The crypto market is an absolute bloodbath!

What many traders (especially the newbies) fail to notice is that that is not necessarily a bad thing. I know that sounds crazy. Hear me out, let me explain and you’ll understand why that is.

Market downturns are the ultimate test for a crypto trader. Prices drop, social feeds flood with panic, and even experienced traders can make irrational decisions.

In that chaos, I’ve learned that rebalancing isn’t just shuffling numbers. It’s about understanding your exposure, being deliberate with every move, and finding opportunities even when the overall market feels like a storm.

After all, there’s a reason why one of the best investors of all time once said “Be fearful when others are greedy, and greedy when others are fearful.” In this article, I’ll share with you how to be greedy right now, when others are panicking.

Here’s how I’m approaching the current dip.

1. Taking a Hard Look at My Portfolio

The first thing I do in a dip is take a deep dive into my holdings. I don’t just glance at the total value. I break it down by:

- Token type and capitalization: How much is in large, established coins versus small-cap altcoins or meme tokens.

- Chain exposure: Where each asset lives (Solana, Ethereum, BNB Chain, etc.) because liquidity and risk differ per chain.

- Risk factors: Volatility, correlations, staking lockups, and illiquid positions.

During this dip, I noticed a pattern: the coins that shot up in the bull market are now the ones dragging my portfolio down.

Some altcoins lost 40–60% of their value, but I still hold them because I see potential long-term recovery. Other tokens haven’t moved much, but their low liquidity makes them risky to sell when I need cash quickly.

I map everything in one place. Seeing the big picture changes how I make decisions. I can see which assets are genuinely overweight and which are my “anchors” keeping the portfolio grounded.

Even subtle insights, like a token that dominates my losses but has strong staking opportunities, can influence whether I hold or trim it.

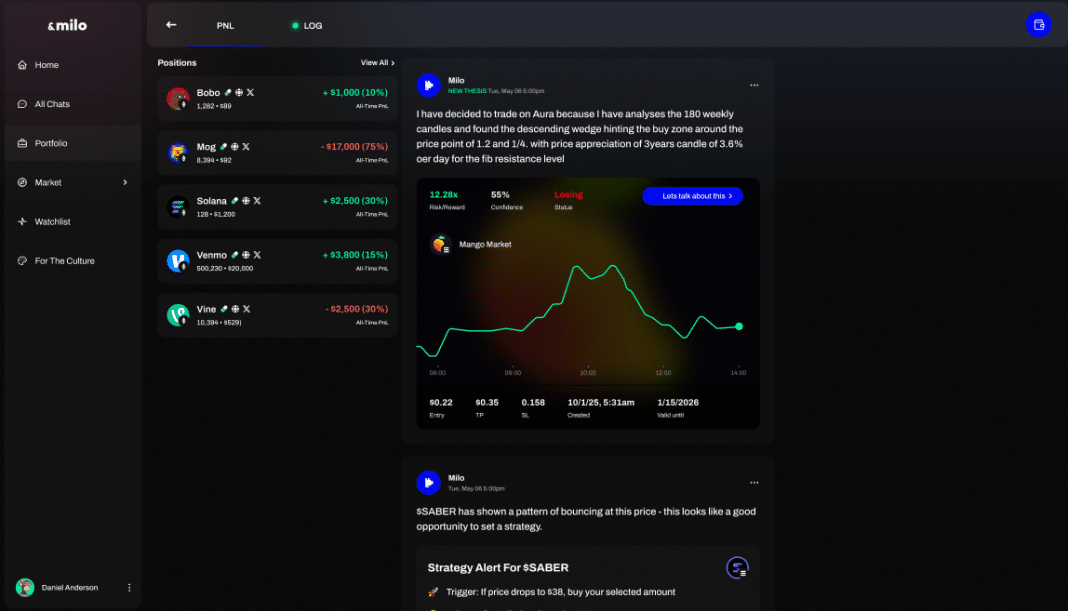

Lately, I’ve started using an AI system that tracks all this automatically. It highlights exposures I might overlook, like a token that’s heavily correlated with others I hold, meaning I’m taking more risk than I realized. This kind of perspective changes my approach from reactive to strategic.

2. Defining My Goals and Risk Tolerance

Once I know what I hold, I get brutally honest about what I want to achieve. During a dip, my priorities shift. I’m less interested in chasing moonshots and more focused on capital preservation, opportunistic accumulation, and selective yield generation.

I ask myself: Am I okay leaving some cash idle to buy dips? How much of my portfolio am I willing to risk on small-cap altcoins? What’s my minimum comfort level for losses before I take action?

Writing down my objectives forces discipline. For instance, I keep half my portfolio in stablecoins and low-volatility assets. I allow up to 10–15% in small-cap coins that I believe could recover strongly, but I cap exposure to prevent catastrophic losses.

I’ve started simulating these allocations using my AI agent. It’s surreal to see “what-if” outcomes for different rebalancing strategies in real-time. I can test aggressive redistribution versus conservative reallocation, and I immediately see the potential drawdowns and upside.

It’s not perfect, but it gives me a framework to make decisions calmly rather than guessing or panicking when the market dumps 5–10% in a day.

Want to try the AI tools I’m using to prepare my portfolio for the bear market? Connect your wallet now and set it up for free!

3. Leaning Into Liquidity

Liquidity has become my mantra during this downturn. I’ve sold or trimmed positions in illiquid tokens that I wouldn’t be able to exit quickly without massive slippage. My focus is on assets I can move freely, whether it’s top-tier coins or stablecoins I can redeploy opportunistically.

I also think about the timing of trades. Some assets are volatile but liquid, and I’ll hold a small portion as swing positions. Others are low-volume and could trap me if I panic-sell. Recognizing which positions could become “stuck” is critical, and it changes how I size my allocations.

Again, AI tools particularly helpful here. They can flag tokens where volume is declining or liquidity is drying up before it becomes obvious. Instead of guessing, I see which positions could pose a risk if I need to rebalance quickly.

The first time I got an alert about an illiquid token I was holding, I sold part of it in a measured way and avoided a huge slippage loss that would have eaten into my stablecoin buffer.

4. Dollar-Cost Averaging Through Redistribution

I’ve abandoned the idea of timing the bottom. Trying to buy the dip in one shot feels reckless. Instead, I layer my rebalancing in small increments. Every week, I shift a portion of risky tokens into stablecoins or move cash into assets I want to accumulate.

It’s about consistency over perfection. I pick allocation targets, like trimming 5% from over-weight positions weekly or adding 2–3% to undervalued coins. Over time, this creates a smoother rebalancing curve and reduces emotional trading. I also combine this with a checklist of conditions, such as minimum liquidity and acceptable volatility, before each move.

Automation has made this painless. I can schedule redistribution, and the system executes trades intelligently across different chains and assets, optimizing for slippage and transaction costs.

I can literally tell my AI agent what I want and let the strategy run, while monitoring and tweaking as needed. It gives me peace of mind, knowing I’m staying disciplined even when the market feels chaotic.

You can set up amazing automations using a crypto AI agent. Connect your wallet here and start discovering the power of AI trading.

5. Generating Yield While Staying Conservative

I don’t just sit on cash or stablecoins. Even in a bear market, I want my capital to work.

I’ve been staking coins for consistent rewards and providing liquidity in safe pairs with stablecoins. The key is picking strategies that balance return with risk. Chasing sky-high APYs from untested protocols is a fast track to losing money in a downturn.

AI helps here too. It can compare dozens of yield opportunities instantly and recommend which align with my current allocation and risk tolerance.

I remember one week when the AI highlighted a slightly lower-yield staking option on a stable token that was far safer than the high-APY altcoin I was considering.

Following that insight preserved capital I would have otherwise risked and gave me a steady, predictable return while the market bounced around wildly.

Closing Thoughts

Rebalancing during a bear market is both science and art. It requires patience, discipline, and an eye for subtle signals that others may miss.

The techniques I’ve shared are the toolkit I use to navigate these challenging conditions.

AI tools have transformed this process. They don’t replace judgment or strategy, but they amplify my ability to see patterns, execute moves, and preserve capital when emotion runs high.

In a dip, that advantage can mean the difference between getting caught in a panic sell and emerging with a stronger, smarter portfolio ready for the next bull run.

The crypto market is chaotic right now, but AI can help you navigate that chaos just like it helped me. If you’re not using it yet, you should start as soon as possible. Connect your wallet to Milo and start protecting your portfolio!