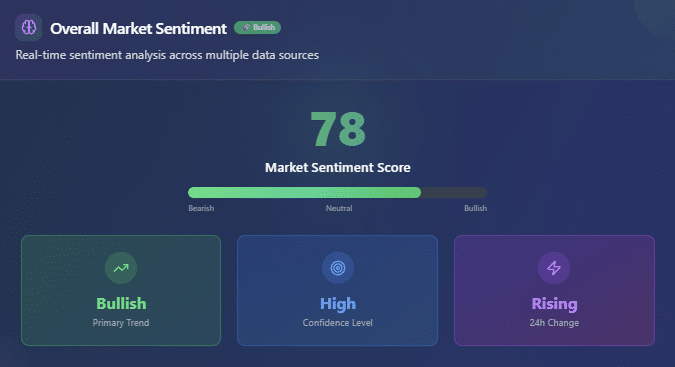

The traders who last are the ones who can feel the shift before the charts show it. They can recognize the change in energy, in participation, in sentiment. Pump Parade and Milo help me confirm what I already sense. They track social shifts, holder activity, liquidity changes: the signals that tell me the market’s heartbeat.

After enough cycles, I’ve realized something important: the market always talks before it moves.

Those who survive and thrive aren’t the loudest, the boldest, or the fastest. They are the ones who listen carefully enough to hear it.