In 2018, I watched over tens of thousands disappear from my portfolio in less than 60 days. I wasn’t rugged or hacked. I was just stupid: overleveraged, overconfident, and completely unprepared for the reality of this market.

I remember staring at the charts, refreshing Blockfolio every 10 minutes like it was going to change something. It never did.

Back then, I thought I was early. Turns out, I was just unseasoned.

Eight years later, I’m still here. A little more scarred, a lot more grounded. And if I had the chance to start again with the knowledge I’ve earned the hard way, this is exactly what I’d do differently.

If you’re just starting in the messy world of crypto, this might be useful for you.

Lesson #1: I Wouldn’t Chase the Noise, I’d Watch What Moves in Silence

In the first bull run I ever experienced, I got swept up in the ICO wave. Everyone was shouting about the “next ETH,” so I followed the crowd.

Got in late, obviously. Held a bunch of projects with pretty websites and zero working code. One of them, I remember clearly: Envion. Promised decentralized mobile mining units. Raised over $100 million. I aped in near the top, watched it implode, and then found out the founders were suing each other (what every crypto investor wants to hear about their project, right?).

At the time, it felt like bad luck. Now I know better. There were no builders. No real traction. Just noise. They were loud about everything they did and poured a lot of money into marketing, but that’s it. Now, I analyze the tokens, not the brand. Well, I use an AI agent called Milo that does it for me. All I have to do is tell it: “Run a security check on $XYZ” and if all looks good, I ask: “Create a trading strategy for $XYZ.” Easy and automated. You can try it yourself here.

If I could go back, I’d spend less time reading headlines and more time watching what smart wallets were accumulating while no one was looking. Hype is loud, but real momentum is quiet.

The earlier you learn to tune out the noise and listen for what’s quietly growing, the faster you’ll stop being exit liquidity.

Lesson #2: I’d Stop Diversifying My Uncertainty

In 2021, my portfolio looked like a patchwork quilt. I held 31 different coins, from layer 1s to food-themed yield farms to a metaverse project that had literal placeholder art on its homepage. I called it “diversification,” but it was really just me avoiding responsibility. If nothing worked, I could say it was the market’s fault.

But when the cycle turned, every single one of those coins bled together. And the few that survived? I had so little in them it didn’t even matter.

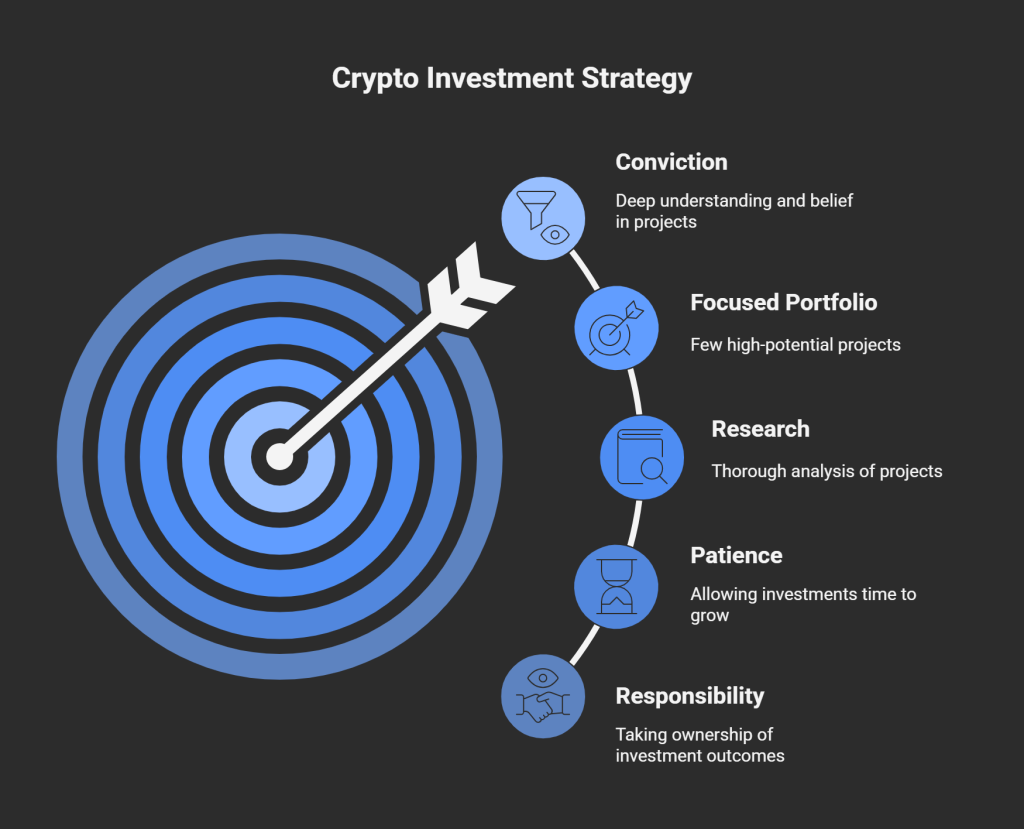

I’ve learned that conviction isn’t about how sure you feel, it’s about what you’ve earned through research, through understanding, through time in the trenches with a project.

And when you have that, you don’t need 30 bets. You need 3 good ones and the patience to let them breathe.

Being spread thin isn’t safety. It’s indecision disguised as strategy. Go deep where it matters.

Lesson #3: I Would’ve Bought When I Was Most Uncomfortable

There’s this moment I keep replaying in my head: early 2019, LINK was trading around $0.80. I had been watching it for weeks. The community was relentless, the GitHub commits were active, Sergey was actually doing things.

But the chart looked dead. It felt like a gamble. I told myself I’d wait for more “confirmation.”

By the time I got in, it was already over $4. I still made money, but nothing close to what it could’ve been if I’d trusted my gut instead of waiting for permission.

That’s the thing about crypto: the best entries always feel wrong in the moment. They go against your instincts. But once you’ve seen enough cycles, you realize that’s exactly what makes them a unique opportunity.

If it feels scary but the fundamentals are strong, lean in. Discomfort is often the cost of getting in early.

Lesson #4: I Would’ve Taken Profits While I Still Believed the Narrative

I was sitting on thousands of dollars in profit on $ZRX in 2021. Bought at $0.30, rode it up to over $2. I felt like a genius. And then I did something incredibly dumb: I decided not to sell any of it.

I read some new tokenomics proposals and thought it was bullish. Everyone on Discord was convinced it was headed to $5. So I held.

Six months later, I panic-sold it at $0.65.

I didn’t lose that money because of bad research or bad timing. I lost it because I was greedy and addicted to the feeling of being right. I wanted to be more right. And that blind spot cost me a life-changing win.

Now, whenever a coin I hold is still trending, still getting attention, and I still believe in it, that’s exactly when I scale out. Not because I’ve lost faith. But because I’ve learned that selling into strength is the only time you get to do it on your terms.

If you wait to feel “done” before taking profit, the market will decide for you. And it rarely chooses kindly.

Lesson #5: I Would’ve Followed Wallets, Not People

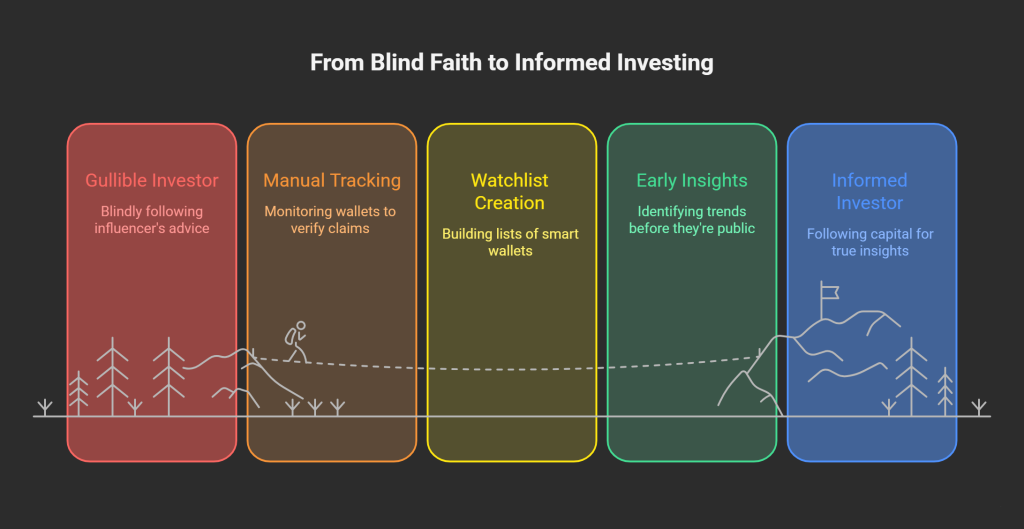

In 2022, I was following this influencer with half a million followers. He tweeted nonstop about a specific DeFi project, said he was “in for the long haul,” doing “multi-year research,” and all the usual conviction theater.

Turns out, he had been offloading that same token in chunks every week. I only realized it after I started tracking his wallets manually.

Could’ve been a paid shill or a pump-and-dump. It doesn’t matter. The point is, it was gullible and painful to blindly get into a token just because someone popular said so. It was like being punched in the gut, and then waking up.

Since then, I’ve built watchlists around smart wallets. Early seed buyers. Protocol devs. Quiet whales. And I’ve seen how the best entries show up in the wallets weeks before they show up in your feed.

Everyone talks. But only wallets whisper the truth.

Follow people and you’ll get played. Follow capital, and you’ll learn how the game is actually being run.

Lesson #6: I Would’ve Taken Fewer Trades, and Made Them Count

For a stretch in 2020, I was glued to charts. RSI, Fibonacci, candle patterns. Every hour of every day, I was looking for the next breakout. I used to believe that more trades meant more chances to win.

All it gave me was stress, sleepless nights, and a portfolio that never moved meaningfully in either direction.

The funny thing is, the biggest gains I ever made came from just sitting on a high-conviction narrative play and letting the market catch up to it. Not from staring at candles. Just from waiting while everyone else got chopped to death.

There’s a rhythm to this game. Most days are just noise. And if you try to force meaning into every candle, you’ll miss the rare moments when everything actually does align.

You don’t need to trade more. You need to wait better.

Lesson #7: I Would’ve Stayed Liquid Enough to Pivot

In early 2022, I was fully deployed. No stables, rotation room or flexibility. I was all in. And then the DeFi 2.0 narratives started popping up: Olympus forks (remember those?), aggregators, protocol-owned liquidity, all of it.

I saw some of them coming. But I couldn’t touch them. I was locked into illiquid, unprofitable bags, telling myself they’d rebound.

They didn’t.

I guess you could also say that I should have taken the loss on some of my bags to capitalize on a fresh, new opportunity. That’s also true, but the bottom line is: whatever you do, always keep a sizable amount of stablecoins ready to deploy.

Having stables lets you move. And in crypto, the ability to pivot when something new starts brewing is the difference between watching a trend and owning it.

Being right means nothing if you’re too illiquid to act on it. Stay nimble.

Lesson #8: I Would’ve Built a System That Fits Me, Not Someone Else

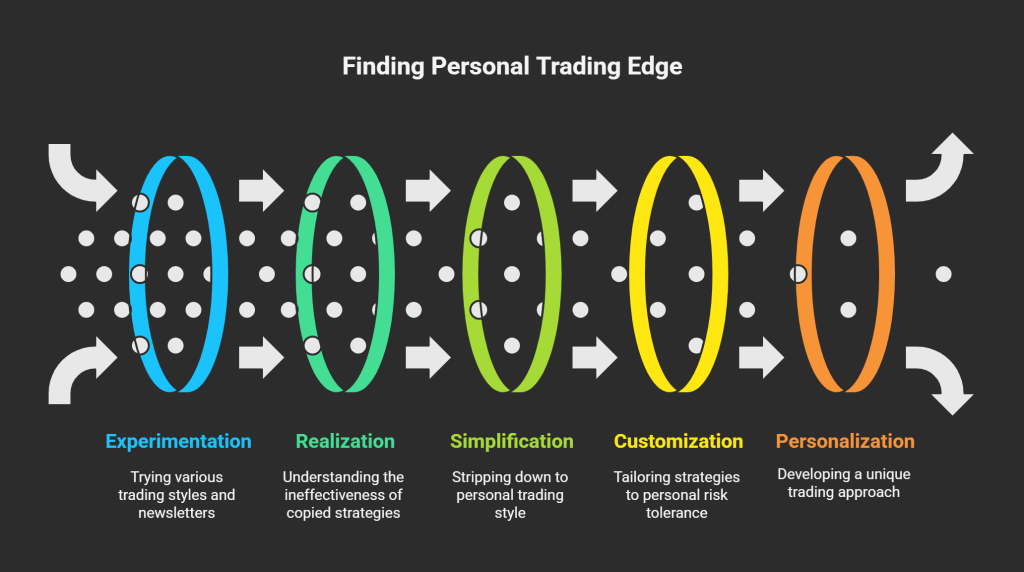

I wasted years trying to mimic other people’s playbooks. I tried being a full-time trader. Tried copying the styles of high-frequency CT guys. Tried following 15 different newsletter “alphas.”

But none of it worked. Because none of it was designed for me.

Eventually, I stripped everything down to what made sense for how I think, how I work, and how I tolerate and manage risk. I focus on narrative rotations. I use tools that surface early sentiment shifts. I hold fewer tokens for longer. I’m not a sniper, I’m a cycle hunter.

That shift changed everything.

Once I stopped pretending to be someone else, I finally started making decisions I could live with, win or lose.

Your edge is who you are. The sooner you stop outsourcing your instincts, the faster you’ll find your lane.

If You’re Still Here, Let Me Leave You With This

Crypto is brutal. It rewards patience until it doesn’t. It punishes FOMO, then flips and punishes doubt. You’ll never time it perfectly. But you don’t have to.

What matters most is sticking around long enough to recognize the rhythm. To spot the recycled narratives. To know when you’re early, and when you’re just wrong.

Be critical with yourself, learn from mistakes, and don’t blame anyone else but yourself. That’s the way you learn to navigate this world, and how you get better at it.

If I had to do it all again, I wouldn’t change the tokens I picked.

I’d change how I saw them.

And that shift, from chasing the game to understanding the game, is what finally gave me the edge I was looking for.

The longer you stay in the game, the less it’s about picks, and the more it’s about perspective.