Most people come into crypto chasing freedom, but end up chained to their screens. They trade every dip, every pump, every rumor, and somehow still feel stuck.

Real financial freedom in crypto doesn’t come from trading harder. It comes from setting up systems that earn for you while you do absolutely nothing. Systems that keep working when you’re asleep, offline, or just tired of watching candles move sideways.

After years of testing, failing, and rebuilding, I’ve found three approaches that actually deliver that kind of freedom. They don’t depend on hype, luck, or perfect timing.

They generate consistent results, protect your downside, and let you step back from the chaos. And the best part is you don’t have to be an expert to set them up.

If you’re serious about making crypto work for you instead of the other way around, these are the three strategies worth understanding right now.

1. AI-Powered Auto-Trading

This is the strategy that changed the way I think about crypto forever.

It wasn’t the first time I tried automated trading. I had dabbled with traditional bots before, but they always felt rigid, frustrating, or downright risky. They followed fixed rules, ignored context, and usually required constant supervision.

Milo felt different from the start. When I first set it up, I wasn’t sure what to expect.

Handing over $350 to an AI agent that would trade my portfolio seemed nerve-wracking. I’ve seen enough “smart bots” crash accounts to know the potential downsides. But Milo promised something unique: the ability to trade according to the rules I set, while continuously adapting to market conditions, without my emotions getting in the way.

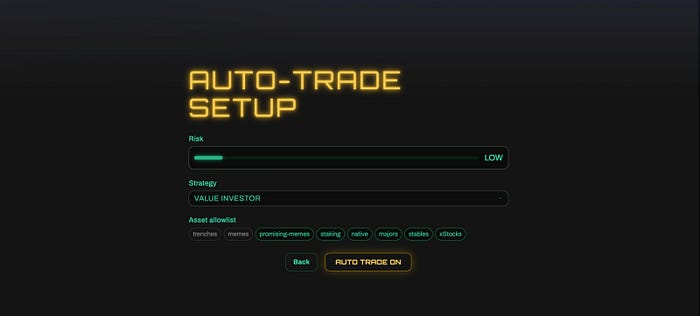

The setup was surprisingly simple. I chose a medium risk level, selected a swing trading strategy, and picked a mix of memecoins and established Solana tokens.

That was all I had to do. Then I let it run.

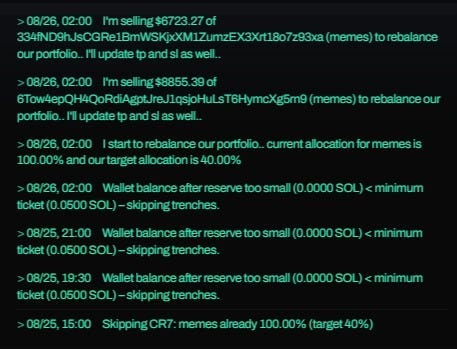

Watching Milo in action was fascinating. It executed more than a hundred trades in a week, gradually growing my portfolio from $350 to over $1,000.

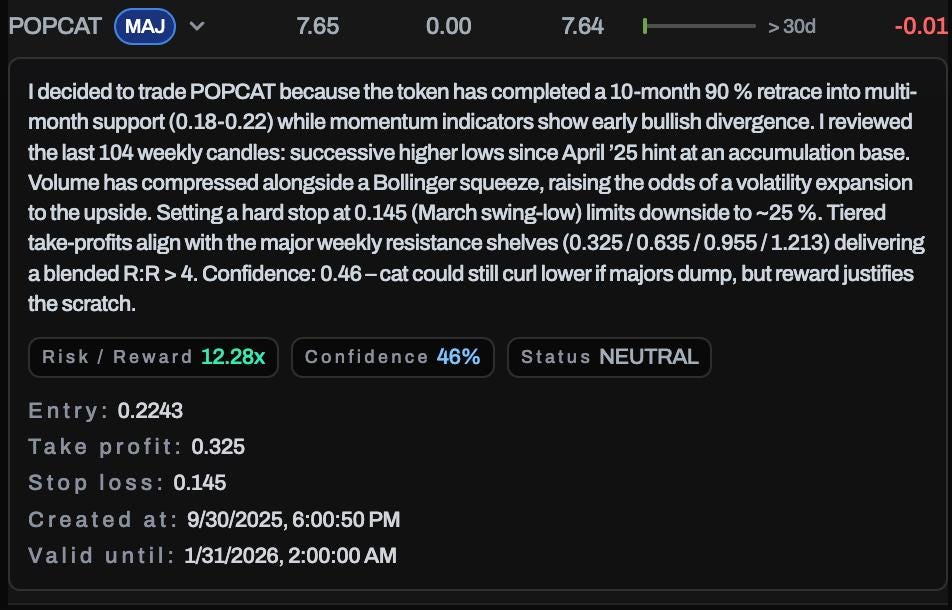

But it wasn’t luck. Milo was analyzing technical indicators, checking on-chain data like token holders and liquidity, and making decisions based on patterns it recognized in real time. Each trade came with an explanation of why it was made and how risk was managed. I could see its reasoning, yet I didn’t have to intervene.

The biggest difference between Milo and any bot I’d used before is emotional control. Human trading is messy. Fear and greed creep in. You hesitate, second-guess yourself, or panic during a sudden drop. Milo doesn’t feel fear. It doesn’t act on hype. It simply executes the strategy I designed, adjusting for the market as it changes.

The result is a consistency that humans rarely achieve on their own.

There were moments when it made trades that I might have avoided or held positions longer than I would have. Some trades weren’t perfect, but overall, the system consistently stacked small wins that compounded over the week. The AI learned from market signals and refined its behavior, something no traditional bot can do.

Even with minor interface quirks or occasional transaction delays, Milo’s impact was clear. It gave me back mental clarity. I wasn’t constantly glued to charts, second-guessing myself, or stressed over every tick in price. I could step back, watch the portfolio grow, and focus on strategy rather than reacting emotionally.

For anyone serious about building passive income in crypto, this approach is a game-changer.

You’re not farming yield or betting on volatile tokens. You’re letting an intelligent system trade for you, continuously adapting, and turning small, consistent gains into real growth. Milo isn’t merely a bot. It’s like having a trading partner that thinks faster, processes more data, and never panics.

👉🏼 Milo is unlike anything I’ve ever used. If you want to try it out, all you have to do is connect your wallet and set up the auto-trader.

2. Stablecoin Lending and Borrowing

For me, stablecoins have always felt like a quiet corner of the crypto world.

They don’t make headlines, they don’t pump or dump wildly, and they don’t have the drama of meme coins or new launches. But that calm is exactly why they are so powerful for building passive income.

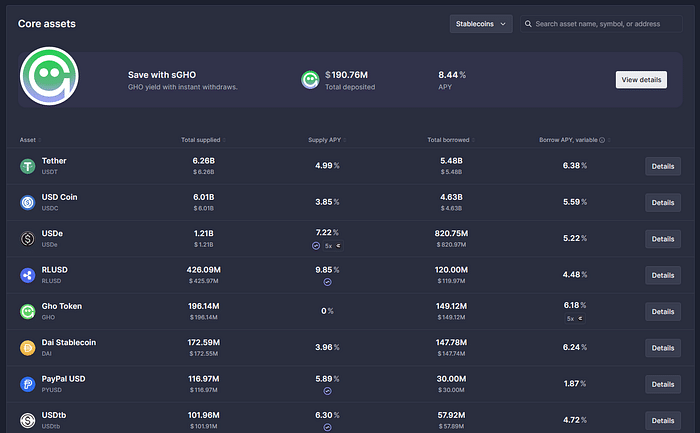

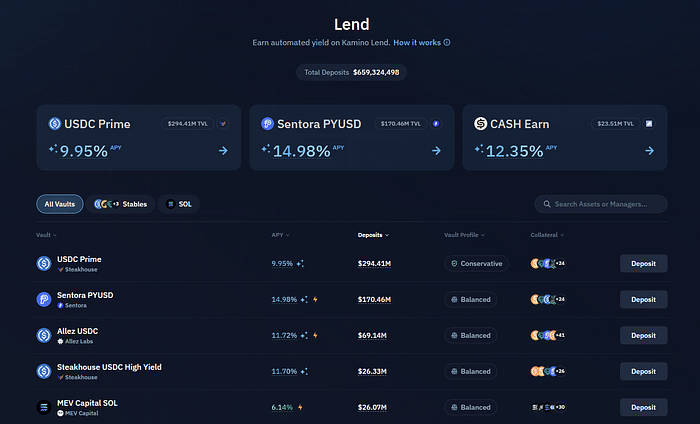

Lending your stablecoins on platforms like Aave, MarginFi, or Kamino lets you earn a predictable yield. You’re providing liquidity to people who need it, and in return, the platform pays you interest. There’s no price speculation involved, no frantic chart watching, and no fear of waking up to a 20 percent drop in the middle of the night.

When I first tried this, I thought the returns were modest. Five to eight percent APY doesn’t sound exciting compared to the wild swings in other parts of crypto.

But over time, that steady interest adds up. The compounding effect is powerful, and because you’re dealing with stablecoins, your principal doesn’t fluctuate dramatically.

One thing I’ve learned is that platform choice matters. Not every lending protocol is equal. I stick to high-quality platforms with proven track records and robust security. I also diversify across a few to reduce exposure to any single point of failure.

Even with moderate yields, that simple layer of risk management makes the strategy feel much safer.

Using stablecoins this way gives you freedom. You’re earning without obsessing over the market. You’re letting your money work quietly in the background while you focus on other opportunities or simply live your life. And because you’re not chasing volatile tokens, it’s easier to stay rational, avoid stress, and stick to your plan.

For anyone who wants a genuinely passive, low-risk stream of income from crypto, stablecoin lending is one of the few strategies that consistently delivers. It won’t make headlines, but it will quietly build wealth over time.

3. Real Yield Protocols and Revenue Sharing

When I first started looking for ways to earn consistently in crypto, I was drawn to anything that promised “high APY.”

Most of the time, that meant inflationary token rewards that only added more of a token I didn’t really want. It felt like a hamster wheel: you earn more tokens, but the value keeps dropping.

And that wasn’t even the worst part, this is: those projects are a ticking time bomb. You know that, at some point, demand won’t be able to absorb the inflationary pressure and the token is going to collapse. And so, you live with a sword of Damocles hanging over your head, and can never get that peace of mind that passive income is supposed to bring you.

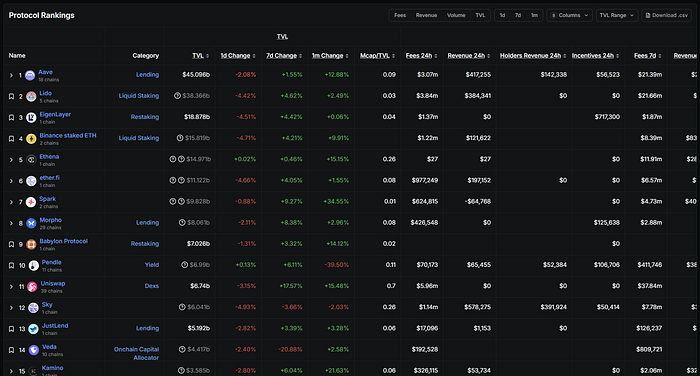

Real yield projects are different. They actually pay you from revenue generated by real activity on the platform.

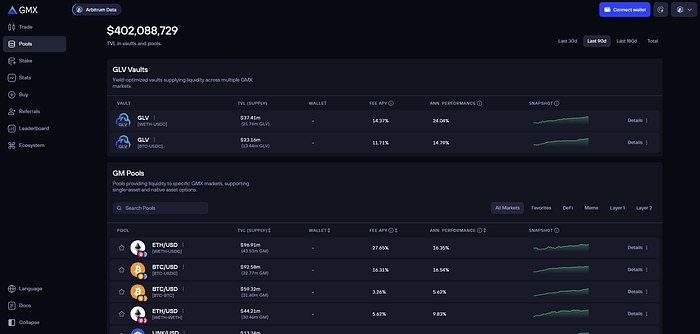

This isn’t about token emissions or hype; it’s about earning from usage. For example, some decentralized exchanges share trading fees with their users, and certain protocols give you a portion of revenue generated from their operations. The more people use the platform, the more you earn.

I started with platforms like GMX and Jupiter staking programs. At first, the returns felt modest, but there was something reassuring about them. Every reward was backed by actual activity. These projects weren’t depending on new people buying in or pumping a token. It was just steady growth that compounded quietly over time.

The key is to focus on projects that generate organic fees. This could be DEXs, bridges, or lending protocols that charge a small transaction fee.

You want revenue that comes from real users doing real things, not hype-driven liquidity mining that dries up the moment the market turns.

Real yield isn’t flashy. You’re not going to triple your portfolio overnight. But over weeks and months, it builds a base of consistent, dependable income. That base can become the foundation for more aggressive strategies later.

One of the things I’ve learned is that patience is underrated in crypto.

The projects that produce real yield reward the people who stick around and understand the ecosystem. It’s a way of letting the market work for you without constantly reacting to price swings or chasing every new trend.

Bringing It All Together

After years of experimenting in crypto, I’ve come to realize that building passive income isn’t about chasing the next big thing or trying to outsmart the market every day. It’s about creating systems that work for you, letting your money do the heavy lifting while you stay focused on the bigger picture.

Real yield protocols taught me the value of consistency. Stablecoin lending showed me the power of calm and steady growth. Even modest APYs became meaningful over time, and the security of stablecoins meant I could sleep at night without worrying about sudden crashes.

Then came Milo, the AI auto-trader, which completely changed my understanding of what passive income can be. It wasn’t just the profits, although they were impressive.

It was the freedom from emotion, the ability to let an intelligent system make disciplined, data-driven decisions on my behalf, and the mental clarity that came with stepping back from the chaos of the market.

Each of these strategies works differently, but they share a common principle: you set the parameters, and then the system does the work. That combination of automation, intelligence, and reliability is rare in crypto.

Most of the time, people are either overexposed to risk, trapped by emotion, or chasing returns that don’t last. These approaches give you a chance to build something real, something sustainable, and something that grows quietly while the world around you reacts to every news headline or price swing.

Passive income in crypto isn’t magic. It doesn’t happen overnight. But with the right strategies and a little patience, it’s possible to create streams of revenue that free your time, reduce stress, and allow you to focus on what really matters.

Let it work for you consistently, and let your money earn without draining your mental energy.