The first real bear market that punched me in the gut was during the Solana crash in 2022.

After seeing massive unrealized gains, I watched $SAMO bleed with no plan and no clue what to do. I lost thousands just because of one silly mistake.

That experience hurt, but it taught me something important. A bear market is not just a downturn. It is a filter that separates people who react emotionally from people who prepare strategically.

This time around I came in with a different mindset. I focused on building systems that help me ignore the noise and act like someone who expects to be here for years. The crazy part is that a bear market is where the foundations for your next bull run are built. It is where retail panic becomes smart money opportunity.

👉🏼 Here is the playbook that changed everything for me, and how you can use crypto AI agents to make it even easier.

1. Rebuild Your Conviction Portfolio

A bear market forces you to answer the question you avoided in the bull market.

What do you actually believe in?

Pull up your portfolio and divide every holding into two categories.

- Keep: Tokens with real use cases, active communities, rising developer activity, healthy liquidity.

- Remove: Tokens you only bought because your friend or a meme account said it would moon.

What survives this cut becomes your conviction portfolio. Everything else was just noise.

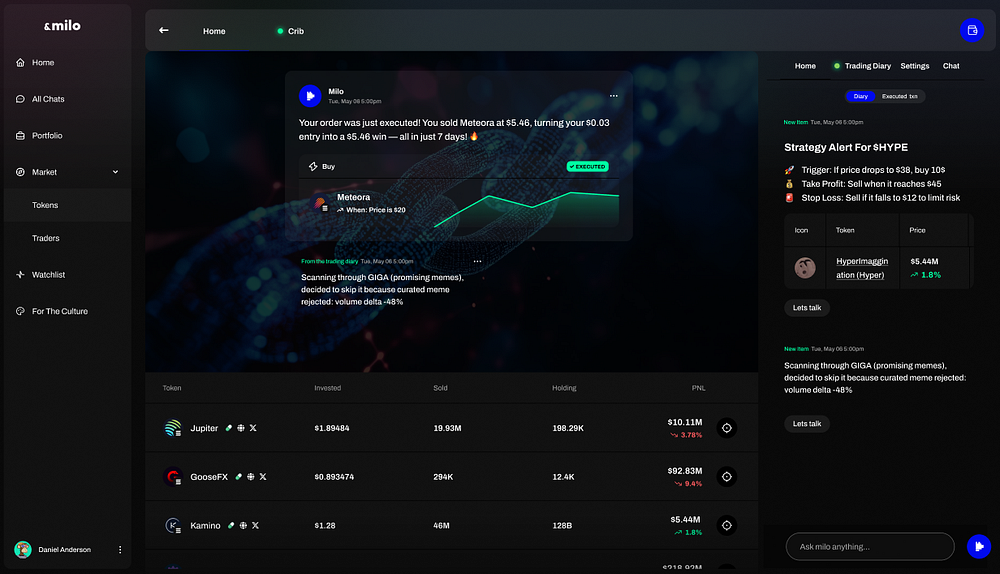

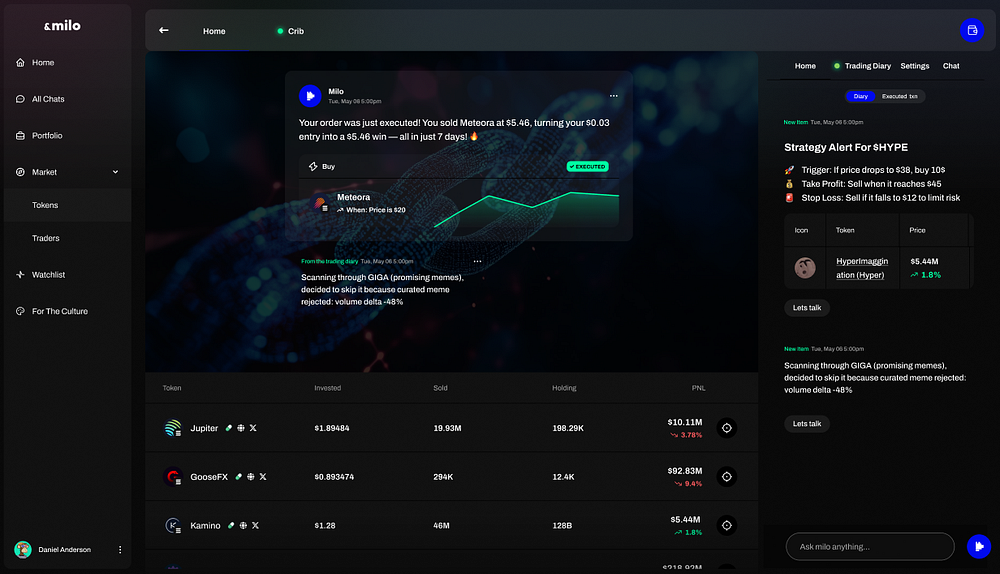

To make this easier, you can ask Milo to break down each holding using on chain signals and highlight positions with strong fundamentals versus weak liquidity or shrinking holder growth.

💡 Milo will give you a precise, straightforward answer based on data and facts, perfect if you’re on the fence about some tokens.

2. Turn Dips Into Controlled Accumulation

Dollar cost averaging works best when prices are low and emotions run high. The trick is to create rules that prevent you from buying every red candle.

- Time based DCA builds consistency.

- Signal based DCA builds intelligent entries.

Use both. Set a base weekly buy, then add extra buys only when your conviction tokens show accumulation, liquidity stability, and real volume.

With Milo, you can set alerts that trigger when your watchlist tokens hit healthy accumulation signals during downturns.

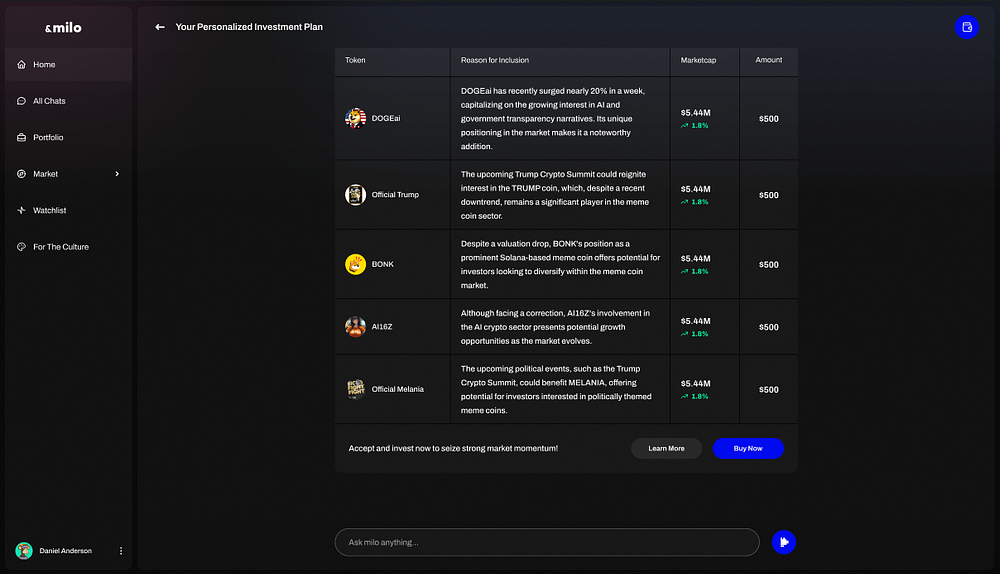

Or, if you prefer a completely automated approach, you can ask Milo to simply execute a DCA plan based on your preferences. It will execute every trade by itself, becoming the perfect partner for a consistent, long-term plan.

3. Hunt For Accumulation While Prices Fall

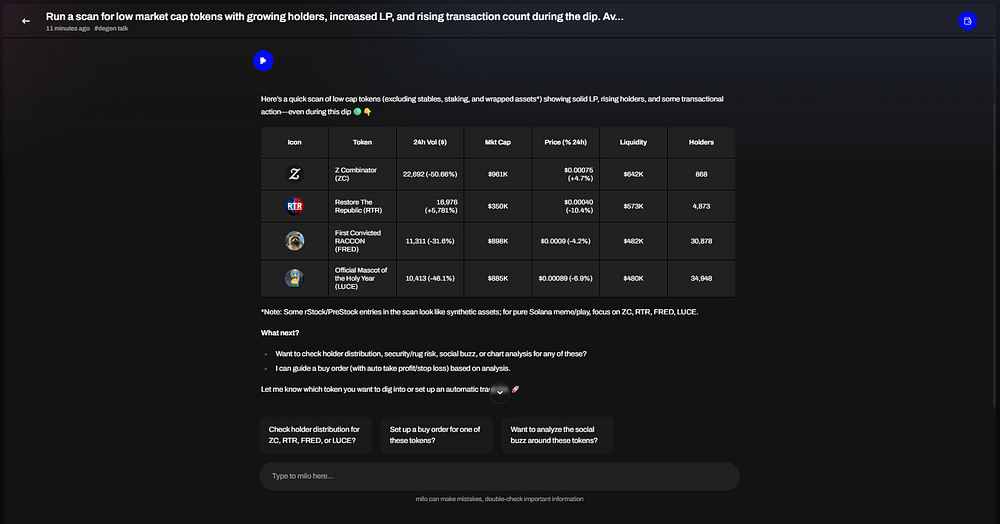

Smart money does not wait for green candles. They buy while others panic. Look for the tokens where:

- Top holders keep adding.

- Liquidity is rising.

- Holder count climbs daily.

- Transactions increase despite price drops.

These tokens often bounce first when the market shifts.

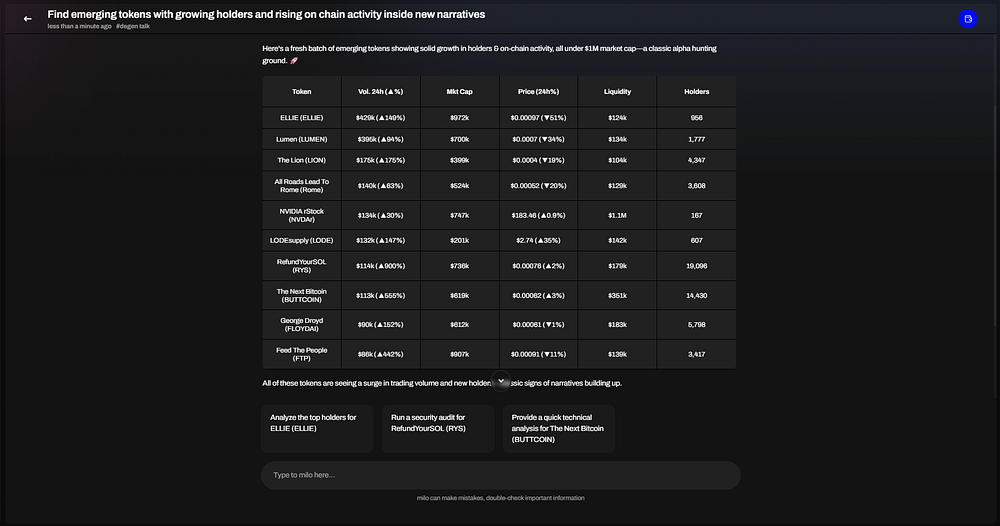

I suggest you run a daily scan in Milo for low market cap tokens with growing holders, increased LP, and rising transaction count during the dip.

4. Audit Your Risk Before It Punches You

A red market turns small mistakes into painful ones. Use the bear to check:

- Do you have too many tokens in the same narrative?

- Could one liquidity rug wipe out a chunk of your portfolio?

- Are you unknowingly leveraged on multiple positions?

- Which assets will fail if the dip lasts longer than you hope?

Selling everything is just realizing your losses. The real key here is to eliminate single points of failure: tokens or positions that, if held for too long, could nuke your entire portfolio.

To do this more easily, you can ask Milo to categorize your portfolio by risk level and reveal hidden correlations and fragility you cannot see on your own.

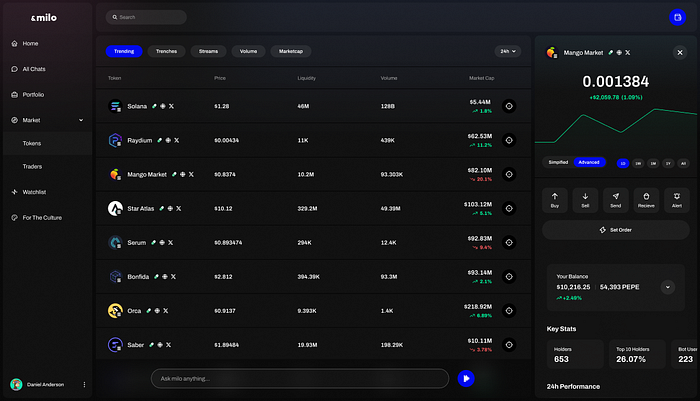

5. Track Only What Matters

Most people stare at price charts and lose their minds. In a bear market, price is the last signal worth obsessing over.

What matters more:

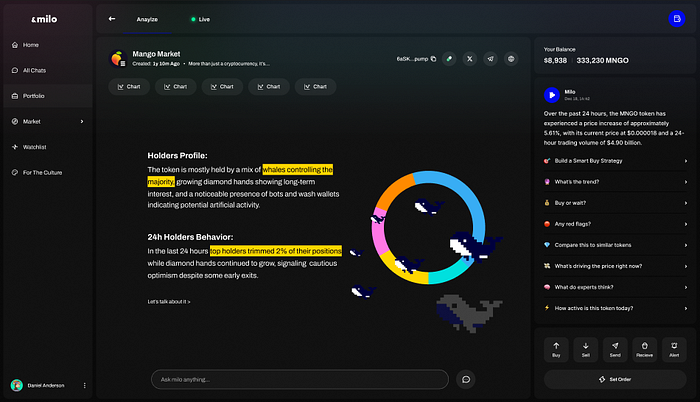

- Whale wallet behavior.

- Cash flowing into or out of LP.

- Daily active traders.

- Developer and ecosystem updates.

- Narrative rotation.

Focus on what predicts future price instead of reacting to current pain.

Now, these metrics and factors are not immediately evident, so they might seem a little hard to track. That’s why using AI can be a real game-changer here.

Try setting Milo to detect when strong on-chain signals appear for tokens you care about, even if price looks ugly and send you an alert or, even better, execute the trade automatically.

6. Keep Dry Powder For Opportunities That Deserve It

A bear market will give you the chance to buy something you always wanted at a price that will feel impossible later. You just need liquidity available when that moment comes.

Decide what percentage of your cash stays on the sidelines so you can strike when true opportunity shows itself. If you can keep a sizeable stablecoin stash, even better: faster execution!

For maximum results, use Milo to rank your watchlist tokens by long-term strength so you always know which narrative or asset deserves your capital next.

7. Use the Bear Market to Accumulate Asymmetric Bets

Everyone talks about life changing gains, but asymmetric plays are built in bears, not bulls.

During downturns, narratives reset. A new sector will rise that almost no one sees yet.

DePIN, SocialFi, AI agents on Solana, real yield tokens. They were all built during the bear market to skyrocket on the bull. The next wave always starts when most people are too scared to look.

Choose a handful of early narratives and dollar cost average slowly into the winners. You do not need many of these. Two or three right bets can change your future.

If you’re struggling, you can have Milo surface emerging tokens with growing holders and rising on chain activity inside new narratives before the crowd notices.

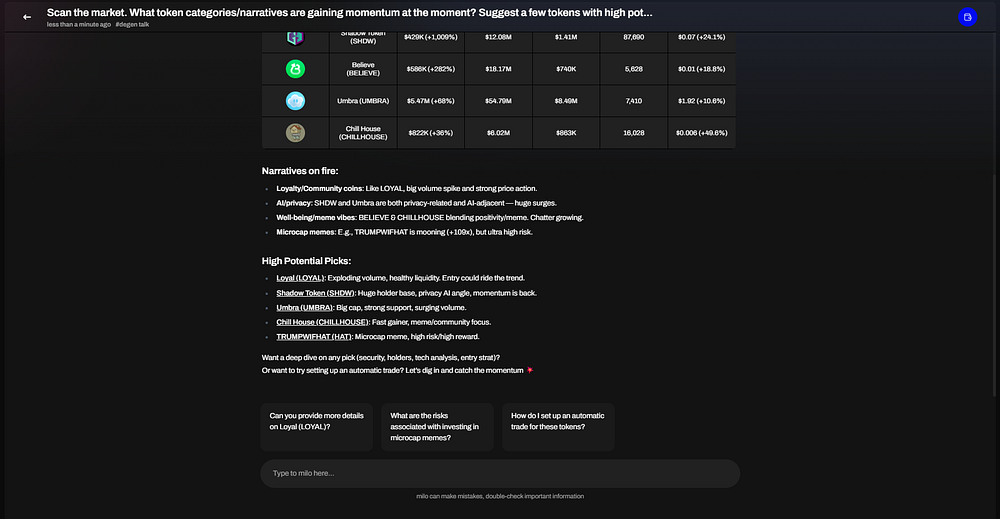

8. Identify Which Narratives Are Gaining Real Strength

A bear market does not kill all momentum. It just hides it. Find the narratives that are losing interest and the ones gaining underground conviction.

Signals to track:

- Developer commits.

- Growth in active wallets.

- New liquidity entering.

- Media mentions over time.

- Bridges, integrations, exchange listings.

If every successful token shares the same set of improving signals, that narrative is cooking quietly beneath the surface.

Use Milo to compare token clusters by narrative and alert you when one sector starts showing higher accumulation and stronger liquidity than others.

9. Build a Rotation Plan Before the Rotation Starts

When markets recover, money rotates.

First into majors. Then into mid caps. Then into meme and momentum plays

If you wait until it happens, you are late.

Instead, you should map your ideal rotation now. Decide:

- Which tokens you will scale into at each stage.

- How much of your stable capital goes into each tier.

- Which positions you trim as you move up the risk curve.

A bear market gives you time to think. A bull market gives you no time at all.

Here’s where AI can make a tremendous difference. Defining such a strategy requires countless hours of collecting and analyzing data. And as you know, data is AI’s greatest strength.

Have Milo simulate rotation paths based on historical patterns and your current portfolio allocations to minimize panic and maximize upside. You’ll get a customized action plan exclusively based on your preferences and current portfolio in seconds, as well as the option to execute it on auto-pilot.

10. Study Whales Instead of Influencers

Influencers are entertainment. Whales are information.

Track wallets that have a history of winning. See what they are quietly buying during boredom and fear. Whale conviction today becomes retail frenzy tomorrow.

You do not need to copy trades. Just study behavior.

Ask Milo to monitor high signal wallets for unusual buys in microcaps. Let it alert you when accumulation begins while price still looks dead.

11. Build Habits That Keep You Here Long Enough To Win

A bear market exposes who was gambling and who is learning. If you want to survive and outperform the next cycle, replace bad habits now while the market punishes mistakes cheaply.

Strong habits include:

- Smaller sizing on risky plays.

- No trading when emotional.

- Regular portfolio reviews.

- Realistic expectations.

- Clear exit criteria for every position.

You do not need to be perfect. You just need to stop giving easy money back to the market.

Using Milo’s trade rationale features can help you check whether your decision is backed by data or driven by emotion before you pull the trigger.

12. Practice Deliberate Patience

Every bull run in history rewarded the holders who stayed prepared when everyone else checked out. The people who come back late always end up buying at the top.

Bear markets feel slow until suddenly they are gone. By the time the excitement returns, the best prices will already be history.

Do the boring work now. It’s not glamorous, but it is how wealth is built. Let Milo automate watchlists, alerts, and periodic checkups so you do not burn out waiting for the next move.

Conclusion: Bears Are Where Winners Are Made

A bear market is the greatest filter in crypto. Most people fail because they only know how to feel confident when charts are green.

The people who build patience, systems, strategy, and conviction now are the ones who will look like geniuses later. The market will recover. It always does. The question is whether you will be ready for it.

With the strategies above you can:

- Strengthen your core portfolio

- Accumulate intelligently

- Find narratives early

- Prepare for rotation

- Follow smart money

- Eliminate self sabotage

- Stay mentally and financially in the game

Combine that with AI tools like Milo that help you stay disciplined, data driven, and alert to real opportunities. That is how you turn a bear market into the foundation for your best cycle ever.