I’ve lost thousands in crypto trades and DeFi, and for years I blamed either bad luck or bad timing.

It wasn’t until I finally understood how the market actually works that I recognized the real reason for my failure: poor decision-making.

If you’ve spent any time in crypto, you know how overwhelming it can be. The space moves fast, narratives flip overnight, and what looks like conviction today can turn into confusion tomorrow.

Early on, I made a lot of decisions based on hype, instinct, and social media chatter. Some worked. Most didn’t.

I’d chase momentum, get trapped in liquidity cliffs, and exit too early when volatility hit. What finally changed was taking a structured, data-backed approach to everything, especially when the market felt chaotic.

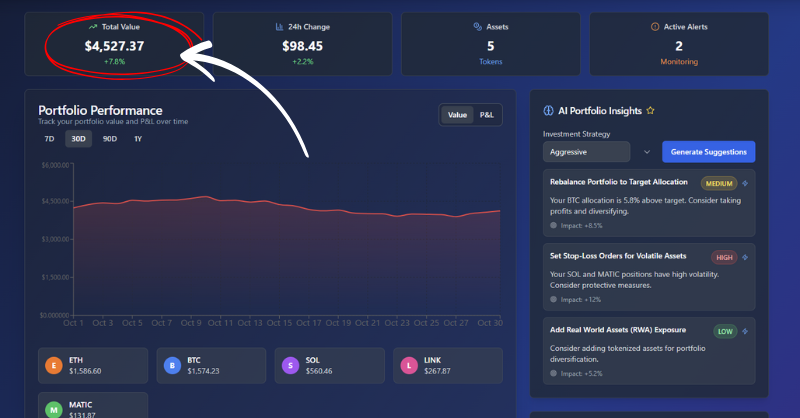

Now I know: crypto investing is really about is building a repeatable system that helps you see through noise, spot genuine opportunities early, and make consistent, intelligent decisions.

After years of refining my process (and watching what separates consistent winners from the rest), here are the three biggest lessons that changed everything for me.

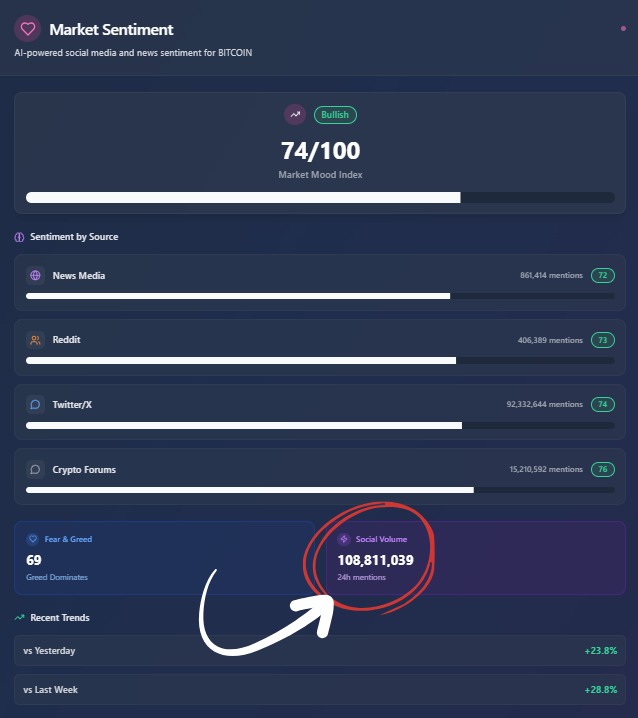

1. Use Better Tools to Track Market Shifts & Social Sentiment

Crypto is flooded with data.

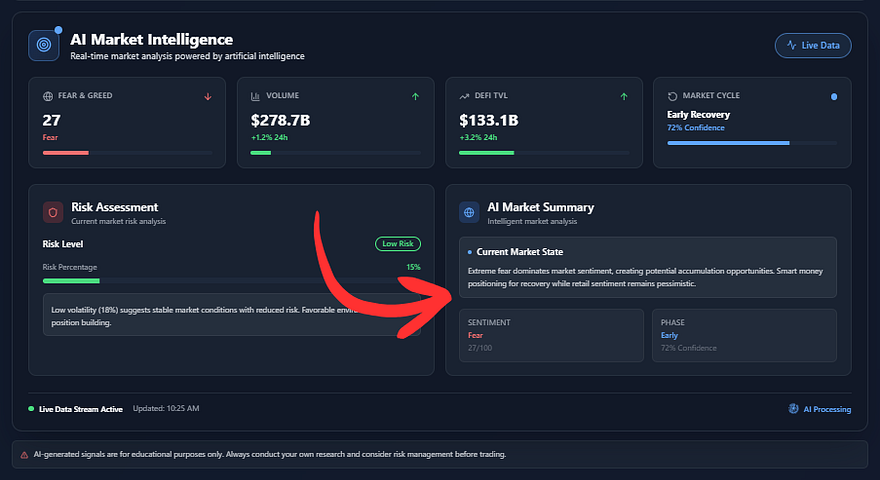

The challenge isn’t access, it’s interpretation. Most people drown in dashboards and alerts without knowing what actually matters. The real advantage comes from combining multiple lenses: social, technical, and on-chain to see where the market is really heading before the crowd does.

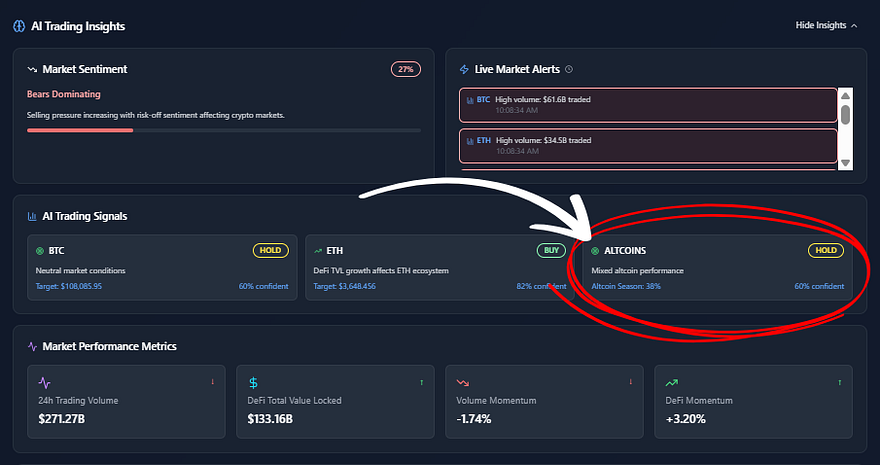

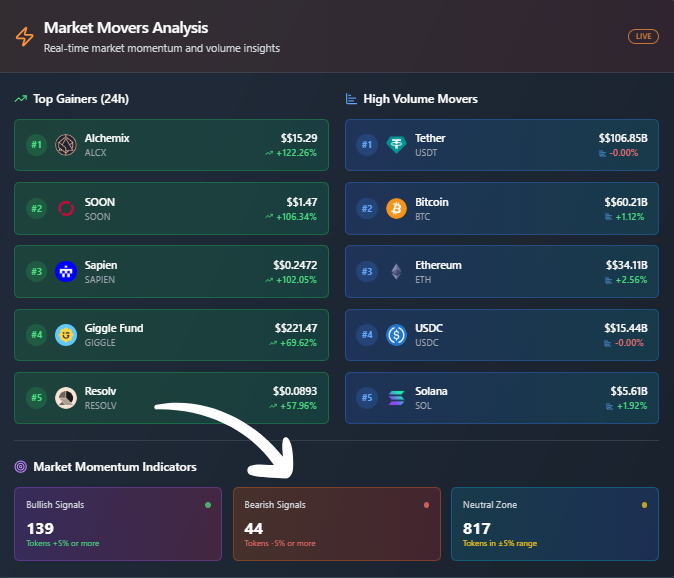

Everyone loves to talk about “altcoin season.” But very few can define it in measurable terms. That changed for me when I started quantifying what used to be “vibes.”

🤔 For example, the Altcoin Season Index helped me track when a broad rotation was statistically underway: when 75% of the top 50 coins were outperforming Bitcoin. That simple shift from opinion to data was a game-changer.

Then, I layered on better tools:

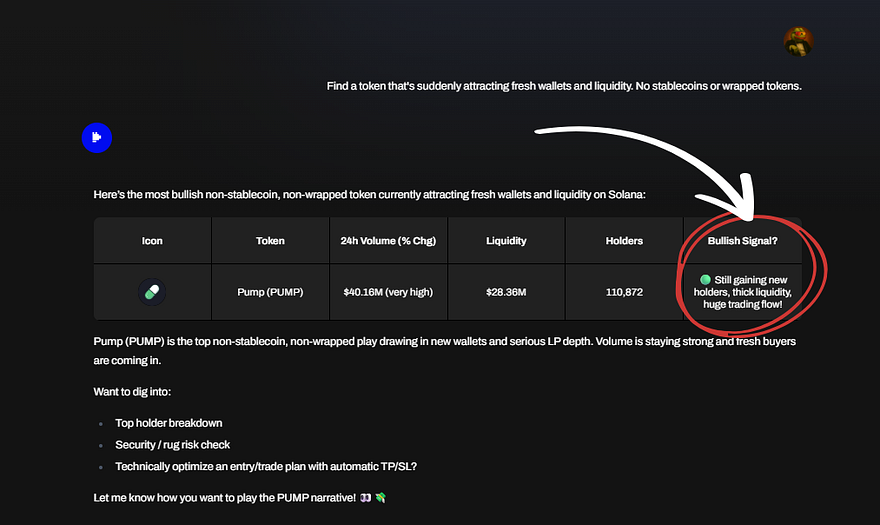

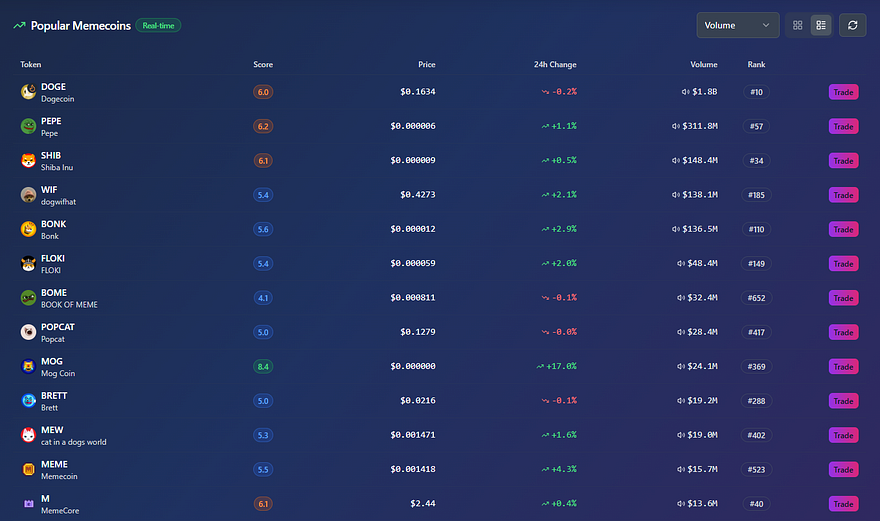

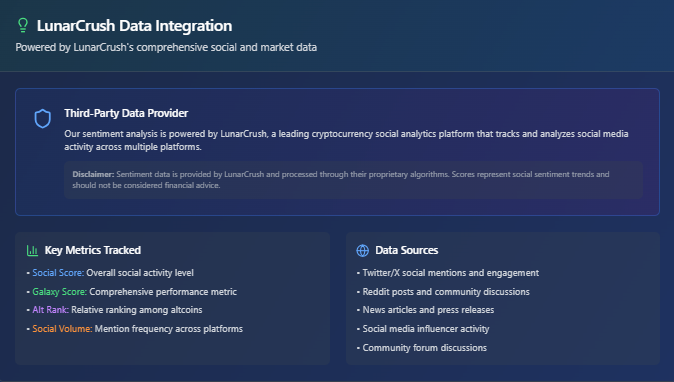

- Pump Parade: My go-to for scanning high-potential, small-cap projects based on market sentiment, on-chain metrics, and technical analysis. It helped me distinguish organic momentum from manufactured hype. Instead of guessing what was trending, I could see it forming in real time.

- Glassnode and Santiment: For macro-level on-chain signals. Watching stablecoin inflows, exchange reserves, and whale wallet activity became my north star for timing shifts in risk appetite.

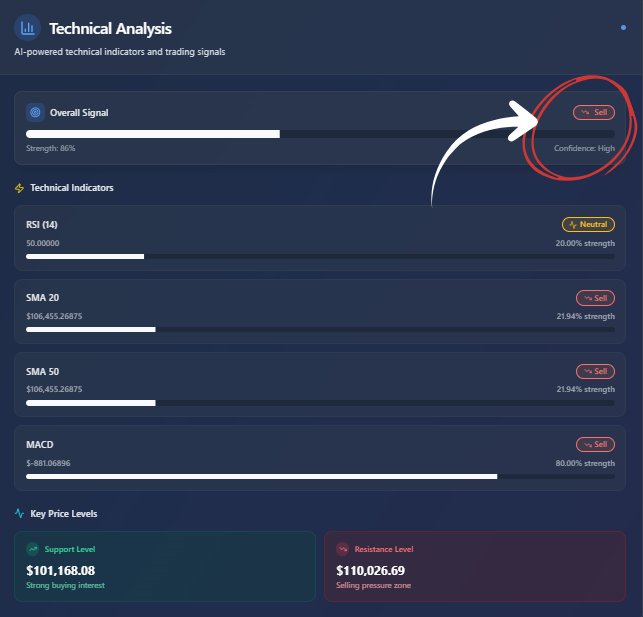

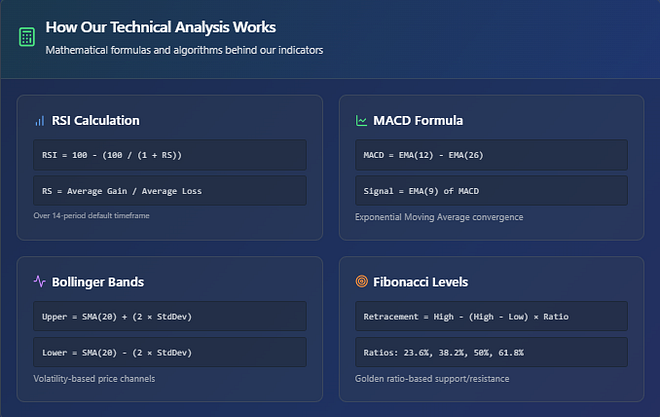

- TradingView: Customized alerts on structure breaks, funding rate flips, and RSI divergences meant I didn’t need to stare at charts all day.

The real magic came when I started correlating these layers.

If Pump Parade showed growing social traction, and on-chain data confirmed rising unique wallet activity (while technicals hinted at accumulation) that was enough to act decisively.

💪🏼 When I combined social sentiment with capital flow data, I stopped getting blindsided. I could see rotations before they were obvious. I could tell when altcoin strategies made sense, and when it was time to step back into BTC or stables.

Most traders make emotional decisions because they don’t trust or don’t know how to read their data. Once you build a system where each layer confirms the others, your confidence compounds naturally.

💡 Lesson: When the data is available, guessing is a choice. Use advanced crypto research and market analysis tools to make sure you’re always well informed.

2. Treat Small Caps as High-Conviction Plays, Not Lotto Tickets

Most people approach small caps like scratch-offs.

They scatter a few bets, pray one 100x’s, and call it “strategy.” But real small-cap success doesn’t come from luck, but from conviction built on evidence.

You have to treat these plays like early-stage startups, not gambling tickets.

That means research. Yes, even for memecoins. Understanding what you own and why is crucial. Every great small-cap win I’ve had shared the same DNA: an early but functional product or viral trend, clear demand signals, and a motivated community that wasn’t just farming airdrops.

What I Look For

Here’s how I evaluate small-cap crypto opportunities today:

- Product over promise: Is there a working MVP or real usage metrics? I avoid anything that’s been “coming soon” for six months.

- Incentive design: How are users rewarded? Is it sustainable, or is it just yield dilution in disguise?

- Team quality: I’ll dig into founders’ previous projects, even non-crypto ones. Execution history matters more than fancy whitepapers.

- Tokenomics clarity: I want transparent unlock schedules, a defined treasury strategy, and a clear link between token usage and network growth.

But data is just the start. What’s most important is interpreting context. I’ll often pair metrics with qualitative cues, like Discord/Telegram growth, GitHub commits, or wallet diversity.

You can tell a lot about a project’s health by who’s showing up, not just how many are there.

My Approach to Position Sizing

Even when I love a project, I size small caps conservatively.

Usually between 0.5–2% of my total portfolio, unless conviction is extremely high.

For example, one of my biggest wins was a DeFi protocol called GMX. I accumulated quietly during a 3-month flat period. The liquidity was low, holders weren’t showing up, but the team kept building. When volume returned and CEX listings hit, the token did a 7x.

But I wasn’t surprised. I’d been watching the fundamentals tighten for weeks. The key wasn’t catching hype; it was catching inflection.

It’s also important to stay update. Every quarter, I reassess:

- Is growth accelerating or stalling?

- Has the roadmap changed?

- Are new competitors eating their niche?

If the data weakens, I scale down. If traction builds, I add on strength.

The Small Cap Mindset

The difference between a gambler and an investor in crypto is process. If you treat a small-cap token like a startup, you start asking sharper questions. You stop chasing pumps and start accumulating conviction.

Because at the end of the day, your edge isn’t in finding the next “moonshot.” It’s in identifying something fundamentally strong before the rest of the market recognizes it.

💡 Lesson: Treat every investment like a business. If you wouldn’t invest in the team or model in another industry, don’t justify it just because it’s on-chain.

Visit Pump Parade and get free access to the most advanced crypto AI tools.

3. De-risk Through Strategy, Not Emotion

The hardest part of crypto isn’t finding opportunities, it’s managing yourself once you’re in one.

The volatility, the hype, the “should I sell?” questions: it all eats at your discipline. The truth is, most people don’t lose money because they pick the wrong coins. They lose because they don’t have a playbook when things get chaotic.

Emotion is inevitable. What matters is that it doesn’t decide for you.

Build Systems, Not Feelings

Every successful trader or investor I know operates with structure. That means predefined entry and exit rules, allocation sizing, and fallback plans. You don’t need to be perfect, you just need to be consistent.

For me, that structure looks something like this:

- Define what kind of trade it is before entering (scalp, swing, long-term hold).

- Decide whe I’ll take profits and where I’ll cut losses before hitting “buy.”

- Use staggered scaling in/out, not all-or-nothing moves.

That alone cut my emotional stress in half. It also prevented me from turning small wins into big losses, something almost everyone in crypto learns the hard way.

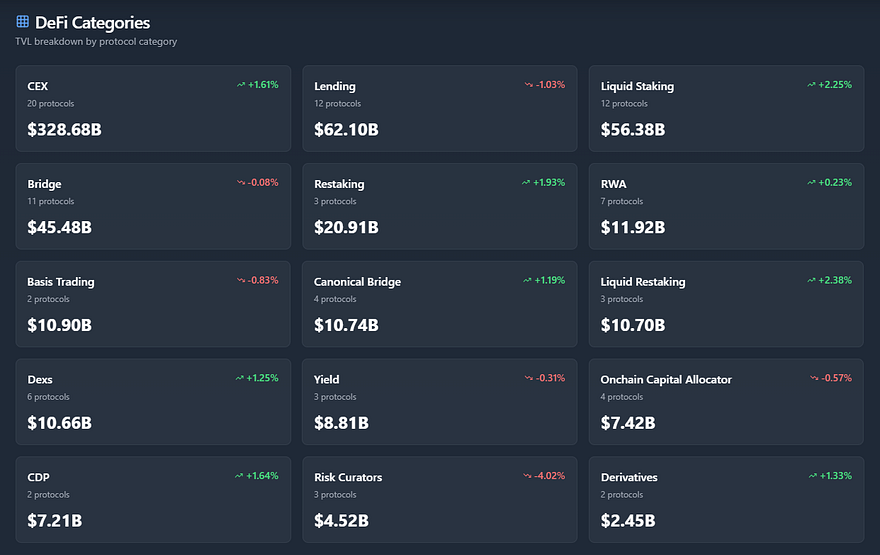

Yield Farming: Risk by Design

Take yield farming, for example. The rewards look irresistible until you realize most “APY” numbers are unsustainable emissions meant to attract liquidity. The trick is identifying when yield is earned (from actual protocol fees or volume) versus subsidized.

My rule is simple:

- If I can’t explain where the yield comes from in one sentence, I don’t farm it.

- I only touch platforms with audited contracts, transparent emissions, and real economic activity behind them.

Yield farming isn’t passive income as much as it’s active risk management. If you don’t know who’s on the other side of the trade, you’re probably their exit liquidity.

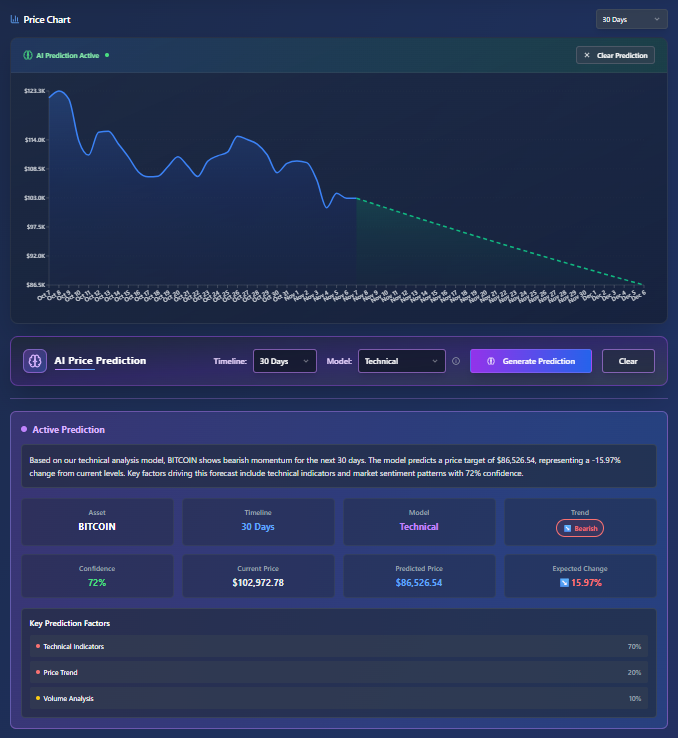

Trading Signals & AI Agents

When it comes to crypto trading signals, I never rely on any single source.

Most signal groups are chasing engagement, not accuracy. I use signals as prompts for deeper research, not instructions to buy.

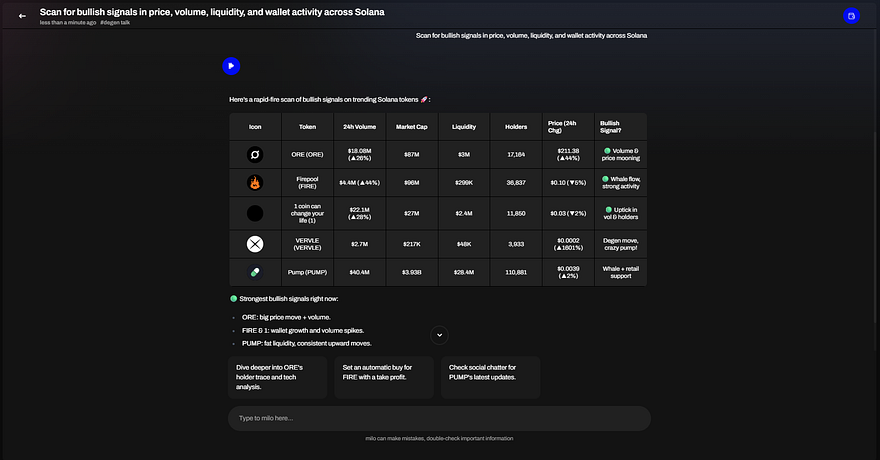

That’s why I use advanced crypto AI tools and agents: systems that scan for anomalies in price, volume, liquidity, and wallet activity across multiple ecosystems.

These agents watch for subtle shifts, like an increase in unique wallet activity right before volume spikes, or LP migrations that signal stealth rotations.

They’ve become my early-warning system. If my AI flags a token that’s suddenly attracting fresh wallets and liquidity, I know something’s happening beneath the surface.

It doesn’t mean “ape in.” It means start paying attention.

Codify Your Edge

Discipline is about codifying your process so emotion doesn’t drive decisions.

That means writing things down: your rules, your triggers, your red lines. It means checking your portfolio weekly, not hourly. And it means accepting that missing a trade is better than forcing one.

Because crypto rewards those who stay alive long enough to catch the next cycle.

💡 Lesson: It’s impossible for us as humans to eliminate emotion. But we can set automations and mechanisms to make sure emotion never overrides our system.

Final Thought: Success in Crypto Is a Process, Not a Fluke

The longer I’ve been in crypto, the more I’ve realized that consistency beats brilliance. The traders who last are the ones who’ve built a process that holds up when the noise gets loud.

This space moves at an impossible pace. New tokens launch every day. Narratives explode and die within weeks. Liquidity rotates across chains overnight. You can’t control that. What you can control is how you respond to it.

For me, that meant slowing down when everyone else was speeding up. It meant asking better questions, tracking real data, and building habits that removed luck from the equation as much as possible.

Most people think crypto success comes from predicting what’s next. But the truth is, it comes from recognizing pattern: in price, in sentiment, and in behavior. And having the discipline to act (or not act) accordingly.

If you want to succeed here long-term, you don’t need perfect timing. You need a framework that helps you:

- See early: Track how sentiment, liquidity, and narratives evolve in real time.

- Act rationally: Size risk, define rules, and let data (not dopamine)drive execution.

- Adapt quickly: The moment your edge stops working, refine it. The best traders aren’t attached to being right. They’re obsessed with staying effective.

I still get trades wrong sometimes. I still misread narratives. But now, my losses are smaller, my wins compound faster, and my decisions are deliberate.

That’s the real payoff of structure: it builds resilience.

So whether you’re trying to find the next breakout altcoin, navigate yield farming platforms, or use AI tools to sharpen your trading, remember: your biggest advantage isn’t access. It’s clarity.

Clarity in data. Clarity in process. Clarity in mindset.

Because in a market built on chaos, the ones who win are the ones who stay calm enough to see through it.

You don’t need more hype. You just need better habits.