Memecoins are a different beast, especially on Solana. They don’t follow the same rules as Bitcoin, Ethereum, or your favorite layer-1 project. In fact, most of the time they don’t follow any rules at all. They can go from zero to a billion-dollar market cap in a week, or vanish just as quickly.

The difference between catching the next big one and getting rugged often comes down to reading the room faster than everyone else.

Easier said than done, right? Especially when most tools traders rely on (technical analysis, on-chain metrics, even sentiment trackers) don’t tell the whole story. A memecoin’s real fuel is culture, momentum, and the crowd’s emotional conviction.

That’s why the MotiMeter exists. It’s built to measure the true health and viral potential of a memecoin, not just its chart patterns or tokenomics.

Why Memecoins Need a Different Approach

If you’ve traded enough memecoins, you know this truth: fundamentals rarely matter.

You can have the best tokenomics in the world, but if the meme isn’t funny or the community isn’t loud, it’ll flop. On the flip side, a coin with no utility, no roadmap, and a $50 website can do 100x if it hits the right cultural nerve.

Most analytics tools are built for coins with utility, revenue, or long-term roadmaps. Memecoins break those models because their value is mostly narrative-driven and community-led. That’s why you need a framework built specifically for the chaos.

That framework is what the MotiMeter provides.

What Is the MotiMeter and How Does It Work?

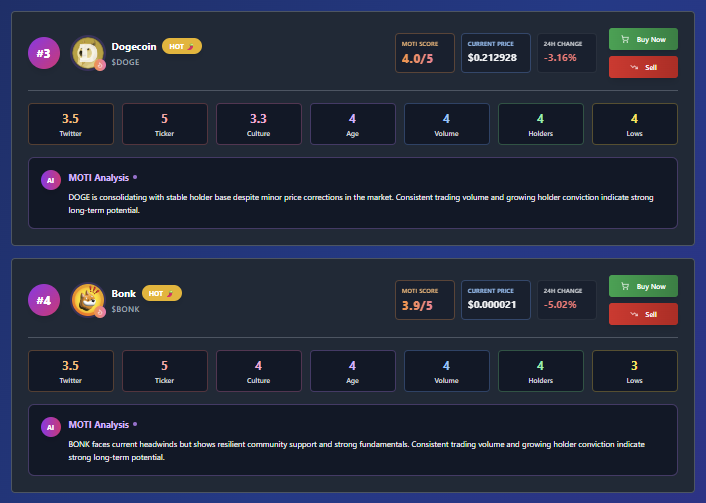

The MotiMeter scores each memecoin across 8 categories, each rated from 1 to 5. The final MotiScore is the average of all metrics combined. A score close to 5 means the coin is firing on all cylinders: culturally, technically, and socially.

Here’s what the MotiMeter analyzes to evaluate a memecoin’s potential:

- Social Media Interaction: Is the conversation real, active, and growing? Memecoins are built on viral loops, and social media is the main battlefield. High engagement from humans (not bots) is a green flag.

- Viral Energy & Community Hype: Are memes flying? Are influencers and community members pushing it organically? This measures buzz in the wider space, not just in the coin’s echo chamber.

- Good Ticker: A short, catchy ticker is everything. It’s easier to remember, search, meme; and can make or break a memecoin’s virality. $DOGE hits different than $LONGTOKENNAME.

- Cultural References: Is the coin tied to current trends, memes, or viral moments? Culture moves fast, coins that ride the wave have a bigger shot at exploding.

- Age & Maturity: Surviving the first hype cycle without collapsing is rare. Coins that make it past their first pump tend to develop stronger communities and price stability.

- Volume Consistency: Big one-day spikes can be misleading. Sustained, healthy trading volume over multiple days or weeks signals real conviction.

- Holder Growth: Are wallets holding the token increasing steadily? Even during dips? This is a strong sign the community believes in the long game.

- Higher Lows: On the technical side, higher lows suggest accumulation and strong hands buying the dips. It’s one of the few reliable chart signals in meme land.

Each of these categories is evaluated with a score from 1 to 5. The final MotiScore is the average of these numbers, giving you a single, at-a-glance rating for any memecoin.

Curious to see how it works? Visit Pump Parade and start using the MotiMeter now. It’s free!

Why the MotiMeter Is More Reliable Than Other Tools

Think of the MotiMeter as a composite x-ray for memecoins. It stacks everything together for maximum accuracy.

Technical analysis might tell you the patient’s heartbeat, sentiment analysis might tell you their mood, but the MotiMeter gives you a full-body scan. It layers the hype, the community, the cultural moment, and the market signals together so you see the full picture.

The biggest edge is that it filters out fake hype. Bot-generated sentiment or paid shill activity might fool other tools, but Moti’s multiple criteria catch the inconsistencies, like low wallet growth or unstable volume in a memecoin that’s supposedly “trending.”

How to Use the MotiMeter to Find the Best Memecoin Opportunities

Here’s where the value kicks in. Consider these practical tactics:

- Look for 4+ Scores Early: If a coin is above 4 across most categories before it trends on major social platforms, you might be early. That’s your signal to dig deeper and decide if you want in.

- Spot Dead Coins Before They Die: If the MotiScore drops sharply in volume consistency or holder growth, the hype might be fading (even if price is holding). That’s an early exit signal.

- Use Cultural Relevance as an Entry Trigger: When a coin suddenly ties into a trending meme or event, its cultural reference score can spike overnight. Those are rare windows to catch viral surges.

- Trade Around Higher Lows: If a memecoin with a high MotiScore is forming higher lows, you can enter on dips with higher probability that momentum will continue.

- Filter Out Weak Memes: A memecoin can have strong charts but a terrible ticker or no cultural hook. Those usually fizzle fast. If Moti’s social/cultural criteria are low, it’s a pass.

- Build Watchlists by MotiScore: Keep a list of top-scoring memecoins and monitor them daily. When the market rotates, these are the ones most likely to pop first.

- Combine MotiScores With On-Chain Data: The real alpha is in spotting coins that score high on hype and momentum but still show low trading volume or market cap. That gap usually means the narrative is heating up before the money fully catches on. And that’s your chance to get in early.

A Quick Real-World Example

Imagine two coins:

$SHIBX scores 4.6 on the MotiMeter. It’s got the full package: punchy ticker, a cultural hook people actually rally behind, memes flying across social media, Discord, and Telegram, and a steady climb in holder growth.

$MOONPUP, on the other hand, scores 2.9. The chart looks fine in the short term, but that’s about it. No cultural stickiness, barely any engagement online, and holder growth that’s dead flat. Without momentum or a community that cares, it’s just another ticker floating in the void.

What’s the conclusion? Even if $MOONPUP has the prettier short-term chart, $SHIBX is more likely to deliver sustained gains. This is because memecoins don’t live and die by technicals alone. They run on belief, culture, and viral energy. A good chart might get traders in the door, but it won’t keep them there.

That’s the difference between tunnel vision and the big picture. Tunnel vision means staring at a single price chart, chasing candles, and ignoring the fact that most pumps without culture fizzle fast.

The big picture means zooming out and seeing the anatomy of a coin: the memes, the momentum, the community’s conviction, and the liquidity to fuel it. That’s what the MotiMeter shows you, not just where a coin is today but how much firepower it has to keep running tomorrow.

Start Using the MotiMeter to Find the Best Memecoins

Memecoin trading will always be risky. There’s no tool that guarantees wins. But the difference between guessing and making informed decisions can be huge, and the MotiMeter is built for exactly that. It respects what actually drives memecoins: people, culture, and conviction.

If you really want to catch the next breakout meme, you can’t treat memecoins like traditional assets. They’re cultural phenomena first, charts second. That’s what Moti helps with: showing you which coins have real staying power and which ones are just on a quick sugar rush.

Next time you’re scanning for plays, don’t just chase what’s pumping. Check the MotiScore and see which coins have real momentum behind them.