I remember, when I first started trading and learning about strategy and analysis, thinking:

“This is impossible.”

Indeed, trading is hard because the market never sleeps, the news never stops, and your own instincts are inconsistent.

Some days you stick to your rules; other days a chart spike or a sudden headline pulls you off course. Even experienced traders know the frustration of missing moves or making impulsive decisions.

Don’t worry, it’s natural. It’s because we’re human.

Yet, there’s another way to solve this problem: AI agents.

I’m not talking about automation bots, which are pretty cool already. But AI agents are much cooler. They act as an extension of your mind.

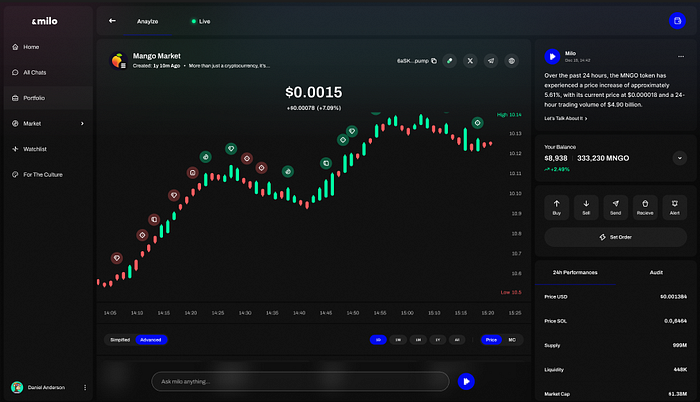

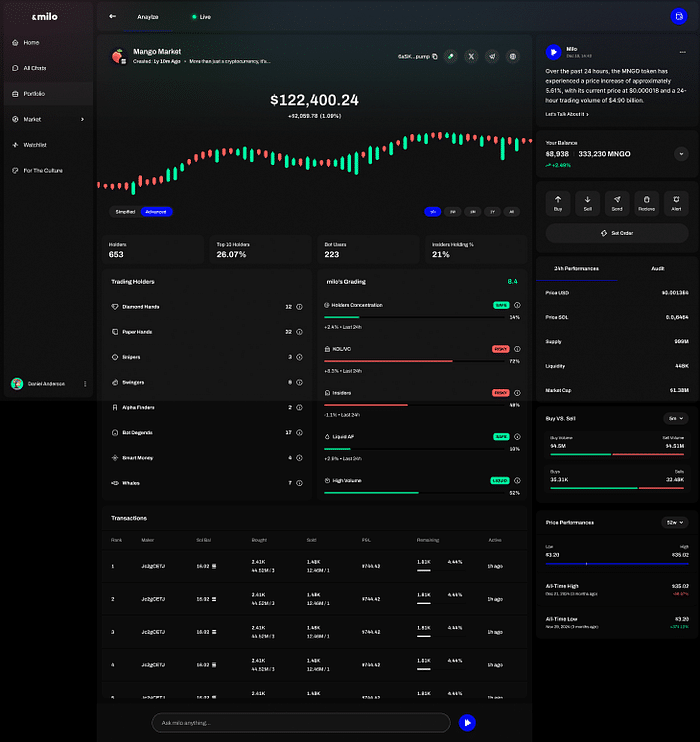

They can scan thousands of tokens, analyze social and on-chain signals, detect manipulation, and react to momentum in real time, 24/7.

Think of an AI agent as a smart apprentice. It observes your style, learns your risk appetite, your preferred assets, your approach to timing, and then begins making decisions that align with you.

Over time, it becomes less a tool and more a partner, a second set of hands that acts like you would if you had infinite attention and zero emotional bias.

But not all AI agents are created equal. The real value comes when you teach the agent your style. Not just giving it rules, but showing it what you care about, what you avoid, and where you thrive.

🧠 In other words, not outsourcing your trading to a third party, but actually using the technology as a tool and an extension of your own mind.

That is what turns a reactive system into a predictive one that can execute your strategy with precision and consistency.

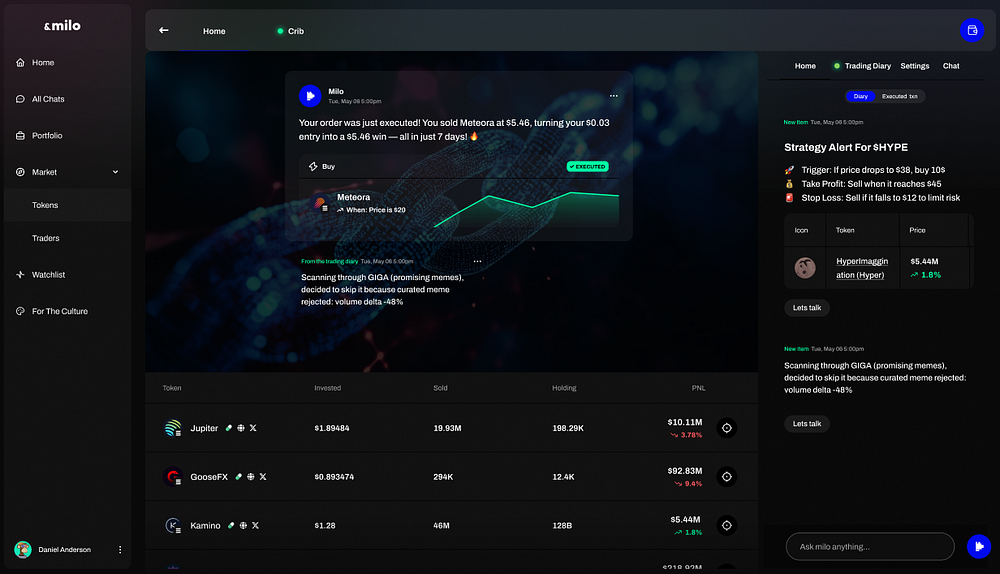

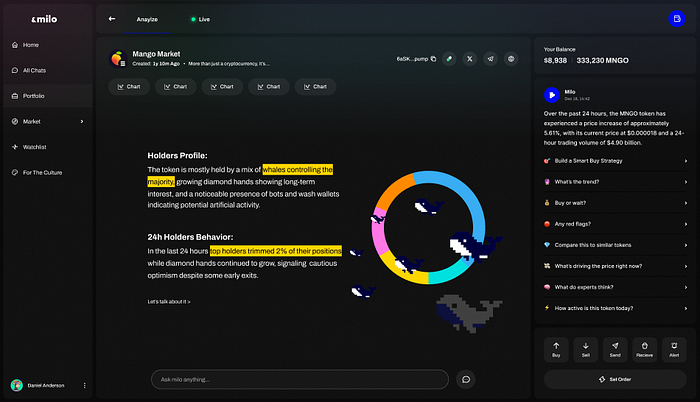

In this article, I’ll share how you can teach an AI agent called Milo how to trade crypto like you would.

But before we dive into setups, let us break down the key elements of building your style into an AI agent. It all comes down to token selection, risk tolerance, and budget allocation. How you choose each of these defines the environment your AI will operate in and directly shapes its behavior.

Let’s dive in.

How to Set Up Your AI Agent Trading Style

First, let’s see how exactly you can start using AI agents for your crypto trading strategies. Don’t worry, it’s incredibly easy.

Setting up your trading style is not about flipping a few switches. It is about teaching the agent how you see the market. Your comfort zone, your instincts, your appetite for risk and your view of what opportunity looks like.

Once you define these pieces, the agent begins to understand the logic behind your decisions.

Here is the step by step process most traders follow when shaping their AI agent.

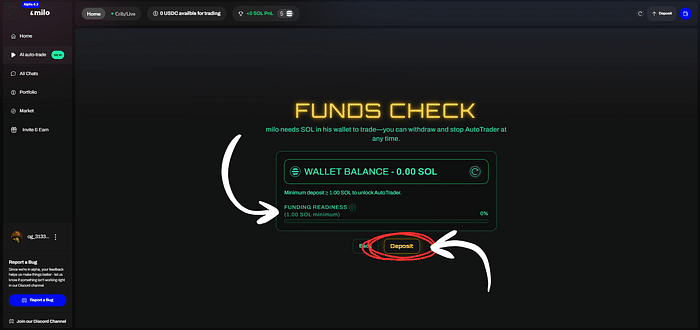

Step 0: Go to Milo and Connect Your Wallet

Before anything else, you need to give the agent a home to operate from.

Visit Milo, connect your wallet, and create your dedicated agent wallet. This sets the foundation for everything that follows. Your agent needs this workspace so it can scan, analyze and execute trades securely without touching your personal funds.

Once your wallet is connected, the rest of the setup becomes smooth and intuitive.

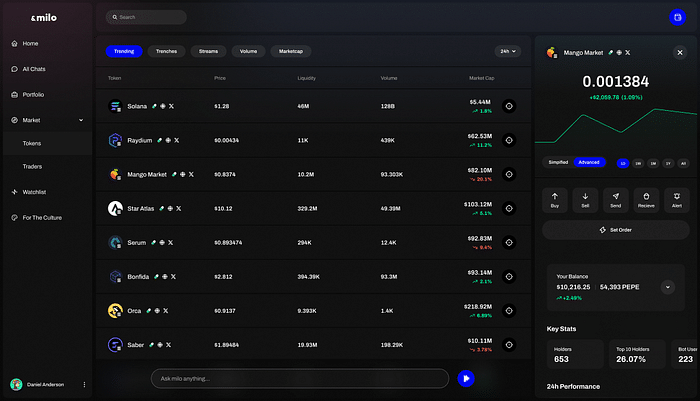

Step 1: Choose Your Token Sets

Every trader has a preferred environment. Some like deep liquidity. Some like chaos. Some like slow accumulation. Your token sets define that environment.

Inside your agent, you will see categories such as:

- Trenches: Early stage, low liquidity, high variance tokens for asymmetric high risk bets.

- Memes: Every Solana memecoin from pump.fun with real time narrative flow.

- Promising Memes: Curated meme list with stronger signals and less rug noise.

- Staking: Tokens focused on accumulation, APY comparison and long term yield.

- Native: Core Solana ecosystem tokens with strong liquidity and clean movement.

- Majors: Blue chip Solana assets for conservative or steady growth profiles.

- Stables: Stablecoins for low risk yield, arbitrage and safe parking during volatility.

- xStocks: On chain mirrors of real world equities for traditional market exposure.

Pick the sets that match how you naturally trade: This is the first signal that teaches the agent where you feel comfortable. Conservative traders often choose Majors and Stables. Explorers mix Promising Memes with Native. High-risk hunters go straight into Trenches and fast-moving microcaps.

Your token universe is your playing field. Choose it intentionally.

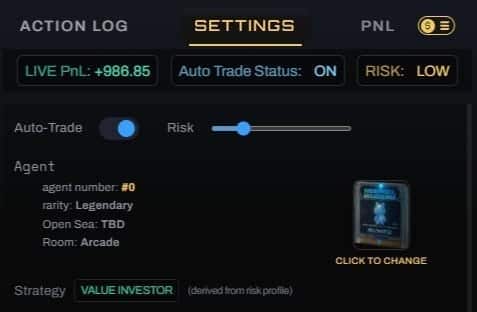

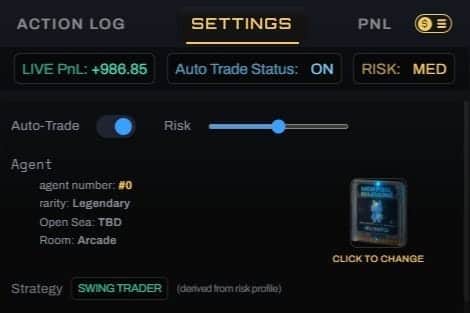

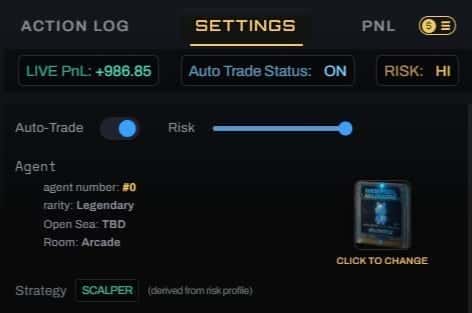

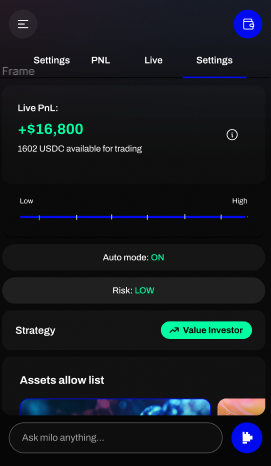

Step 2: Select Your Risk Profile

Your risk setting tells the agent how boldly it should act inside the environment you chose.

- Conservative: The agent becomes patient. It waits for clarity, avoids volatility and protects capital first.

- Moderate: Balanced. The agent takes opportunities when signals are clean but stays away from unstable setups.

- Aggressive: High tempo. The agent chases momentum, enters early trends and embraces volatility as part of the game.

Your risk setting changes how the agent behaves even with the same token sets. This is where your trading personality becomes visible.

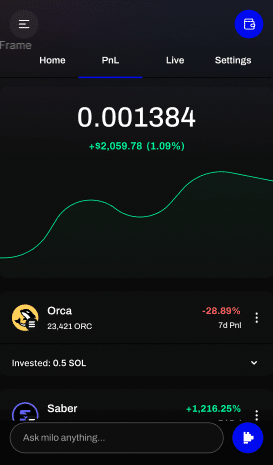

Step 3: Decide Your Budget

Your budget will define how Milo opens and closes positions and is directly tied to your risk profile. Naturally, a larger budget means more and bigger trades, but also higher risk.

Choose a budget that feels natural and comfortable. The agent will adapt to the way you want capital to flow.

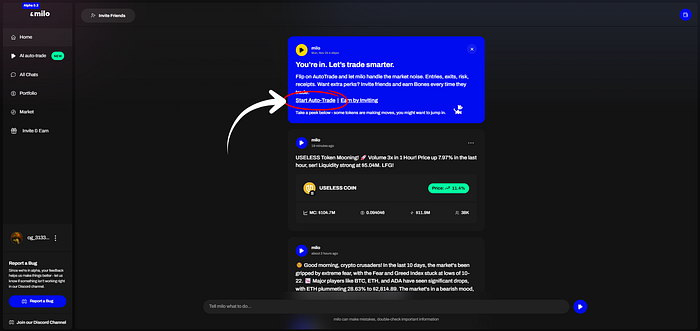

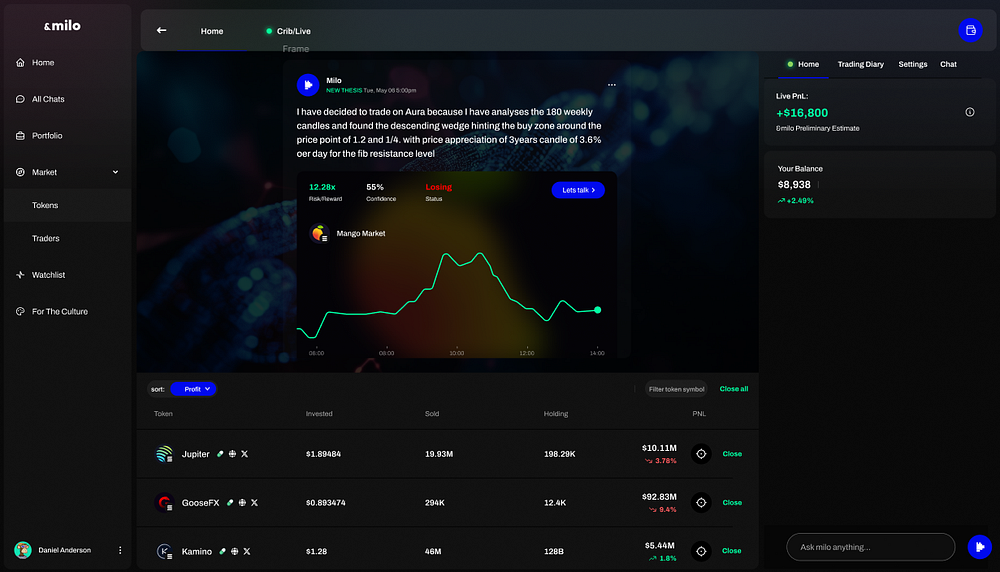

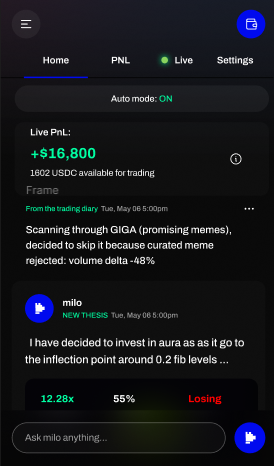

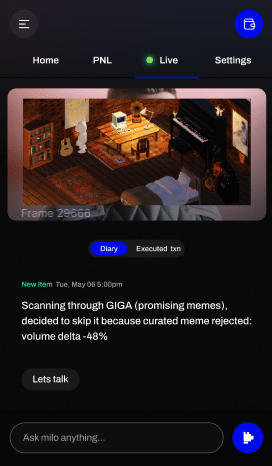

Step 4: Turn On Autotrading

Once you are comfortable with your setup, activate autotrading.

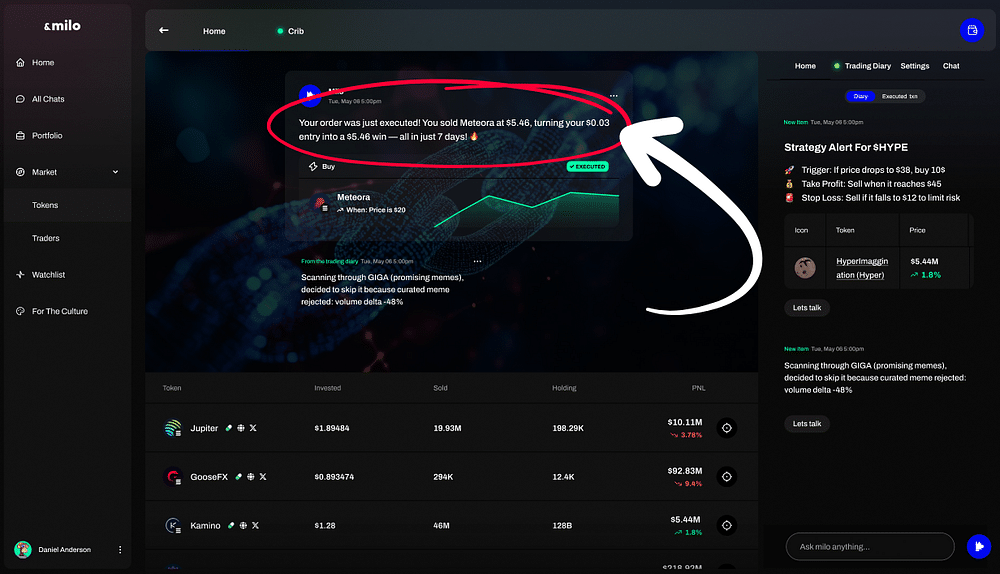

This is where the agent shows what it has learned. It scans, analyzes and executes based on the style you built. It follows the logic you believe in, even when you are offline.

The more you refine your settings, the more aligned it becomes. Eventually, it will feel like a second set of hands that trades with the same instincts you do.

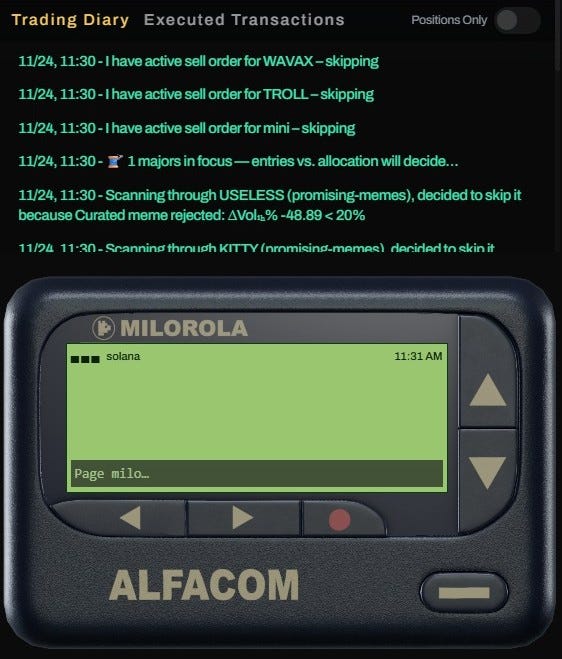

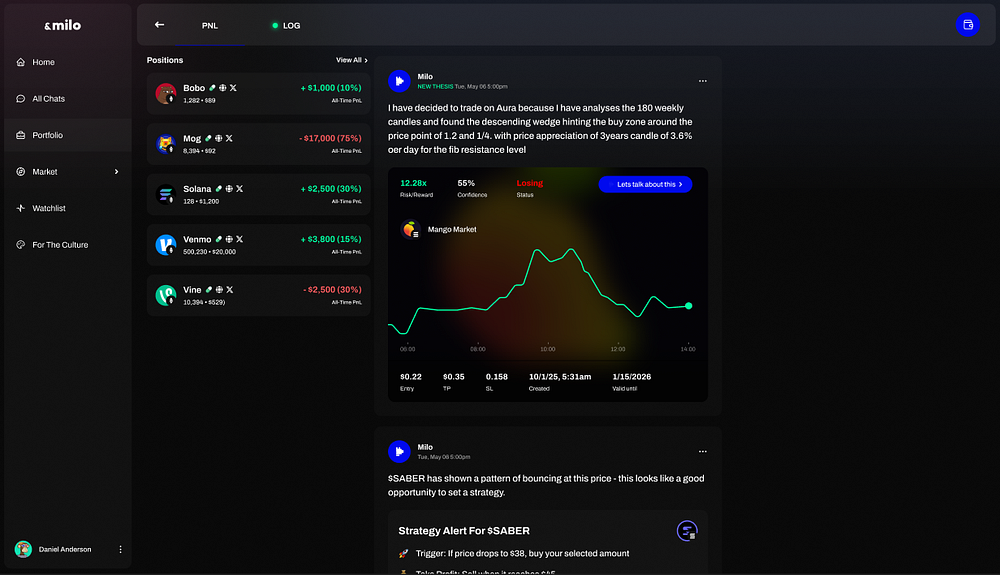

Step 5: Review, Adjust and Improve

Your trading style evolves over time. The market shifts. Your goals change. Your agent should grow with you.

Every few days, check:

- How it is allocating

- Which tokens it prefers

- How aggressive or patient it behaves

- Whether it is reacting the way you expect

Then adjust. The agent adapts quickly and begins reflecting your newest logic almost immediately.

Now that we’ve covered how to set up your Milo agent, let’s look at a few strategies you can actually try.

Each setup pushes Milo to behave a little differently, so take a moment to pick the ones that match how you like to trade and how much risk you’re willing to take.

Feeling confident to start on your own? Go right ahead! Connect your wallet to Milo and automate your crypto trading with AI.

Low-Risk Setups

1. Liquidity First Strategy

Some traders want stability above everything else. You prefer tokens that move slowly, behave predictably, and give you clear entry and exit lanes. This setup teaches the AI agent to prioritize safety through liquidity and consistency.

What this feels like: Your portfolio moves with a calm rhythm. There are fewer surprises, fewer sharp reversals, and fewer moments of doubt. The agent seeks clean charts with steady volume instead of chasing spikes.

Recommended configuration:

- Token sets: Majors, Native, Staking, Stables

- Risk profile: Conservative

- Budget: Spread out with small, evenly sized positions

Why it works: The AI agent filters out noisy tokens and focuses on stability. This reduces the chance of sudden losses and ensures your capital flows into assets that behave in predictable ways.

👉🏼 Set up this strategy on Milo’s Autotrader.

2. Trend Confirmation Strategy

Some traders prefer to wait for the market to show its hand. This setup tells the agent to avoid guessing and instead follow clear, confirmed trends.

What this feels like: Your entries feel supported by the market. You avoid premature buys. The agent steps in only when multiple high-quality signals line up and the trend already shows reliable direction.

Recommended configuration:

- Token sets: Majors, Staking, Promising Memes

- Risk profile: Conservative

- Budget: Broad allocation with emphasis on trend strength

Why it works: The agent relies on confirmation before entering trades. This keeps you out of risky early impulses and places you in positions backed by real momentum.

👉🏼 Set up this strategy on Milo’s Autotrader.

3. Rotational Rebalancing Strategy

Some traders like being exposed to strength without making risky bets. This setup guides the agent to slowly rotate capital into outperforming categories and away from weakening ones.

What this feels like: Your portfolio stays aligned with what is working in the market. Movements feel smooth and intentional. You avoid volatility while still capturing steady growth.

Recommended configuration:

- Token sets: Majors, Native, Stables

- Risk profile: Conservative

- Budget: Weighted evenly with occasional slow shifts

Why it works: The agent constantly evaluates sector performance and reallocates with patience. This creates a slow, steady compounding effect without exposing you to unstable tokens.

👉🏼 Set up this strategy on Milo’s Autotrader.

Medium-Risk Setups

1. Momentum with Filters Strategy

Some traders want exposure to excitement but with guardrails. This setup lets the agent chase momentum, but only when safety checks pass.

What this feels like: You catch strong moves without feeling reckless. Trades feel intentional. The agent finds active tokens but avoids those propped up by thin liquidity or manipulated volume.

Recommended configuration

- Token sets: Promising Memes, Memes, Native

- Risk profile: Moderate

- Budget: Balanced mix of stable tokens and momentum plays

Why it works: The agent combines momentum detection with safety filters. You get upside potential while avoiding many of the common traps in fast-moving markets.

👉🏼 Set up this strategy on Milo’s Autotrader.

2. Narrative Tracking Strategy

Some traders believe the strongest moves come from stories. This setup teaches the agent to follow emerging narratives and act early when social energy begins to build.

What this feels like: You catch tokens just as the conversation around them starts picking up. Trades feel timely. The agent avoids tokens pumped by bots and focuses on real, organic excitement.

Recommended configuration:

- Token sets: Memes, Promising Memes

- Risk profile: Moderate

- Budget: Moderate concentration toward narrative-driven assets

Why it works: Narratives often lead price action. By detecting social momentum early, the agent positions you ahead of broader market recognition.

👉🏼 Set up this strategy on Milo’s Autotrader.

3. Range and Breakout Strategy

Some traders thrive on structure. This setup guides the agent to wait for tight ranges and only enter when a breakout shows real strength.

What this feels like: Your trades feel precise. There is clarity in the setup. The agent waits for consolidation, watches liquidity, and commits only when the breakout is convincing.

Recommended configuration:

- Token sets: Promising Memes, Native, Memes

- Risk profile: Moderate

- Budget: Balanced, with slightly more weight toward breakout candidates

Why it works: Breakouts backed by liquidity have strong continuation potential. The agent becomes selective, entering only when the chart supports a sustained move.

👉🏼 Set up this strategy on Milo’s Autotrader.

High-Risk Setups

1. Early Trend Sniper Strategy

Some traders thrive on speed and early entries. You want to catch moves before most of the market notices them. This setup makes the AI agent a fast, alert operator that hunts early signals.

What this feels like: The market feels alive. The agent reacts quickly to rising volume and early upticks in activity. Trades are frequent and smaller, giving you many chances to capture emerging momentum.

Recommended configuration:

- Token sets: Trenches, Memes, Promising Memes

- Risk profile: Aggressive

- Budget: Small, rapid-fire positions with short time-in-position

Why it works: The agent steps in before trends fully form. This increases the potential for outsized returns when the early signal turns into a genuine wave.

👉🏼 Set up this strategy on Milo’s Autotrader.

2. Hyper Momentum Chaser Strategy

Some traders want pure intensity. You aim for tokens that explode out of nowhere. This setup pushes the agent to chase the fastest, hardest momentum bursts.

What this feels like: Your portfolio moves quickly and aggressively. Trades open and close in short windows. You capture sudden surges and exit before the move cools.

Recommended configuration

- Token sets: Trenches, Memes

- Risk profile: Aggressive

- Budget: Concentrated positions with tight rotation

Why it works: The agent reacts instantly to explosive metrics. It enters during rapid acceleration and exits before exhaustion, maximizing potential in high-speed markets.

👉🏼 Set up this strategy on Milo’s Autotrader.

3. Speculative Narrative Strategy

Some traders want to live at the edge where new themes are born. This setup tells the agent to dive into emerging stories before the market fully catches on.

What this feels like: You discover tokens early. You see themes forming before they trend. The agent picks up unusual patterns in social chatter and enters ahead of narrative expansion.

Recommended configuration

- Token sets: Trenches, Promising Memes, Memes

- Risk profile: Aggressive

- Budget: Small, experimental positions across early narrative plays

Why it works: New narratives often produce some of the biggest runs. The agent focuses on early discovery, giving you exposure to themes before the crowd arrives.

👉🏼 Set up this strategy on Milo’s Autotrader.

Why You Should Use AI Agents to Trade Crypto

At the end of the day, the whole point of setting up Milo isn’t to add another dashboard to your life. It’s to give yourself a real advantage.

Most traders drown in noise, react too slowly, or miss the setups sitting right in front of them. Milo fixes that. It scans nonstop, evaluates risk faster than you ever could, and acts the moment the opportunity is there.

When you dial in your agent with the right strategy, you’re not guessing anymore. You’re not chasing. You’re letting an on-chain smart assistant do the heavy lifting while you stay in control.

If you’ve been looking for a way to trade with more confidence, more clarity and more consistency, this is your shot.