I stopped trusting my own instincts in trading.

I know it sounds insane. Everyone in crypto says to “trust your gut” and “trade with conviction.” But my instincts were costing me money. I’d exit too early, hold too long, or ignore signals because I thought I knew better.

And while I was busy second-guessing myself, AI-driven traders were quietly taking the wins I was missing.

So I did something that felt counterintuitive. I started relying on AI instead of my gut. Not by handing full control over to some shady black-box bot, but by plugging AI into the parts of trading where humans consistently fall short: speed, execution, data collection and analysis, pattern recognition, security checks, and narrative tracking.

That one shift changed everything. My profits jumped by around 40% over six months of live trading. I traded in the same markets, I used the same strategy. Everything was exactly the same except for this one difference: using AI to fill the gaps I couldn’t cover alone.

In this article, I’ll show you how I actually use AI day-to-day, what worked, what didn’t, and how it directly boosted my results. More specifically, I’ll share the four ways I integrated AI into my crypto trading strategy.

1. Auto-trading with AI Agents: Real Strategies, Real-Time Execution

The first time I let an AI agent execute a trade for me, I was nervous.

I kept hovering over the screen, waiting for the slightest, most insignificant reason to cancel it, convinced it would make some dumb mistake.

What actually happened was the opposite: it caught a setup I would have missed completely. And even if I didn’t I wouldn’t have gone for it.

Here’s the problem with manual trading: you can only stare at and analyze so many charts at once.

On busy days, I’d track maybe five or six pairs seriously, with another ten on the side. But when you’ve got hundreds of coins moving across Solana alone, that’s like trying to find one firework in the middle of a New Year’s Eve show.

By the time you notice the spark, it’s already exploded.

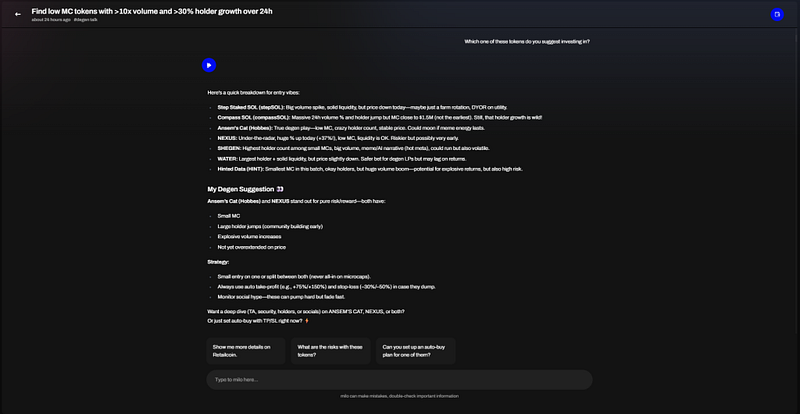

I instructed my first auto-trading agent to handle exactly that. Instead of trying to watch everything myself, the AI scanned the entire market at once, looking for technical triggers I had defined: volume spikes, RSI breakouts, and sudden liquidity inflows.

I gave it varied, carefully crafted prompts based on multiple signals to try different trading strategies. When two or three of those signals lined up, it placed the trade automatically.

The results were eye-opening. In one 30-day stretch, the agent executed 52 trades. Thirty-nine of them closed green, with an average gain of 11.8%. The most successful trade closed 65.31% in profit.

That might sound modest, but here’s the thing: it was more active than what I ever could’ve been. In the same time it took me to research, analyze, and finally execute one trade, this agent had already closed dozens, with an unrealized gain of around 7%.

My job shifted from “frantically scanning charts” to “checking what the AI surfaced, adjusting strategy and managing risk.”

The real power here isn’t handing over your entire account and hoping for the best. It’s designing clear, rules-based strategies and letting the AI do what it does best: react instantly and execute without hesitation.

The AI agent I used is called Milo. It’s built on Solana, connects directly to your wallet, and is completely free to use. You can try it here.

It doesn’t get tired, it doesn’t second-guess, and it doesn’t panic-sell because of one red candle (like I did).

For me, auto-trading wasn’t about replacing myself as a trader. It was about removing the parts of trading I was bad at (speed, discipline, and consistency) and keeping the parts I’m good at, like judgment and risk management.

That balance is what turned AI from a scary experiment into a 24/7 assistant that actually makes me money.

Important: AI agents can be a double-edge sword. If you use them right, they can make you incredible amounts of money. But if you don’t, they can make you lose everything in an instant. At the end of the day, success is all about finding the right prompt. After many experiments, I found 7 that always worked. You can steal them here: We Tried 50+ Crypto Trading Prompts on a Solana AI Agent — These 7 Delivered the Best Profits.

2. Price Predictions Based on Real-Time Analysis

Price prediction tools get a bad rap in crypto. Most people hear it and think of crystal-ball YouTube gurus claiming that Bitcoin will go to $1M next year or random bots posting lines on a chart.

That’s not what I’m talking about.

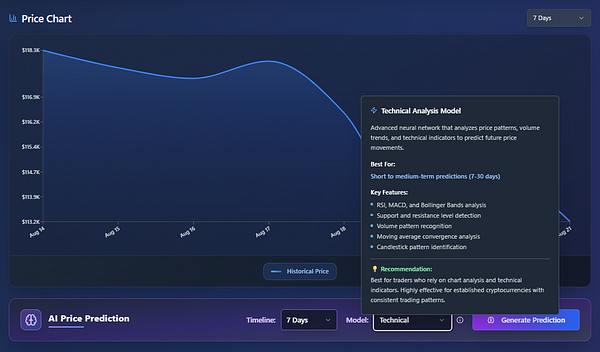

What worked for me was using AI to navigate through massive amounts of historical and real-time data (stuff no human could realistically process) and then turning that into probabilities I could actually trade on.

In other words: it’s data-driven predictions, based in unquantifiable amounts of on-chain and market data, processed, interpreted and analyzed in real-time by an AI system developed exclusively for this purpose.

That’s right. You shouldn’t use a general-purpose LLM like ChatGPT for this. That’s a terrible idea, because those systems generate responses based on language, not market analysis. This is different.

Here’s an example: Pump Parade built an AI prediction model with access to an exhaustive set of data, including:

- Market data (price action, liquidity, trading volume, market cap).

- On-chain data (amount of holders, tokenomics and supply, token distribution and concentration among wallets, etc.).

- Social engagement metrics (social media presence and mentions, interaction spikes).

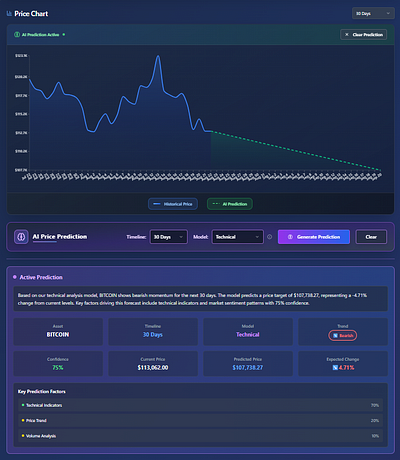

It supports over 200 cryptocurrencies, and all you have to do is choose which one you want to create the prediction for, the model you want to use, and the time frame for the prediction. Within seconds, I generated hundreds of short-term forecasts that were right about 65–70% of the time.

I know that might not sound like a huge leap, but here’s the math: let’s say my own intuition could give me about 50% accuracy, basically coin-flip odds. That 15–20% difference from AI was enough to shift my results dramatically.

However, the bigger advantage is that my 50% accuracy only works reliably on big cryptocurrencies: Bitcoin, Ethereum, maybe Solana.

The AI doesn’t have that limitation. It can apply the same predictive edge to smaller, low-cap tokens, where the potential gains are much higher. So, the real value comes not from making more accurate predictions, but from using them to spot opportunities no human brain could find.

The key lesson: prediction models don’t have to be perfect. They just need to tilt the odds in your favor.

If you normally make money half the time, and suddenly you’re winning six or seven trades out of ten instead of five, the compounding effect is massive.

Now, you shouldn’t treat these models as gospel, and you shouldn’t blindly follow every signal. What you should do is use them as a filter.

In other words, don’t see them as a magical crystal ball that can help you see the future, but as a data visualization and processing tool. If the AI’s outlook and my own analysis line up, that’s when I size in with confidence. It’s like having a second opinion from someone who can scan millions of data points instantly. Something our human brains could never do on their own.

3. Wallet Tracking for Safety Checks and Opportunity Spotting

Crypto can make you rich fast, but it can also wipe you out in seconds. I’ve learned this the hard way.

Early on, I lost a painful chunk of capital because I didn’t notice a suspicious token contract before buying in.

It was a wake-up call: no matter how good your entries or predictions are, one bad rug pull or phishing scam can undo months of gains.

Here’s the real problem: I’m not a developer or a programming expert. Back then, I didn’t know how to identify a faulty contract. I still don’t.

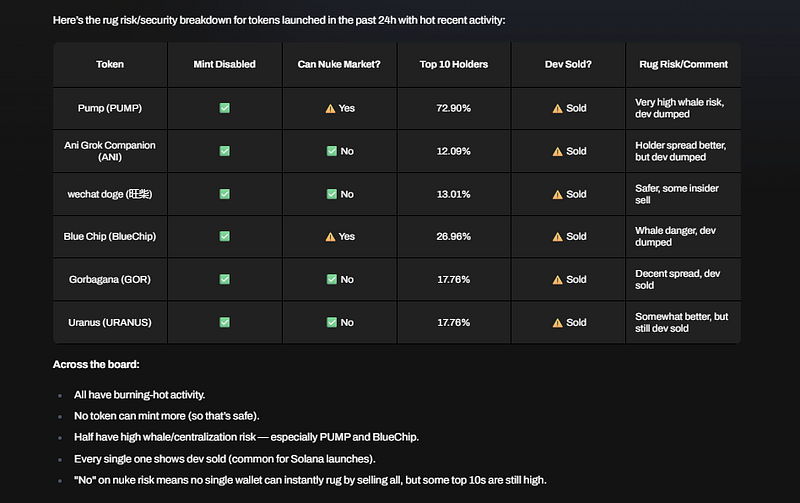

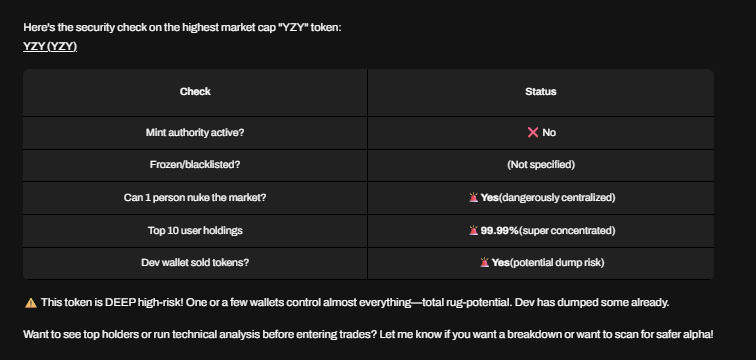

That’s where AI became a game-changer. I found a free AI agent that can monitor large wallets, unusual token movements or volume spikes, and contract changes in real time.

Instead of manually tracking dozens of wallets and scanning new tokens (a process that was exhausting and often too slow), the AI watches continuously and flags anything that looks off.

One memorable example was Yeezy Coin ($YZY): Backed by Kanye West, it saw massive amounts of capital as soon as it launched. When I dug in, it turned out to be a coordinated pump by insiders with a high likelihood of a rug pull.

While everyone was buying into the hype, I avoided it entirely. If you want to know how it turned out, all you have to do is look at the chart.

Now, the real benefit is much greater than just avoiding losses (which is already a massive advantage on itself). It’s the confidence that comes with knowing the AI has your back 24/7. I can focus on analyzing tokens, spotting opportunities, and defining the strategy instead of constantly worrying if I’m about to get rugged.

Over time, this layer of protection alone saved me a number of trades that would have cost me 20–30% of my portfolio each time.

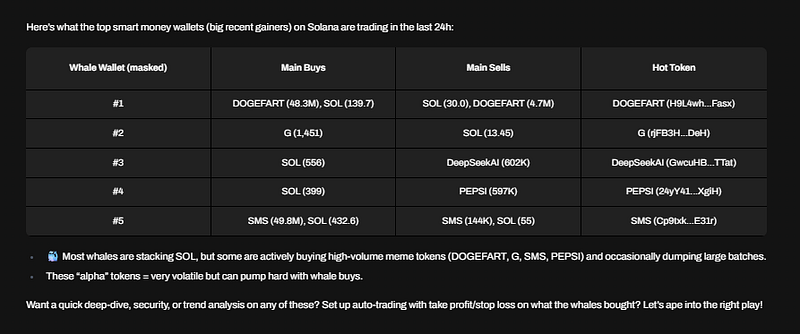

But wallet tracking isn’t only about avoiding scams. it’s also one of the best ways to spot real trends.

We call them experienced or “smart money” wallets. With AI, you can easily track them, see what they are doing, and follow their steps.

These are the insiders, traders, and investors that get into tokens before they are even mentioned in social media or Telegram groups.

Since it’s purely based on pattern recognition, AI agents are absolutely amazing at this. They immediately detect trends and automatically set the trades for early entries, so when retail pushes the price, you’re already positioned for profit.

Without AI, you never would have even seen that activity happening in the first place.

This is what I love most about wallet tracking: it turns the noise of thousands of random trades into something legible. Instead of chasing hype after it explodes, I can see conviction moves happening in the background, before they go mainstream.

And the truth is, following the right wallets is often a far better signal than listening to influencers or scanning charts alone.

Security checks and wallet tracking are not flashy, but they’re essential. If your strategy is sharp but your safety net is weak, AI can plug that gap and protect your gains, letting you trade with more confidence and less stress.

4. Turning Narratives and Social Chatter Into Trading Signals

If price is what you see on the chart, narrative is the invisible force pushing it there. And in crypto, narratives move faster than anything else.

One meme, one viral post, one new community trend can spark a frenzy that dwarfs even the cleanest technical setups.

For the longest time, I tried to keep up with narratives manually, scrolling through social media, jumping between Telegram and Discord, lurking in Reddit threads.

It was exhausting, and worse, I was always late. By the time I pieced together what people were excited about, the early gains were already gone.

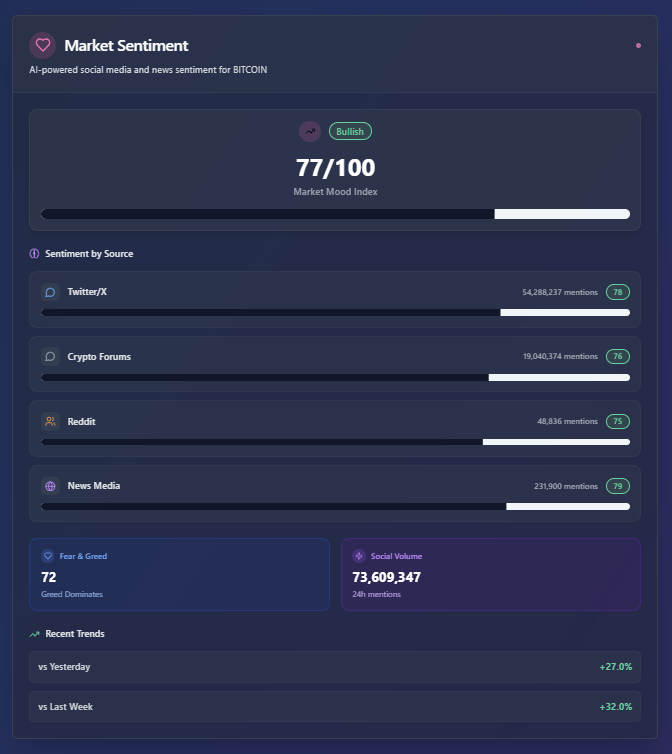

AI makes an immense difference in this area. I found and use trained models to track social chatter across multiple platforms, not just for volume or trends, but for sentiment shifts too.

It looks for patterns humans overlook: sudden spikes in positive mentions, repeated phrases across different communities, or unusual activity around a specific coin name. Most importantly, it can also detect bots to distinguish between real engagement and fake interactions or paid shills.

For example, Pump Parade’s social sentiment tracking tool keeps track of all mentions of any cryptocurrency or token of your choice, along with the Fear & Greed index, and assigns a Market Mood score based on the sentiment and volume of interactions.

Then, it compares it to the past day and week so you can see in which direction the trend is going. All in a digestible, readable way to jump right into the action.

This is where narrative tracking shines: it separates real momentum from manufactured hype. Everyone’s seen projects try to buy engagement or spin up fake communities, but AI is much better than me at spotting the difference. Bots post the same phrases, real users don’t. Organic conversations grow steadily, fake ones spike and die.

The AI helps me focus on coins with actual grassroots energy, not just noise.

Over time, I’ve realized that narrative tracking is less about predicting the future and more about reducing lag. Instead of reacting days later, I can respond within hours, sometimes minutes, when the first sparks of a new trend appear.

And in a market where being early is everything, that speed has made a massive difference in my results.

AI and Crypto Trading: It’s About Expanding Your Capabilities

The biggest shift for me wasn’t just adding AI to my trading for the sake of it: it was realizing I’d been competing at a disadvantage all along.

While I was relying on instincts, gut calls, and late reactions, others were running with real-time execution, prediction models, wallet intelligence, and narrative tracking. All based in real-time data. No wonder I was always one step behind.

AI didn’t replace me as a trader. It amplified me.

It covered the blind spots I couldn’t fix on my own: discipline, speed, endless monitoring, and data analysis at a scale no human brain can match.

And once I combined that with my own judgment and risk management, the results spoke for themselves: a significant increase in profit consistency, less stress, and the confidence that I wasn’t flying blind anymore.

To me, that’s one of the most important benefits of using AI in your crypto trading strategy: the peace of mind.

Crypto is brutal to those who hesitate. Trends vanish in hours, scams take minutes to drain wallets, and opportunities slip past in seconds. You can keep trusting your gut and hoping for the best , or you can give yourself the tools to actually compete.

The truth is, AI didn’t just improve my trading. It forced me to rethink how I even approach the game.

For years, I treated crypto like a test of willpower, instinct, and screen time. But the market doesn’t care how disciplined or “experienced” you think you are. It only cares about who adapts the fastest.

Once I accepted that, AI stopped feeling like a crutch and started feeling like a weapon. And now I can’t imagine stepping into a trade without it.