Let us begin by saying the quiet part out loud:

Crypto AI agents aren’t magic.

There’s no superintelligence, no singularity. They aren’t independent or capable of thinking. It’s all about data inputs and outputs. So, if you talk to them like a confused intern, they’ll act like one.

But the reverse is also true:

If you prompt them well, they become monsters: relentless, hyper-focused trading machines that outclass most of what’s out there.

We didn’t believe it either… until we tested it.

So we ran a deeper experiment. Instead of throwing more money at the AI, we threw more language at it.

We fed Milo, our Solana-based crypto AI agent, over 50 prompts to manage our portfolio and trade for us. And then we watched closely: what worked, what confused it, and what unlocked crypto trading god-mode behavior.

Let’s break them down.

Want to try this yourself? Milo’s Beta is live. Connect your wallet now and start automating your crypto portfolio. Just don’t prompt like a potato.

Why Prompts Matter More Than You Think

Milo isn’t designed to be an independent trader (not yet, at least). It can design and execute trades, but only after your instructions. It’s critical that you know exactly what you want and are as clear as possible when you instruct him.

The problem is most people treat crypto AI agents like passive bots.

But these things are more like trading assistants with a memory, an edge, and a caffeine drip that never runs out.

You don’t just “run them,” you guide them. And the quality of your prompt is the difference between a sniper and a scattershot.

That’s what we learned. The hard way.

Our first few prompts were vague, emotional, or overly complex:

- “Find the next $WIF.” Too subjective.

- “Make me money.” Please.

- “Search for undervalued tokens.” Based on… what?

Once we got more precise with our prompting, more metric-driven, and more focused, everything changed.

The AI started to behave like a sharp analyst. All it needed was clear instructions.

Here’s what worked.

7 Prompts That Actually Made Milo Smarter (and Us Richer)

We tested a lot of prompts. Some flopped, some were decent… but these 7? These turned Milo into a scalping, sniping, volatility-hunting beast.

If you want to see what actually works (and steal a few for yourself), this is where it gets good.

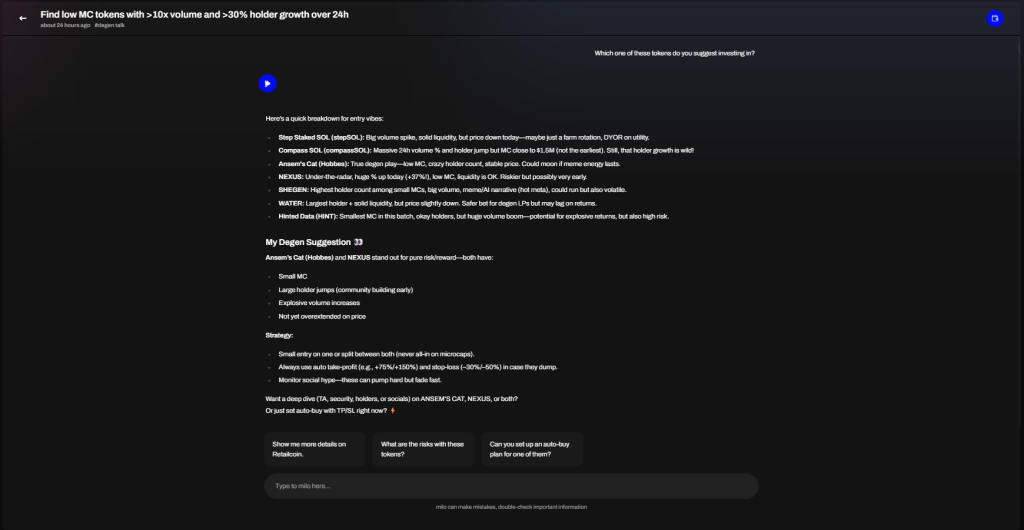

1. “Find low MC tokens with >10x volume and >30% holder growth over 24h.”

This combines volume squeeze and early community growth: two positive indicators and bullish signals. Milo flagged 7 tokens in a couple of seconds. We automatically discarded the first two as they were Solana liquid staking tokens.

The others were all fair game, although risky plays: Low-cap tokens with different holder amounts, price action, and volume increases.

There was no clear play, so we took it one step further. We asked Milo:

Which one of these tokens do you suggest investing in?

Milo delivered an excellent response, offering a clear overview of each token based on price action, volume, liquidity, market cap, and other key on-chain metrics.

He then analyzed the data in real time to assess each token’s potential and risk/reward profile, ultimately identifying his top picks, each accompanied by a concise explanation of the logic behind his choices.

And just like that, we had two winners: HOBBES and NEXUS.

We instructed Milo to set up the trades and we waited. And soon enough, we were glad to see the crypto AI agent hit the nail right in the head.

HOBBES pumped 13.11% ($0.000267 to $0.000302) while NEXUS jumped 65.31% ($0.000237 to $0.0003918)

2. “Scan for tokens with high growth in number of holders and transaction count, with <$3M market cap. Avoid liquid staking tokens and anything with >$100K.”

This one targets early-stage organic traction: a solid combo of rising demand without bloated valuation. The AI filtered out narrative noise and zeroed in on tokens where actual users were showing up.

However, our original prompt was flawed: in the list, Milo included kumaSOL, a liquid staking token. We wanted to avoid them as they are merely representations of the underlying token that is staked (in this case, $SOL).

What we liked here is that, besides the technical information, it included a highlights column with a short comment on each token. For example, one of the tokens it found ($SORRY), had only $15 of trading volume, so it warned us to double check it.

Another token (Cat Intelligence Agency or $CIA) was also showing a red flag on trading volume. We weren’t fully satisfied with the list. No big deals, but a good reminder that AI can still make mistakes and that we shouldn’t trust it blindly.

So, we decided to refine our original prompt and filter out liquid staking and other tokens with >$100K trading volume over the past 24 hours.

Immediately, Milo gave us a new list.

We decided to go for the two biggest coins on the list by market cap: $MOG and $SIMP. After a quick check, we saw that both tokens were already climbing rapidly. To capitalize on the bullish momentum, we went ahead and asked Milo to set the strategy.

This time, we went for specific goals, targeting 20% profit: a “conservative” approach for crypto, but a very interesting goal for a single trade.

Both trades went on to develop in the same way, with a critical difference right in the end.

$SIMP was a major success, fulfilling the take-profit order after a major pump that cashed us that 20% gain. It even kept running for a little bit more after our trade closed, meaning we could have made even more from it. Still, we achieved our goal, and it’s important not to get greedy.

$MOG had a similar spike in price, but it had a strong correction barely after the take-profit limit Milo set up for us.

We were able to draw some conclusions from this. First, yes, the trade succeeded, but only because we were lucky enough to set that specific goal. Milo had originally suggested a more aggressive approach, targeting 40-50% profit. Our $SIMP trade would have still been fulfilled, but the $MOG trade would have failed, costing us our initial investment.

Which brings us to the second item. And that is that despite having great awareness and understanding of the market, token distribution patterns, and technical analysis capabilities; you shouldn’t trust an AI agent with your portfolio to execute a strategy you’re not comfortable with. If its suggestion doesn’t feel right for you, ask it to adjust.

Milo is extremely versatile in that regard. You can ask it to lower the price targets, reduce the initial buy amount, or even ask it in plain English: “I want something less risky.” The important thing is to make sure you understand this: The AI does the trading, but it’s you who defines the approach.

Milo’s Beta is live and you can start using it right now. Connect your wallet now and start automating your crypto portfolio.

3. “Find launch-phase tokens with >$3K initial LP and consistent transaction count growth.”

Great for catching fresh launches that aren’t ghost towns. LP commitment and early traction, are great indicators for Milo to identify projects with real skin in the game, not just hype.

At first glance, the list was a little puzzling. 3 out of the 5 tokens of the list had suffered considerable losses over the last 24 hours, the most notable being $BOME with a whopping 25.92% drop.

Skeptical, we asked Milo to tell us what it considered to be the best investments of the list. Its response was even more confusing, as he doubled down on the tokens with negative momentum.

Literally, the three tokens that had dropped in the last 24 hours were Milo’s top picks.

Now, we’re not newbies in the crypto market. We know that the best time to buy is when there’s blood on the market and everyone’s panicking. Still, this felt unnecessarily risky.

But we weren’t there to judge. We were there to test Milo’s capabilities and functioning with different prompts, and so we did.

Imagine our surprise when all three tokens bounced back at almost the same time.

We went into these trades ready to lose the initial investment, but somehow, Milo knew these tokens would recover in the short term.

This one really caught us off guard, so we were curious to know exactly how, out of the hundreds of other scams, pump and dump schemes, and shady coins that launch every day, Milo picked these three.

To be honest, its response was a little underwhelming. We were expecting some complex formula, packed with advanced reasoning and technical miracles. Instead, he simply said he analyzed the on-chain data and activity. He even dared to say some of its calls were obvious!

That’s alpha, anon! 🚀 Here’s why those tokens were solid calls:

1. Early-Stage, Big LP:

All three had launch-phase vibes with $25M–$41M in liquidity. That means whales and smart money are providing real backing—exit risk is lower, and moves can be strong.

2. High On-Chain Activity:

Their trading volumes ($1.8M–$121M daily) and active holders were huge for “new” tokens. Steady or growing transaction counts almost always front-run price reversals and bounces.

3. Meme/Meta Momentum:

Meme tokens are notorious for high-volatility, but with strong socials and community, bottoms get bought up fast.

MEW and FARTCOIN are meta-fresh, and BOME’s resurgence potential was obvious from volume plus all the chatter.

4. No Wrappers/Stable Risk:

We cut out low-beta wrapped tokens and stables so you get pure upside, not peg holding.

5. Liquidity + Social + Trade Growth = 🔥

These are the core three signals for bounces:

High initial LP

Growing or sustained transaction count

Surging or consistent social traction

6. Technicals Lined Up:

The 24h dips signaled local exhaustion, making them prime bounce candidates for risk-manged auto trades.

Bottom line:

I filtered for what the best human degen scouts would:

Early + high LP + action + meme energy + solid risk control.

Pure crypto-natty instinct, but backed by data and flow.

Want to ape similar setups or want a real-time signal feed? Just ask for “launch-phase meme plays” or “trend bounce alpha” next round, and I’ll serve the goods.

Stay up, stay alpha, let’s keep catching these pumps! 🟢✨

4. “Scan for tokens with big recent volume jumps, check their RSI and recent charts for bullish divergence.”

Classic signal stacking. Volume spikes catch attention, but pairing it with RSI divergence helped Milo spot breakouts that weren’t just short-term volatility. This prompt was especially strong with tokens trading sideways, where pattern confirmation matters more.

We were disappointed that three out of the four tokens in Milo’s initial list were quite different to what we were looking for. All of them already had >$1B market cap, and the third one didn’t match our criteria (oversold RSI and bullish divergence).

The fourth one, however, immediately caught our attention: $SLERF, a much smaller token ($40M market cap) with the lowest RSI of the four. Volume was also low compared to the rest of them, but with a healthy volume to market cap ratio of 3.6%.

So, we dived in. And it played out exactly as Milo predicted.

Yes, the AI warned us the token looked bad in the short-term, but it also said that it was likely to bounce off support. And it did. After three, maybe four hours fighting at support, bulls stepped in and the token recovered 7% overnight.

Now, although Milo’s 20% target didn’t hit, and that the token looked like it might keep climbing, we decided to pull the plug on this one, secure our 7% gains and move on with the experiment.

Which is a good excuse to remind you that you are in command. Milo is supposed to do the trading for you, not the decision-making. That remains your responsibility. We knew this, and we weren’t comfortable with the initial goal, so we made the call. Don’t forget to do it too.

Milo’s Beta is live and you can start using it right now. Connect your wallet now and start automating your crypto portfolio.

5. “Scan current trending/high-volume Solana tokens for the last 3h, dig into their buy/sell pressure and LP growth. Find tokens with steady buys, low sell pressure, and climbing LP.”

This prompt turned Milo into a real-time market pulse checker. Instead of chasing spikes, it hunted tokens building quiet momentum.

At first glance, we thought the list of tokens Milo generates was too long, which made us think it wasn’t specific enough. But then we noticed the last two columns. The first one tracked the liquidity available in the token’s trading pool, and the second one provided a brief note explaining the overall situation of the token.

Those two columns were perfect. They immediately helped us skip the first three tokens, as they were not what we were looking for. The first two didn’t show the liquidity growth we were targeting, while the third one had already pumped and was going through a correction.

However, we still had many options to choose from, so we went ahead and asked Milo to narrow it down for us:

“Which of these coins do you think have more chances of high price increases in the short term?”

We were happy to see that Milo agreed with us, removing the first three tokens on the list, as well as other options. In the end, it picked four options: $TISM, $COMMUNITY, $MOBY and $DEGEN.

Additionally, of the four candidates, Milo suggested that $TISM was the best bet, showing “textbook meme liftoff: LP, volume, price, and community heat all spiking together.”

Now that we had our winner, it was time to set up the strategy:

“Suggest a plan of action for $TISM. Include specific entries and exits.”

In a few seconds, Milo created a complete strategy for us.

The results here were nothing short of outstanding. Not only did Milo pick the right token, it set a bold profit target of 45% on the final sell order, which was hit with ease.

$TISM began climbing steadily, then exploded minutes later, hitting every target Milo had placed and soaring well beyond them. Even now, $TISM is trading at nearly 2x our entry.

An incredible call by Milo that, once again, could have made us more money had we been more ambitious.

6. “Avoid tokens with >30% held by the top 5 wallets, or tokens with >40% held by the developer wallet”

Sometimes the best trade is the one you don’t take.

This is defense, not offense. Not all gains are worth the risk. Naturally, this type of prompt won’t help you find any good opportunities or make you any money, but it will act as a kill-switch against potential rugs or exit pumps.

In other words, it helps Milo filter out tokens with high supply concentration, either on whales that can dump and nuke the market or on shady devs that might just be looking to use you as exit liquidity.

You can use this prompt whenever you like. Make it clear at the start of the conversation to make sure that anything Milo suggests from that point forward has gone through this initial filter, or squeeze it in the middle of the conversation to have the AI double-check on the tokens it has already found to avoid losing time and money on these type of scams.

7. “Scan for tokens launched in the last 24h, with big recent (1h) transaction counts. Flag rug risks, and only surface tokens with LP locked, renounced ownership, or multisig detected.”

This is our early-entry filter, but with guardrails. It let Milo move fast on brand new launches without stepping on landmines.

It cross-checked volume surges with on-chain safety signals, catching legit early momentum plays and skipping the ticking rugs.

One of our best-performing prompts for high-risk, high-reward discovery.

Milo’s response was outstanding. It found six brand new tokens and provided key information we were looking for regarding token distribution and developer commitment.

Again, lots of options here, so we asked Milo to help us out once more.

“Which of these are best for short term gains?”

And again, Milo didn’t disappoint. It gave us a full pros and cons list of the tokens it found earlier, highlighting the critical aspects of each, explaining the risks, and assigning an overall score to the different tokens according to their potential rewards.

It also gave us a warning:

“Devs have sold on all, so these are not for long-term holding.”

In other words, Milo has enough situational awareness to understand that devs who have dumped all their tokens on the market for quick gains are a sign of low commitment. And that although you might make some short-term profits from these tokens, you don’t want to keep them in your wallet for very long.

So, onto the important part: how did Milo do this time?

We decided to give $ANI a shot, the token it placed at the top of the list of potential short-term gainers. As always, it suggested a plan of action, with specific entry points, take-profit and stop-loss orders.

The results for this one were literally insane. Milo’s plan worked to perfection and all orders were fulfilled within a couple of hours.

We probably got lucky and just entered at the right moment. Still, Milo allowed us to find the opportunity in time, and automate the trades so we didn’t miss it. And it worked like a charm.

So… Are AI Agents the New Alpha?

Yes and no.

They don’t give alpha. They amplify it.

If your prompt is vague, they’ll fumble. If it’s sharp, they’ll fire like a sniper. That’s the entire game. Human brains get tired. AI agents don’t. But they still need a good coach.

And if you’re thinking these results are way too good to be true, that there’s no way all these prompts worked as well as they did… you’re right, they didn’t.

Go back to the top and read this article’s headline. We tried more than 50 prompts. Here, we’re only telling you about the 7 that worked flawlessly. Most of them didn’t yield these results, many of them didn’t yield any results whatsoever.

That’s why we’re sharing these prompts with you. Because we know they can work. But with this comes another warning: just because they did this time, it doesn’t mean they will every time. The crypto market changes constantly, and nobody, not even AI, can predict where it will go next.

The point being: even if you have the most powerful crypto AI agent in the world at an arm’s reach, it won’t help you if you don’t use it right. AI isn’t a magic solution to profitable crypto trading. But if you have a strategy, know what you’re looking for, and can take the risk, you’ve already taken the first step.

If you understand this, you’re ready to try Milo. Connect your wallet now and start automating your trades. You can try our prompts if you want!

What You Can Do Next

Here’s our advice if you’re serious about using crypto AI agents like Milo:

- Start tracking your best (and worst) prompts.

- Focus on data, not vibes.

- Treat the AI like a partner, not a genie.

- Iterate. Refine. Repeat.

We also highly encourage you to test, refine, and perfect your own prompts. The seven we list here worked for us, but your trading approach might be different. Maybe you want to do fewer traders with higher risk but also higher rewards. Or you’re more interested in longer term trades with tokens with stronger fundamentals.

It’s all up to you. Like we said, Milo will take over the trading, but you’re the one calling the shots.

In any case, you have an incredibly powerful tool at your disposal. But like Uncle Ben said, with great power comes great responsibility.

Unfortunately, most people will never get the full value from crypto AI agents. Because most people won’t take the time to talk to them properly.

Make sure you do, and you’ll be shocked at what you can achieve.