Picture this: you refresh your social media feed and see Bitcoin trending. It’s already up 15% in a few hours. The entries are gone. You scroll through your watchlist and it’s the same story.

The coins you glanced at yesterday are now out of reach, and you’re stuck debating whether to chase green candles or sit on your hands.

That’s the nightmare every trader knows: being right about the narrative, but late on the move.

This is why traders cling to predictions. AI can crunch order books, sentiment feeds, and on-chain flows to spit out where the next spike might land. It feels like the holy grail: a machine that sees the future before you do.

But here’s the situation most miss: AI isn’t just about telling you what’s coming. It’s about positioning you so you’re already there when it happens.

AI-powered price prediction is amazing. We know it, we built an agent for it. But if you don’t act on it, it makes no difference at all.

Because in crypto, timing beats foresight. The traders who win aren’t the ones who guess best. They’re the ones who are positioned first and execute at the right time.

TL;DR:

- Being right about a narrative but late on the move turns you into exit liquidity.

- AI’s real value for crypto traders isn’t about predicting prices, it’s about positioning you before the pump.

- Positioning means being early: spotting narratives, entering liquidity first, sizing risk, and building conviction.

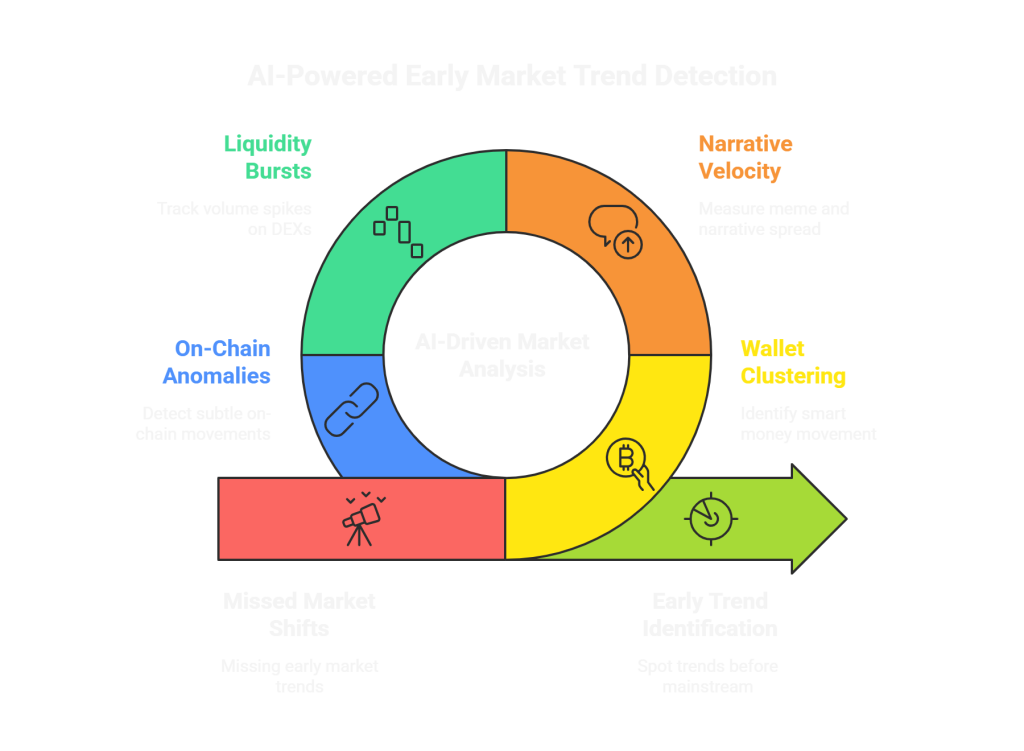

- AI helps by tracking wallet clusters, narrative velocity, liquidity bursts, and on-chain anomalies in real time.

- Pump Parade gives you free AI-powered tools to predict and position yourself to execute with confidence.

- Milo, our AI agent, integrates into your trading flow by permanently monitoring markets, spotting trends based on market and social data, and automating your portfolio based on real-time analysis.

Why Positioning Is Just as Important as Predicting

Markets aren’t machine, they’re moods. They swing on liquidity, hype, and herd psychology. One minute they look orderly, the next they’re chaos.

A prediction can give you direction, that’s true. But direction without timing is useless. If you’re entering after the crowd has already flooded in, you’re not early: you’re exit liquidity.

That’s where positioning comes in. In trading, positioning means setting yourself up before the move happens.

It’s about preparing your entries, risk, and exposure so that when the market shifts, you’re already in the spot to benefit.

In crypto, positioning shows up in a few ways:

- Narrative positioning: spotting the early signs of a trend or meme before the crowd notices.

- Liquidity positioning: entering before the surge of volume hits, so you ride the wave rather than chase it.

- Risk positioning: adjusting size and stops so you can move fast without overextending.

- Psychological positioning: building conviction from sentiment, on-chain flows, and data so you don’t panic-sell right before a breakout.

Positioning is about sliding in while the wave is still forming, not showing up after it crashes onshore. It’s the difference between watching a pump happen and actually profiting from it.

How to Use AI for Crypto Trading to Its Maximum Potential

Most traders still think AI’s superpower is predicting prices.

To be fair, they’re not wrong. AI shines at processing massive amounts of data and spotting patterns, which are exactly the skills that technical analysis has always depended on.

But the real magic runs deeper: AI lets you see structural shifts in the market before they hit the mainstream. It’s like having a radar tuned to where energy, capital, and attention are quietly stacking up.

💡 For a complete guide on how to use AI for crypto trading in the best way possible, visit our dedicated article: How to Use AI for Crypto Trading (The Right Way)

Here’s what that looks like in practice:

- Wallet clustering: AI can spot when “smart money” wallets start leaning into a new sector or token. It’s not only about who’s buying but who’s buying early, and whether they’re moving systematically or testing the waters. Catching these clusters can clue you into the next trend before retail notices.

- Narrative velocity: Memes and narratives are the heartbeat of crypto. AI can measure how fast a token or meme is spreading across social media, Telegram, Reddit, and Discord. When chatter starts to spike, sentiment shifts, or community engagement jumps, AI flags it. This tells you where the conversation (and potentially the capital) is flowing before you see it on your feed.

- Liquidity bursts: Volume spikes on DEXs often signal where the real money is moving. AI doesn’t just see that a token is trending. It tracks who’s trading, how much, and whether the liquidity shift is likely to sustain. This helps you ride waves instead of chasing them.

- On-chain anomalies: Sometimes the most powerful moves happen quietly. Wallets shifting funds, preparing for listings, or making coordinated swaps can hint at major pivots before they hit the news. AI catches these subtle moves, giving you early warning signals that most traders will completely miss.

As you can see, this is very different from some random, out-of-the-blue prediction with no substance behind it. What AI can offer is more like a radar, constantly scanning the market for real-time energy.

Yes, it can analyze the data and point toward where price might head next. But that’s only part of the story. More importantly, it highlights the places where attention is starting to cluster, where liquidity is beginning to flow, and where momentum is quietly building beneath the surface.

That’s the real advantage: AI doesn’t just project a possible future. It gives you the signals you need to position yourself ahead of time, before the wider crowd even knows what’s happening.

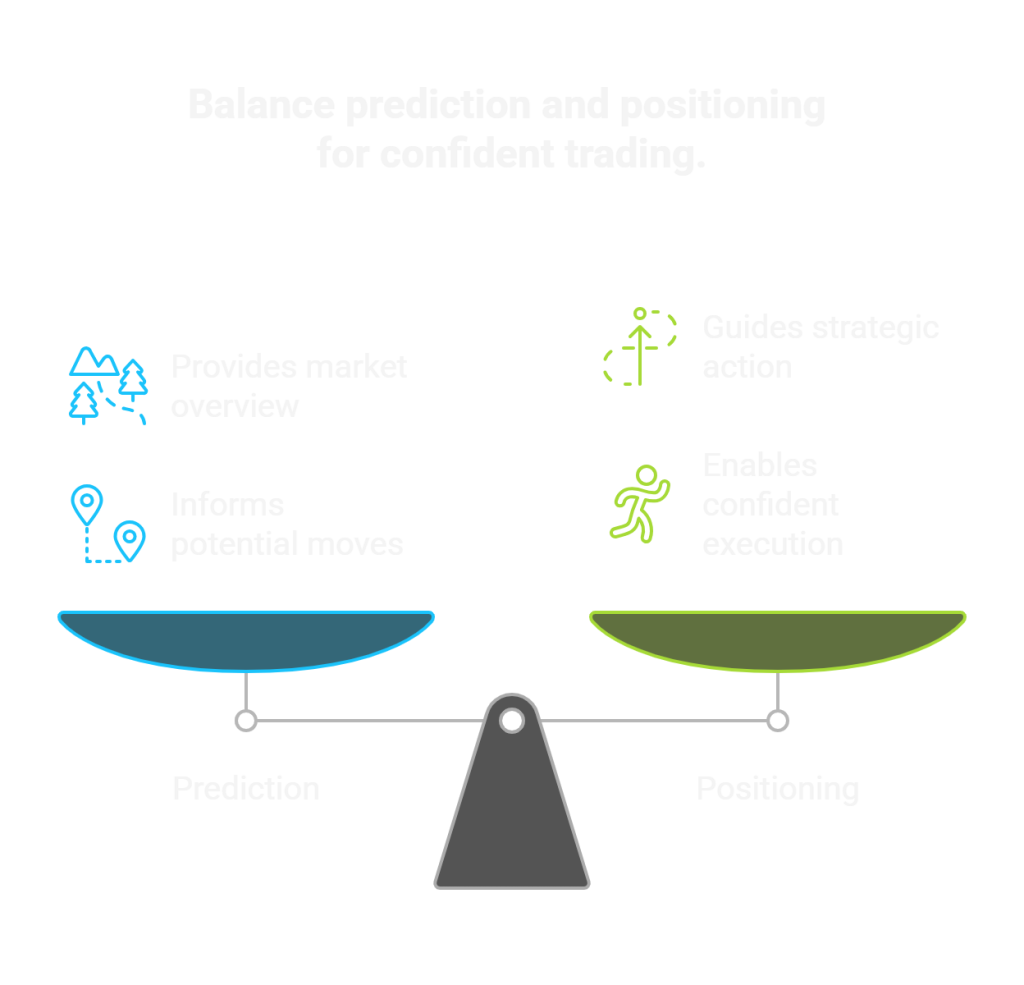

Prediction + Positioning = Conviction

Here’s one way to think about the difference between prediction and positioning we’ve been talking about throughout this article:

- Predictions give you the map.

- Positioning charts the course over it, telling you when and where to move.

Put them together, and you get conviction: the ability to act with speed and confidence, without second-guessing.

This is where most traders misuse AI. They treat it like a signal service: “Tell me what to buy.” But the smart traders ask a different question: “What’s changing , and how can I get there first?”

That shift in mindset makes all the difference. It’s how they:

- Track wallet behavior and social chatter in real time, not hours later when the news breaks, but as the signals are happening.

- Scan for unusual market activity automatically, catching things no human could spot in the noise of hundreds of charts and tokens.

- Execute instantly and cleanly, without hesitation, FOMO, or emotional baggage.

Conviction is rare in trading because most people are guessing, chasing, or waiting for confirmation that comes too late.

With both prediction and positioning, you’re no longer asking if you should buy or not. You already know why you’re entering, when you’re entering, and what you’ll do if it moves against you.

And that’s the massive advantage AI provides to crypto traders who use it: It doesn’t replace your judgment, it amplifies it.

It gives you visibility into the hidden layers of the market, and the speed to act on them before everyone else even realizes what’s happening.

And that’s exactly what we’ve built into Pump Parade. Instead of forcing you to juggle endless dashboards or gamble on half-baked signals, it brings the pieces together in one flow.

In addition to our AI-powered price prediction tool, you can track social sentiment from the trenches before the trends are consolidated on your social media feed, follow how fast a narrative is spreading across digital communities, analyze a specific token (and even the market in general) to spot anomalies and opportunities.

What Pump Parade offers goes beyond information: it’s context, momentum, and timing, all surfaced in real time. For traders, that means less hesitation, fewer “too late” entries, and more confidence in knowing why you’re taking a position, not just what you’re buying.

Pump Parade is available for everyone and free to use. You don’t need to connect your wallet or hold a token. Go to Pump Parade to try our AI-powered tools!

Conviction isn’t about blind faith. It’s about seeing things clearly (and early) enough so that hesitation disappears.

The Future: Beyond Reading AI, Into Acting With It

Here’s the shift that’s coming: the winners won’t just use AI to read predictions. They’ll integrate AI directly into their trading stack: research, positioning, and execution all flowing together.

Here’s where crypto AI agents take it to the next level.

Think about them as advanced plugins for your wallet. When you integrate them, they can automate your portfolio management, monitor markets 24/7, flag anomalies the second they happen, and even track wallet clusters or new narrative surges before they trend on social media.

Instead of juggling ten dashboards and endless charts, you have an agent that works tirelessly in the background, surfacing only what matters most so you’re never late, never blind, and never frozen by indecision.

We have contributed to the development a state-of-the-art AI agent that can do all this and more. Its name is Milo and it’s free to use. We’ve put together many guides for you to get started. When you try it, you’ll never stop using it. Discover how to integrate AI agents to your crypto trading process here: We Tried 50+ Crypto Trading Prompts on a Solana AI Agent — These 7 Delivered the Best

At the end of the day, every trader is chasing the same thing: clarity in the chaos. Predictions can point you in the right direction, but positioning is what actually gets you paid.

The traders who learn to work with AI (not just read it) will move faster, act smarter, and ride the waves others only watch from the shore.

The choice is simple: you can either wait for the market to tell you what happened, or start using AI to position yourself for what’s coming.