Predicting cryptocurrency prices is one of the hardest challenges in finance. If it was easy, we would all be millionaires.

Markets move fast, sentiment shifts in minutes, and technical signals often contradict each other. To tackle this, we built an AI-driven prediction system that combines traditional financial analysis, real-time sentiment tracking, and advanced machine learning into one cohesive architecture.

Instead of relying on a single method, our system works across three different models: Technical Analysis, Sentiment Analysis, and a Hybrid Model that blends both. Together, they form a resilient, multi-layered framework for price forecasting based on real-time analysis of on and off-chain data. It’s free to use and supports over 1,000 cryptocurrencies.

Now, let’s dive into how it works to help you make the most out of it.

Pump Parade’s AI-powered crypto prediction tool is free for everyone to use. Open any token page on Pump Parade, scroll down to the chart section, and click on “Generate Prediction” to get started.

Multi-Layered Prediction Framework

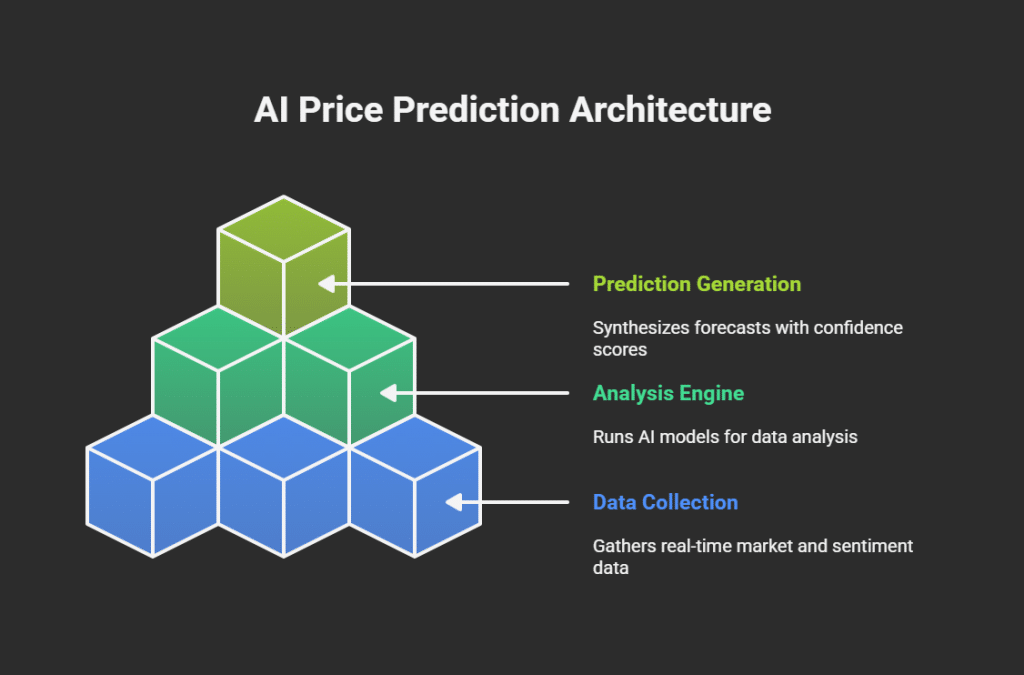

At the core, the AI price prediction system runs on a three-tier architecture:

- Data Collection Layer: Aggregates real-time market prices, technical indicators, sentiment data, and community activity.

- Analysis Engine: Runs AI models tailored to each type of analysis.

- Prediction Generation: Synthesizes results into actionable forecasts with confidence scores.

This separation makes the system modular, scalable, and fault-tolerant. If one source or model fails, predictions still run on fallback mechanisms.

This ensures that the system always has a reliable source of data to base its predictions on, ensuring that every forecast is backed by a real analysis and is not randomly generated, as other basic AI models may operate.

Data Inputs: The Foundation of Accuracy

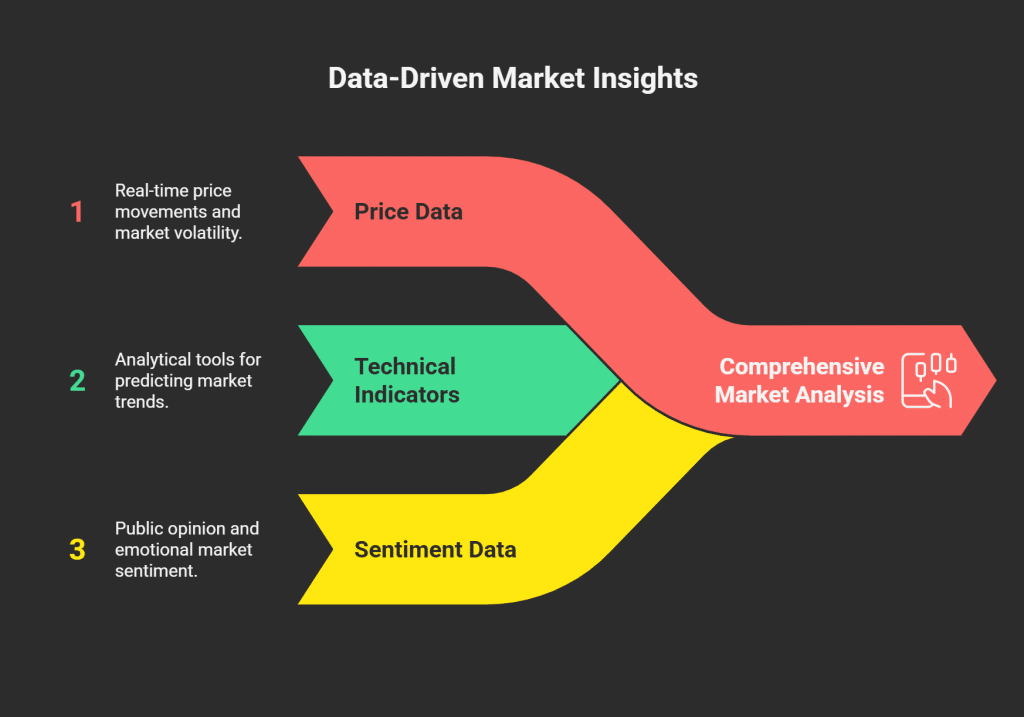

Everything starts with high-quality data. The system ingests:

- Price Data: Real-time candles, volume, volatility metrics.

- Technical Indicators: RSI, moving averages, regression trends, volatility indexes.

- Sentiment Data: Twitter mentions, Reddit threads, news sentiment, Fear & Greed index.

All data is standardized into a clean structure, making it easy to plug into multiple models without data loss or inconsistency.

For example, the Relative Strength Index (RSI) is calculated directly from recent price changes, flagging overbought (>70) or oversold (<30) conditions. Moving averages identify trend direction, while volatility indexes measure market stability. Linear regression provides slope and intercepts for price trends.

This combination gives the AI both raw market signals and psychological indicators to work with.

Pump Parade’s AI-powered crypto prediction tool is free for everyone to use. Open any token page on Pump Parade, scroll down to the chart section, and click on “Generate Prediction” to get started.

The AI Models

Some traders like to design their plan around technical data and analysis, others believe that sentiment is more important when determining market movements. That’s why we have integrated both philosophies into the AI price prediction engine to provide traders with everything they need regardless of their preferences.

Here’s how each of these models work.

1. Technical Model

The technical analysis model focuses purely on numbers. It ignores sentiment and emotion and is designed exclusively to find patterns in the on-chain and market data sets. Ideal for the data-driven traders.

Primarily, it analyzes:

- Current price vs. moving averages.

- RSI values (momentum).

- Trend slopes (linear regression).

- Volatility levels.

- Volume surges.

- Support and resistance zones.

The system collects this data at the exact moment the user clicks on “Generate Prediction,” ensuring that all information is as recent and reliable as possible. Then, it feeds it to an AI model and instructs it to follow a structured format, evaluating each factor systematically and carefully. Finally, the model classifies the trend as bullish, bearish, or neutral, and estimates the likely percentage price change over the prediction period based on the data it’s fed.

2. Sentiment Model

The sentiment analysis model tracks the pulse of the market community. It’s more suitable for emerging, small-cap tokens that don’t have significant trading volume, such as memecoins or recently-launched tokens.

This model measures:

- Social sentiment scores (positive vs. negative chatter).

- Twitter mentions and engagement spikes.

- Reddit discussions and upvote velocity.

- News headlines sentiment.

- Fear & Greed index values.

These metrics quantify the “mood” of the market. For instance, a strong technical sell signal might be overridden if sentiment is overwhelmingly bullish and backed by surging community activity.

3. Hybrid Model

The hybrid model blends both sides, technical and sentiment, into a weighted analysis. By default:

- Technical indicators: 60% weight.

- Sentiment indicators: 40% weight.

This model acts as a balance point: when sentiment and technicals disagree, it dampens the extremes and produces a more conservative prediction.

AI Integration and Prediction Pipeline

Once the system collects the data, it generates predictions using Google Gemini AI as the primary backend, with Meta Llama 3.1 (via OpenRouter) as fallback. If both fail, a pure mathematical model kicks in, calculating price trends from historical data.

The system uses regex-based parsing to cleanly extract:

- Trend (bullish, bearish, neutral) based on data interpretation.

- Confidence score (0–1 scale) based on a variety of factors.

- Expected percentage change.

- Predicted price levels.

These values then feed into a compound growth engine, which generates a daily prediction curve. Instead of just giving a single target, it produces a day-by-day price trajectory, including timestamps and confidence levels.

Accuracy and Validation

Sometimes, especially with small-cap tokens with low trading volume, the available data set is not large enough to make an in-depth analysis.

The AI price prediction engine can still read it and analyze it to create a forecast. But to warn the user that this prediction is based on lower quality data, we have integrated a confidence rating that indicates each prediction’s reliability.

This confidence rating is based on:

- Signal clarity (e.g., strong RSI divergence = higher confidence).

- Historical backtesting accuracy.

- Input data quality.

- Market conditions (high volatility lowers confidence).

Backtesting allows us to continuously refine factor weights and calibrate accuracy. Over time, the model adapts to changing market regimes, aiming for higher reliability every time.

User Experience

We won’t pretend Pump Parade is the only AI crypto price prediction tool. There are many out there, but they tend to be overly complex to use and provide unclear results.

We aimed to make our AI prediction feature accessible to everyone and straightforward to use. The tool handles all of the advanced, complex processes in the backend to simplify the user experience, allowing users to generate predictions in just a few clicks.

On the frontend, predictions are delivered in a clean, interactive UI:

- Prediction charts with confidence intervals.

- Trend indicators (bullish/bearish/neutral, color-coded).

- Factor breakdowns showing why the model predicted what it did.

- Timeframe selectors for flexible horizons (7–90 days).

Users can toggle between Technical, Sentiment, or Hybrid models depending on their trading style.

Final Thoughts

It’s important to mention that, even if we’ve taken all the predictions and designed the system for resilience and accuracy, it can still make mistakes.

Unexpected events happen, markets take surprising turns, and even the best, most experienced traders can make the wrong calls. AI models are no different: even when all the data is available and all patterns and indicators point the same way, the market might surprise everyone and move the other way.

That being said, our AI-powered prediction system aims to augment traders with faster, smarter, and more adaptive analysis.

It’s designed to carefully merge hard technical signals with the soft science of sentiment, and back it all with resilient AI infrastructure. This enables traders to leverage a tool that’s both data-driven and market-aware.

It doesn’t promise perfection (no prediction model ever can), but it does deliver consistency, transparency, and adaptability: three things traders need most in the chaotic world of crypto.