Let’s break one of the unspoken rules of Web3 together:

“Don’t trust. Verify.”

Because this time… we trusted.

We handed $200 to a Solana AI agent, gave it minimal instructions, and let it loose in the wild world of memecoins. No safety net. No manual overrides.

The AI agent’s name is Milo: an on-chain autonomous trader built to manage portfolios and hunt opportunities with cold logic and real-time data.

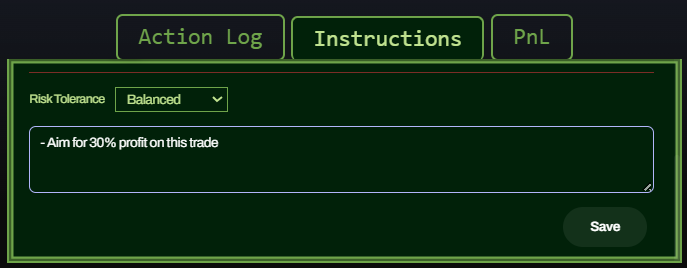

We literally gave it one instruction:

“Find low-volume Solana memecoins with bullish momentum. Target at least 30% profit.”

Then we stepped back and watched.

What happened next surprised us more than we expected. Not just because it made money, but because it showed us what the next era of trading looks like.

Why AI Agents Might Be Exactly What Retail Needs

Before diving into results, let’s zoom out and explain why all of this matters.

Retail trading, especially on Solana, has turned into a speedrun of chaos. Most traders fall into one of the following cycles:

- Buy the memecoin X or Reddit are hyping → Watch it moon → Watch it rug → You’re left holding the bag.

- Spend hours building TA setups → Get carried away by emotion → Ignore stop-loss when price dips → Blame the devs.

- Join 12 alpha groups → Get conflicting signals → Miss the entry → FOMO in anyway.

Sound familiar?

Humans aren’t wired to outpace a market that rotates narratives every 15 minutes.

In other words: There’s no human brain capable of processing that much information and executing accordingly.

We chase pumps, second-guess entries, and let emotion override our own strategy.

AI agents don’t do any of that.

- They don’t sleep.

- They don’t get emotional.

- They don’t revenge trade after a red candle.

They just scan, decide, and execute consistently.

So, our whole experiment starts from a simple question:

Can a Solana AI agent, using the same information available to us, outperform the average human trader just by being ruthlessly consistent?

Spoiler: Yes. And it wasn’t close.

The Setup: Giving Milo $200 and a Simple Mission

We wanted this test to mimic what a real, retail user might do.

We created a fresh Solana wallet, loaded it with $200, and connected it to Milo, the AI agent.

We told it:

- Prioritize Solana memecoins with strong short-term momentum.

- Target at least 30% ROI.

- Risk toleration: Balanced.

Milo took it from there. It started scanning markets, pulling on-chain liquidity and wallet flow data, checking token legitimacy, and lining up potential entries.

It didn’t feel like a trading bot running a script. It was more like a trader who already understood the environment and was waiting for instructions.

And when they arrived, it executed like a pro.

What Milo Actually Did

Milo went to work immediately.

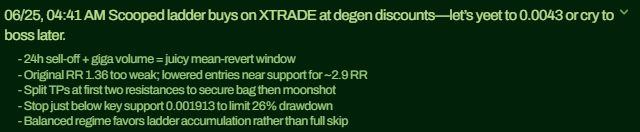

It placed its first trade order within minutes: $XTRADE, a low-volume token picking up steam. Milo broke down its entry and exit logic in plain language. It laddered entries, managed position size, and placed profit targets based on volatility.

Other trades followed:

- $USELESS: Caught a dip after a high-risk/reward signal.

- $AURA: Set up laddered buys with evolving stop-losses.

- $STUPID: Scaled in post-pump, preparing for a short-term volatility scalp.

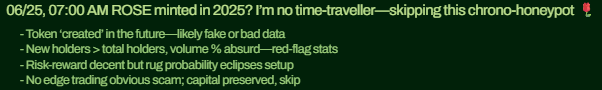

It also passed on several tokens after analyzing holder distribution and inconsistent developer activity.

One key example: $ROSE, which looked good on price action but didn’t pass Milo’s security screen due to inconsistent data.

One of the aspects we liked about Milo was that it explained the rationale behind each trade: what it saw, why it passed, where it expected entries and exits.

In other words: this wasn’t automation for the sake of automation. This was intelligent, explainable execution. It showed reasoning.

The Results

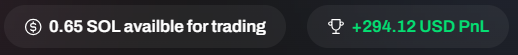

From our initial $200, Milo generated a portfolio value of $494.12. That translates to a 147.06% return in about 24 hours.

Here’s the quick breakdown:

- Initial capital: $200

- Top trade: $XTRADE (+101.81%)

- Worst trade: $SPX (+0.6%)

- Current value: $494.12

Were there hiccups? Yes. Milo made some high-slippage trades we wouldn’t have touched manually. It missed a few late-night launches.

But did it outperform manual trading in the same time period? Undeniably. And with near-zero effort.

Even if we spent hours monitoring charts, telegram groups, and DEX tools, we would’ve struggled to match its output, let alone exceed it.

What This Means for Trading Going Forward

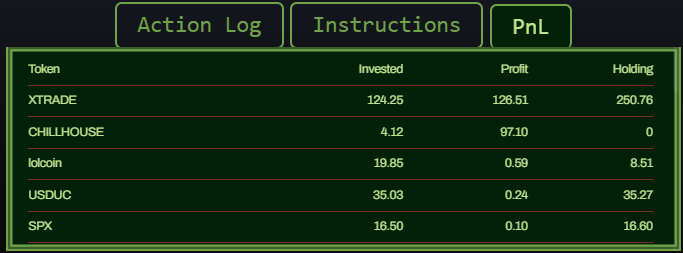

Retail is burned out.

Solana alone sees hundreds of memecoin launches daily. Most are low-effort pump and dumps. The rest are buried in noise. Manually tracking them is not just inefficient, it’s impossible.

And the game is changing fast.

Solana AI agents like Milo represent a new kind of trader, one that never tires, never hesitates, and is undisturbed by emotion, always following the plan.

Yes, they are convenient, but they are much more than that too.

Think about them as an extension of yourself. An upgrade for your slow, human brain that gives you not only the capacity to process gigantic volumes of data in seconds, but also equip yourself with:

- 24/7 execution without burnout.

- Personalized risk settings.

- Instant response to market shifts.

- On-chain memory for smarter future trades.

- Protection against emotional interference.

If you are trader, you have nothing to be worried about. You’re not working against them but with them. They don’t replace your strategies, they scale them.

You define the rules. They run the playbook.

What’s Next

We’ve seen how Milo works, but our experiment isn’t over.

Now that we’ve tested basic functions, we’re ready to push it to the limit:

- Multiple wallets running competing strategies (swing vs. scalp vs. snipe).

- Granular prompts to test how far its “understanding” goes.

- Long-term tracking against manual trades.

Because what we’ve seen so far is just a preview.

The endgame is something we have never seen before. Human and machine teaming up against scams, schemes, and noise.

We don’t need to beat the machines. We need to trade with them.

And right now, platforms like Milo are proving it’s not just possible: it’s already happening.