On Solana, tokens launch every minute. By the time you’ve refreshed your browser, five new pairs are already live. Most of them go nowhere. A few turn into 10x plays. And that’s the real struggle: you can’t possibly track them all, no matter how many tabs or alerts you set up. More and more traders are leaning on Solana AI agents to keep up.

If the term is new to you, these aren’t the old Solana trading bots that just auto-snipe contracts. They’re smarter. They scan the chain in real time, pick up on liquidity shifts, track holder growth, and even watch social chatter in real time.

While you’re juggling work, sleep, or just life, your Solana AI agent is running on the background, separating signal from noise and flagging trades worth your attention.

The truth is traders who use crypto AI agents are starting to catch plays earlier, execute cleaner, and stack profits while everyone else is still chasing the candle. If you’re not using one, you risk getting left behind in a market that moves too fast for humans alone.

For the past few months, we’ve been developing and testing our own Solana AI agent. Its name is Milo, and it has completely transformed the way we operate on the Solana ecosystem. And now that it’s free and open for everyone to use, we want to show you all the possibilities it has to offer you.

So, let’s get straight into it. Here are seven things a Solana AI agent can do for your trading right now, and why you must start using them if you don’t already.

If you’re more the self-taught type, we encourage to connect to Milo and start exploring it on your own! Connect to Milo now.

1. Discover Hidden Tokens Before They Trend

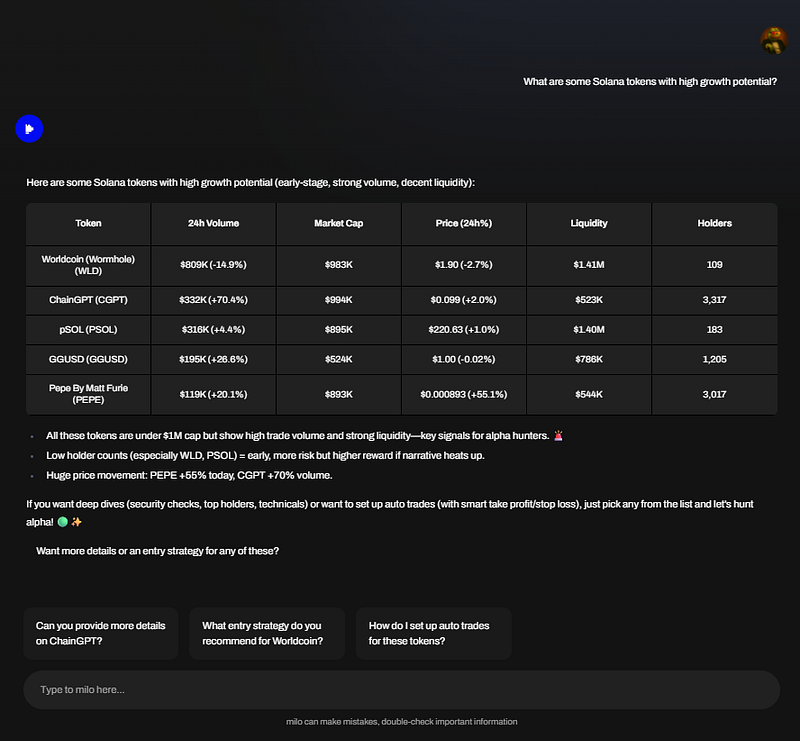

AI agents are processing on and off-chain data every minute. They can scan thousands of Solana tokens in seconds, highlighting the ones showing real momentum.

While other traders are stuck scrolling charts or reading tweets, your AI agent identifies spikes in volume, new liquidity pools, and genuine holder growth.

This is important because it isn’t guesswork or language-based answers like ChatGPT would provide, but real, data-backed analysis.

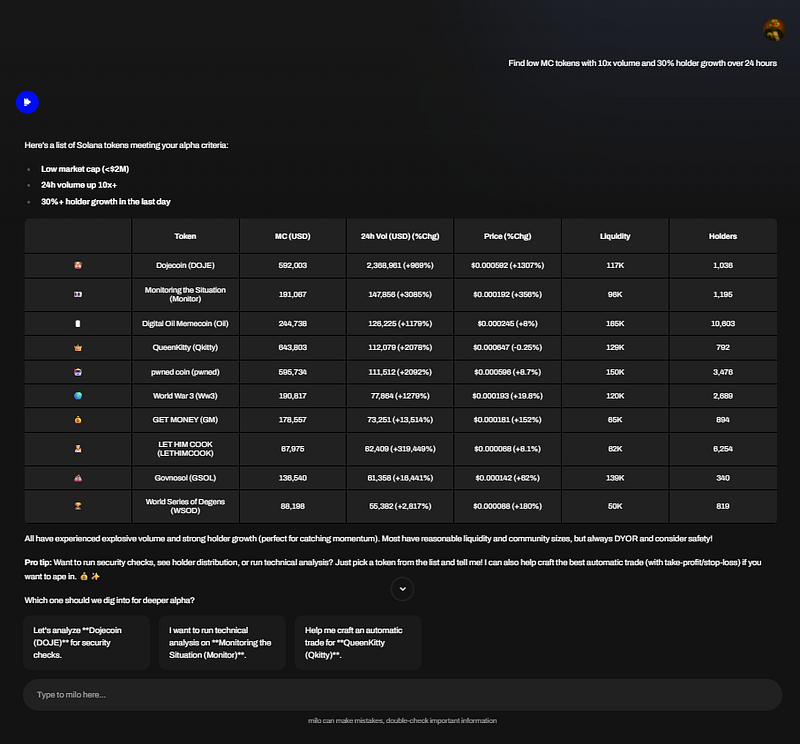

For example, our Solana AI agent called Milo can pinpoint tokens that have the early signs of traction simply by analyzing its volume, holder growth, and liquidity, giving you a head start before hype drives the price up.

For traders focused on memecoins or small-cap gems, this early detection can mean the difference between catching a 5x move and watching it slip by.

2. Decode Market Signals Instantly

Instead of juggling multiple tools, Solana AI agents consolidate technical indicators, wallet tracking, and sentiment analysis into actionable insights and even trading plans.

Milo, for example, watches for RSI divergences, momentum shifts, whale activity, and narrative trends.

In other words, besides telling you what’s happening and what tokens are moving, it explains and helps you understand why. That insight allows you to make smarter entries and exits, identify overbought or oversold conditions, and avoid trades that look good on the surface but are structurally weak.

Remember, crypto AI agents are amazing at processing and analyzing data, but the final decision will always be yours. That’s why it’s vital to understand not only what’s happening, but why it’s happening too.

3. Execute Smarter Trades With Less Risk

Most traders underestimate how much execution can eat into profits. Slippage, poor routing, and frontrunning bots can turn what looks like a winning trade into a loss.

The beauty about crypto AI agents is that they can handle this automatically. As a native Solana AI agent, Milo finds the best routes across Solana DEXs and aggregators, adjusting for slippage, and using MEV-resistant swaps when possible. As a security measure, Milo can verify available liquidity before jumping in, making sure it’s safe to trade.

It also ladders entries by default, spreading your position over multiple fills to reduce risk (although you can ask not to do it). The result is smoother execution and a cleaner PnL, especially important in volatile, small-cap markets like Solana memecoins.

Milo is free and open for everyone to use. Connect your wallet and start integrating AI to your crypto trading strategy.

4. Trade Safely With a Dedicated Solana AI Agent Wallet

Risk management is more than stop-losses, it’s a structural aspect. It requires integrating it into your strategy and planning.

Ideally, your crypto AI agent would operate from a separate wallet, keeping your main holdings isolated and in cold storage. That allows you to test aggressive strategies, explore high-risk tokens, or experiment with new prompts with a specific budget, keeping your primary funds untouched.

You gain the freedom to innovate, all while protecting the core of your portfolio. This separation is especially important when trying out automated trading for the first time.

Note: Milo connects directly to your Solana wallet, which makes it possible for it to automate your portfolio and execute trades on your behalf. You can either connect with your usual wallet or create and fund an entirely new one if you want to keep your trading funds separated.

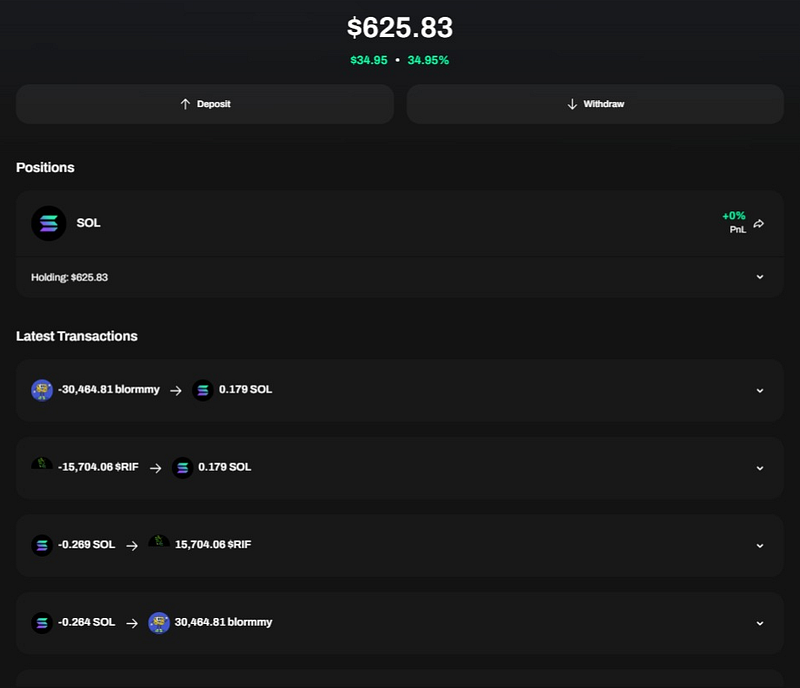

5. Manage Your Portfolio Like a Pro

This is one of the critical differences between a trading bot and a crypto AI agent. While the former is designed to follow a set of basic rules automatically, the former can use logic to follow your commands in real-time. This opens up a wide range of possibilities that go beyond automated trading.

For example, Milo functions as a full Solana trading platform. You get a clear dashboard showing your active positions, past performance, and PnL.

You can also ask it to run a customized analysis on your portfolio and suggest actions to manage risk, improve efficiency, balance your exposure, or any other action you want to take. It’s like having an expert assistant to help you manage your funds and assets the best way possible.

Over time, you can mix automated trades with your own manual strategies while maintaining a single, organized view of your entire portfolio.

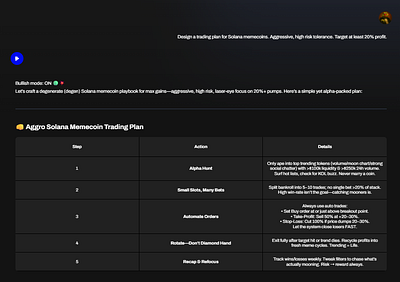

6. Automate Strategies With Natural Language

Perhaps the biggest advantage of crypto AI agents: anyone can use them.

You don’t need to know Python or Solidity to leverage Milo. Its natural language interface turns your instructions into actionable strategies in seconds.

You can write basic prompts like:

“Run a technical analysis on Solana $SOL”

Or more complex, advanced commands like:

“Find low MC tokens with 10x volume and 30% holder growth over 24 hours” or “Show launch-phase tokens with more than 3K LP and growing tx count.”

Milo interprets the rules, filters the tokens, and can even create strategies and execute trades according to your risk limits and preferences.

This lowers the barrier to advanced trading strategies and puts institutional-level tools in the hands of retail traders to operate like a pro with as little as $10.

7. Learn Faster and Trade With Confidence

There’s a difference between trading better and being a better trader. With Milo, you get both.

Indeed, an underrated advantage of a good Solana AI agent is how much you learn just by using it. When Milo throws out trade calls at your command, it breaks down why a token was flagged, what signals are firing, and how the market is shifting around it.

Every trade becomes a small, personal crypto trading masterclass for you and you alone. The more you review its insights, the better your own instincts get.

Over time, you stop chasing candles and start anticipating them, turning your trading from reactive to proactive.

Why Solana AI Agents Matter

Crypto moves fast. Blink and you miss the run. Rely only on gut, and you’ll always be a step late. That’s why crypto AI agents matter: they give you speed and clarity you can’t match manually.

In a live test, Milo took $200 and flipped it into $494 in just 24 hours. On another experiment, we tested more than 50 prompts, of which 7 consistently delivered outstanding results. That’s what happens when you put institutional-level speed, scale, and analysis into a tool that works for you 24/7.

Results like this are typically only accessible to hedge funds. That’s the big change crypto AI agents bring to the table. Anyone can access them. Whether you’re trading with $10 or $10,000, an AI agent levels the playing field, helping you spot opportunities earlier, avoid traps, and execute with precision.

Getting Started With Solana AI Agents: It’s Easier Than You Think

We know exactly what you’re thinking. The idea of running trades through an AI agent might feel intimidating at first, but it’s actually much simpler than you think.

You don’t need a coding background or years of trading experience. Just a willingness to test, learn, and refine.

The key is starting small, following a process, and letting the AI do the heavy lifting while you build confidence step by step until you find an approach that you’re not only comfortable with, but also yields results.

It may take some time, but it’s absolutely possible. So, if you’re ready, here’s the 5 simple steps you need to follow to start using crypto AI agents:

- Connect your wallet to Milo. Start with a small test wallet, separate from your main one.

- Use precise prompts with clear filters like market cap, volume, and holder growth. If you need help, you can steal some of the prompts that worked for us.

- Set risk rules for position size, slippage, and profit targets.

- Review Milo’s rationale before approving trades. Make sure you’re comfortable with every decision.

- Refine prompts as you go to improve results.

The Risks (and How They’re Controlled)

Now, let’s talk about the uncomfortable part.

The truth is, no AI agent can erase the inherent risks of crypto. Rug pulls, low liquidity, and slippage are part of the landscape. And even though you can use Milo to run security checks and filter out most fraudulent tokens, there’s no way of being 100% accurate. Not even with AI agents.

That said, risk doesn’t have to mean chaos.

The biggest danger is going in blind or letting the AI run unchecked. That’s why control is built into the process. With a dedicated agent wallet, your main funds stay completely safe. Starting with small test allocations is a good way to limit exposure while still seeing real results.

Clear rules on position size, slippage tolerance, and profit targets give you a framework the agent must respect. And because Milo explains its trade rationales, you can review and approve before execution, adding a human layer of oversight.

The goal isn’t zero risk (that doesn’t exist in crypto) but managed, transparent, and intelligent risk, where you know exactly what’s at stake and why.

The Future Belongs to Traders Who Adapt

Things are changing.

Solana AI agents like Milo are levelling the playing field. The speed, scale, and clarity that once required deep coding skills or institutional tools are now in your hands.

Traders who embrace this new wave will sharpen their instincts, execute smarter, and stay ahead of the crowd. Those who don’t risk being left behind, chasing pumps instead of leading them.

It’s not a matter of convenience. It’s a matter of survival.

This is your chance to move from guessing to knowing, from reacting to anticipating. Don’t wait for the market to teach you the hard way. The sooner you start, the better.

If you’re lost and don’t know where to begin, we recommend you start with Milo. It’s extremely easy, and you will get the hang of it in no time. And if you still have questions, make sure to send them our way and we’ll help you out.